Problem 4-33 DCF valuation Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $116 million equity portfolio offering a dividend yield (DIV1/ Po) of 6.6%. Dividends and portfolio value are expected to grow at a constant rate. Your annual fee for managing this portfolio is 0.66% of portfolio value and is calculated at the end of each year. a. Assuming that you will continue to manage the portfolio from now to eternity, what is the present value of the management contract? (Enter your answer in millions rounded to 1 decimal places.) Present value million b. What would the contract value be if you invested in stocks with a 5.6% yield? (Enter your answer in millions rounded to 2 decimal places.) Contract value milllion

Problem 4-33 DCF valuation Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $116 million equity portfolio offering a dividend yield (DIV1/ Po) of 6.6%. Dividends and portfolio value are expected to grow at a constant rate. Your annual fee for managing this portfolio is 0.66% of portfolio value and is calculated at the end of each year. a. Assuming that you will continue to manage the portfolio from now to eternity, what is the present value of the management contract? (Enter your answer in millions rounded to 1 decimal places.) Present value million b. What would the contract value be if you invested in stocks with a 5.6% yield? (Enter your answer in millions rounded to 2 decimal places.) Contract value milllion

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter13: Valuation: Earnings-based Approach

Section: Chapter Questions

Problem 18PC

Related questions

Question

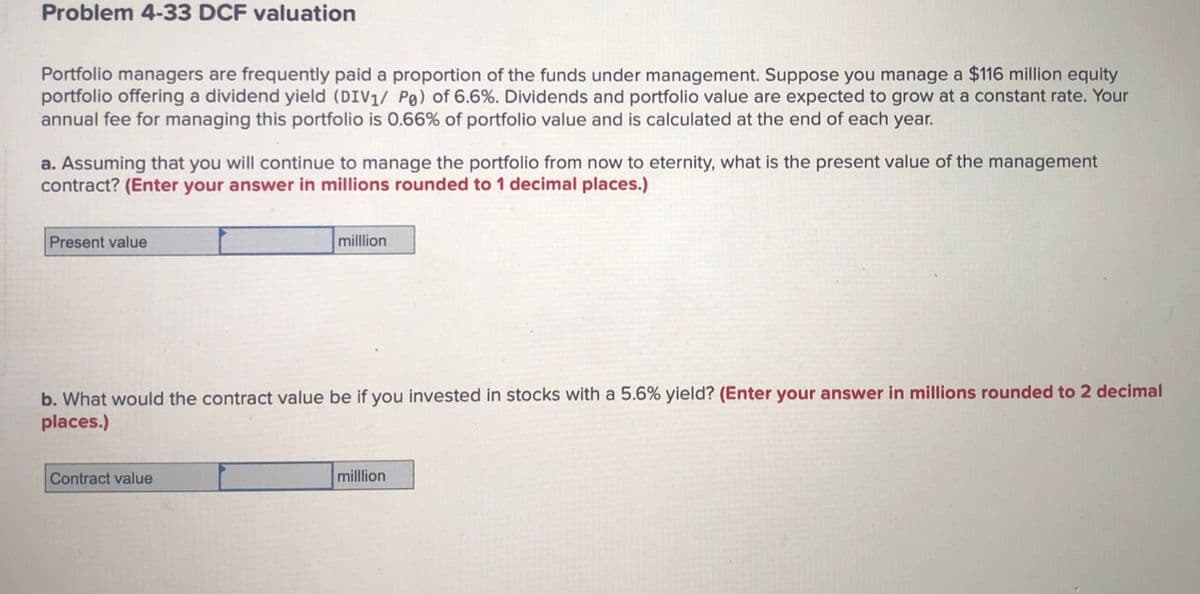

Transcribed Image Text:Problem 4-33 DCF valuation

Portfolio managers are frequently paid a proportion of the funds under management. Suppose you manage a $116 million equity

portfolio offering a dividend yield (DIV1/ Po) of 6.6%. Dividends and portfolio value are expected to grow at a constant rate. Your

annual fee for managing this portfolio is 0.66% of portfolio value and is calculated at the end of each year.

a. Assuming that you will continue to manage the portfolio from now to eternity, what is the present value of the management

contract? (Enter your answer in millions rounded to 1 decimal places.)

Present value

milllion

b. What would the contract value be if you invested in stocks with a 5.6% yield? (Enter your answer in millions rounded to 2 decimal

places.)

Contract value

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning