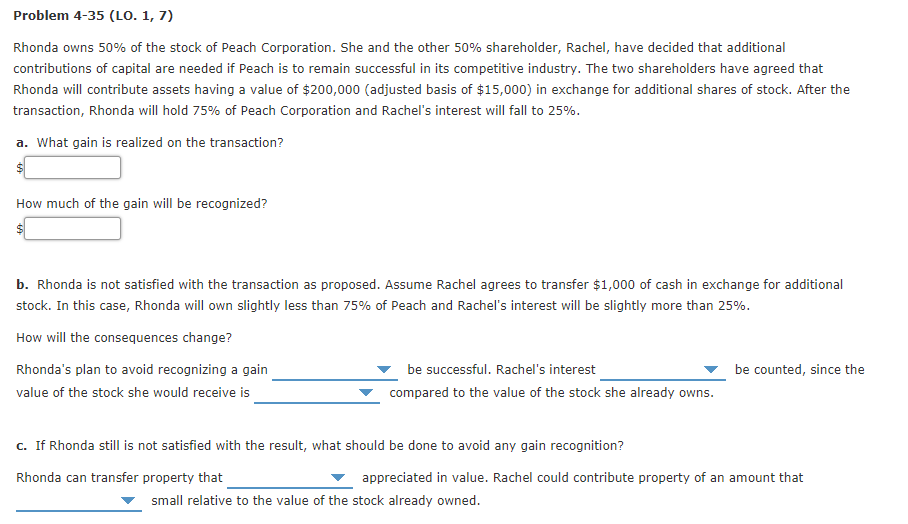

Problem 4-35 (LO. 1, 7) Rhonda owns 50% of the stock of Peach Corporation. She and the other 50% shareholder, Rachel, have decided that additional contributions of capital are needed if Peach is to remain successful in its competitive industry. The two shareholders have agreed that Rhonda will contribute assets having a value of $200,000 (adjusted basis of $15,000) in exchange for additional shares of stock. After the transaction, Rhonda will hold 75% of Peach Corporation and Rachel's interest will fall to 25%. a. What gain is realized on the transaction? How much of the gain will be recognized? b. Rhonda is not satisfied with the transaction as proposed. Assume Rachel agrees to transfer $1,000 of cash in exchange for additional stock. In this case, Rhonda will own slightly less than 75% of Peach and Rachel's interest will be slightly more than 25%. How will the consequences change? Rhonda's plan to avoid recognizing a gain be successful. Rachel's interest be counted, since the value of the stock she would receive is compared to the value of the stock she already owns. c. If Rhonda still is not satisfied with the result, what should be done to avoid any gain recognition? Rhonda can transfer property that appreciated in value. Rachel could contribute property of an amount that small relative to the value of the stock already owned.

Problem 4-35 (LO. 1, 7) Rhonda owns 50% of the stock of Peach Corporation. She and the other 50% shareholder, Rachel, have decided that additional contributions of capital are needed if Peach is to remain successful in its competitive industry. The two shareholders have agreed that Rhonda will contribute assets having a value of $200,000 (adjusted basis of $15,000) in exchange for additional shares of stock. After the transaction, Rhonda will hold 75% of Peach Corporation and Rachel's interest will fall to 25%. a. What gain is realized on the transaction? How much of the gain will be recognized? b. Rhonda is not satisfied with the transaction as proposed. Assume Rachel agrees to transfer $1,000 of cash in exchange for additional stock. In this case, Rhonda will own slightly less than 75% of Peach and Rachel's interest will be slightly more than 25%. How will the consequences change? Rhonda's plan to avoid recognizing a gain be successful. Rachel's interest be counted, since the value of the stock she would receive is compared to the value of the stock she already owns. c. If Rhonda still is not satisfied with the result, what should be done to avoid any gain recognition? Rhonda can transfer property that appreciated in value. Rachel could contribute property of an amount that small relative to the value of the stock already owned.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 32P

Related questions

Question

See Attached. 6

Transcribed Image Text:Problem 4-35 (LO. 1, 7)

Rhonda owns 50% of the stock of Peach Corporation. She and the other 50% shareholder, Rachel, have decided that additional

contributions of capital are needed if Peach is to remain successful in its competitive industry. The two shareholders have agreed that

Rhonda will contribute assets having a value of $200,000 (adjusted basis of $15,000) in exchange for additional shares of stock. After the

transaction, Rhonda will hold 75% of Peach Corporation and Rachel's interest will fall to 25%.

a. What gain is realized on the transaction?

How much of the gain will be recognized?

b. Rhonda is not satisfied with the transaction as proposed. Assume Rachel agrees to transfer $1,000 of cash in exchange for additional

stock. In this case, Rhonda will own slightly less than 75% of Peach and Rachel's interest will be slightly more than 25%.

How will the consequences change?

Rhonda's plan to avoid recognizing a gain

be successful. Rachel's interest

be counted, since the

value of the stock she would receive is

compared to the value of the stock she already owns.

c. If Rhonda still is not satisfied with the result, what should be done to avoid any gain recognition?

Rhonda can transfer property that

appreciated in value. Rachel could contribute property of an amount that

small relative to the value of the stock already owned.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT