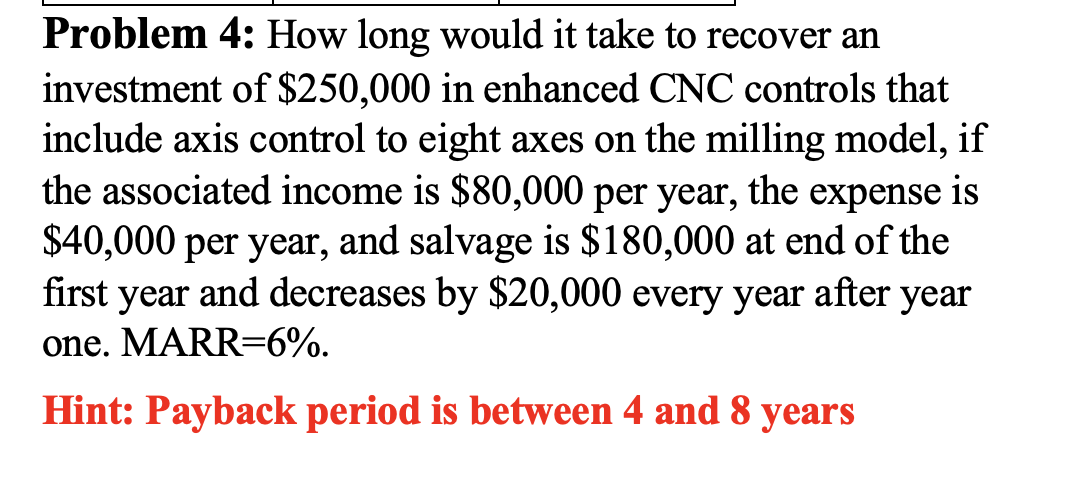

Problem 4: How long would it take to recover an investment of $250,000 in enhanced CNC controls that include axis control to eight axes on the milling model, if the associated income is $80,000 per year, the expense is $40,000 per year, and salvage is $180,000 at end of the first year and decreases by $20,000 every year after year one. MARR=6%. Hint: Payback period is between 4 and 8 years

Q: What are the objectives of fiscal policy in developing countries?

A: Fiscal policy is the term used to describe how the government manages the flow of money through the…

Q: Question For each sentence below describing changes in the tangerine market, discuss whether the…

A: The minimum measure of remuneration that an employer is expected to pay wage workers for the work…

Q: Assume that there are four consumers A, B, C, and D, and the prices that each of them is willing to…

A: Given that, There are 4 consumer A, B, C, D Each consumer willingness to pay is $2.50, $2.25,…

Q: There's two things driving the prices," says wool general manager for PGG Wrightson, Grant Edwards.…

A: Demand and supply are the two forces that affects the market and its price. Here wool market is…

Q: In a nation with excessive population growth, and unskilled labor, the production possibilities…

A: The graph known as the production possibilities curve (PPC) illustrates all the possible output…

Q: nput either "increase" or "decrease" where relevant: A decrease in the price of a complementary…

A: At the point when the price of complementary goods increments, keeping other factors consistent,…

Q: 5. Consider the following Extended Form game where P1 stands for Player one and P2 stands for player…

A: The Nash equilibrium is a dynamic hypothesis inside game hypothesis that expresses a player can…

Q: Y = K (LE) ¹-α. e economy has a capital share of 1/3, a saving rate of 20 percent, a depreciation…

A:

Q: What are the two reasons for unfavorable terms of trade in semi-developed countries?

A: Terms of trade of a country is the proportion of export price index to the import price index.

Q: An economist estimates that a market has a demand curve of the form P = 37-(1.23) Q and a supply…

A: Economic market equilibrium happens when the degrees of supply and demand adjust, making ideal…

Q: Boblandia produces no oil. It starts at potential GDP with inflation equal to the Central Bank's…

A: How inflation happens? The contradictory phase in economy a situation happens when there is…

Q: constraint optimization 1. a. use the substitution method. given the production function,…

A:

Q: identify the graph that best demonstrates the impact of a large wildfire that destroys one of the…

A: Avocado is the input used to produce guacamole. This implies that the availability of avocado…

Q: G5

A: We know that The banks are considered to be one of the most important entities in the financial…

Q: Consider the following pure exchange economy with different consumer pref- erences and endowments…

A: Given: Individual A: uA = uA0.2 YA0.8 , WA =(60,25)Individual BuB = uB0.4 YB0.6 , WB…

Q: unicipality is studying a water supply plan for its tri-city and surrounding area to the end of year…

A: Present worth comparison technique In this technique of comparison, the cash flows of each option…

Q: Alcoa and Kaiser, duopolists in the market for primary aluminum ingot, choose prices of their 500…

A: Cooperation in repeated games that have an infinite time period can be sustained with trigger…

Q: What are the characteristics of the different market structures ?

A: When studying a market, we must first define what we mean by "market" and which qualities constitute…

Q: In early 2000, China was the fastest emerging economy in Asia. However, in recent years, China has…

A: Given information: C = 250 + 0.6(Y-T) --------> Consumption function T=15 + 0.05Y…

Q: In Example 6.4, wheat is produced according to the production function: q=100 (K0.7L0.3). Beginning…

A: In economics, diminishing returns is the decline in the marginal (steady) result of a production…

Q: The demand function below is estimated usi the data generated by a randomized control trial:…

A: Lnqxd=a+bLnpx+cLnpy+dLnp2+e The null hypothesis H0:b=0 or c=0 or d=0 Alternative hypothesis H1:b is…

Q: The demand for a good is QA=200+0.3I-PA+2PB, where QA is the quantity demanded of Good A, I is the…

A: Given Demand for good A: QA=200+0.3I-PA+2PB .... (1) PA and PB are the prices for…

Q: The table below shows revenue data for different firms producing cars. Use the given information to…

A: The market share can be calculated by dividing the individual firm's revenue from the industry's…

Q: Assume no change in currency holdings as deposits change. A banking system with target reserve ratio…

A: Excess reserves are capital reserves held by a bank or monetary foundation in excess of what is…

Q: Receive with the help of indifference curves and the budget outline the optimal consumption plan.…

A: Individual demand: It refers to the demand of an individual or a household. This demand occurs when…

Q: What are the main characteristics of oligopoly? How does output and price compare to that of perfect…

A: A market is said to be in an oligopoly when there are just a few businesses selling products,…

Q: Just clarify "tariffs on a variety of American exports..." to identify who is imposing these…

A: Tariff is a type of trade barrier used by the government to protect its producer or influence price…

Q: The maintenance on a machine is expected to be P6322 for the second year and an additional P1,750…

A: Considering the information given, we have to calculate Interest rate per year = 5% N (term) = 5…

Q: Suppose that BYOB charges $2.00 per can. Your friend Lorenzo says that since BYOB is a monopoly with…

A: Please find the answer below. MONOPOLY MARKET: A monopolistic market is a theoretical condition…

Q: Isovalue lines are lines along which the utility is constant. lines along which the value of input…

A: Isovalue lines are the lines along which the value if output is constant. The slope of the line…

Q: 4. In 2020, from Jan 29th to March 15th, (Select All that Apply) Helpful Hint: There are 6 correct…

A: January : - Objective: Maximum employment & price stability (long run objective of 2%…

Q: A Contractor imported a bulldozer for his job, paying P 350,000 to the Manufacturer. Freight and…

A: Given The contractor pays to manufacturer = P350,000 Freight and insurance charge =P18000 Broker's…

Q: 5. Suppose after you graduate from Algoma University, you find a job that pays you $75,000 a year.…

A: Case-1 no.of years n=30years=30*12=360months Interest rate (i) =3.5% per year = 0.35/12 = 0.00292…

Q: I need help with explanation for answer

A: We An economic system is the merging or the combination which actually defines the social community…

Q: 1(a) In the Solow Growth Model the output function for the economy is given by: Y = 1.02 K 1/3 (L x…

A: The golden steady state level is reached where the consumption is maximized . The slope of…

Q: How does the microeconomic theory of fertility relate to the theory of consumer choice?

A: The relationship between the consumer's preferences and the expenditure is depicted by the theory of…

Q: What are the effects of a monetary contraction? Show the AS-AD and IS-LM with two stages and the…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: What limits the Bank of Canada’s ability to steer the economy to avoid both recession and inflation?

A: The flexible exchange rate and inflation control objective are the two primary foundations of…

Q: Discuss the Keynes's Theory of Money and Prices.

A: We know that Keynes reformulated the Quantity Theory of Money(QTM). He believes that money does not…

Q: Figure 7-2 Price (dollars per pound) $3.00 2.50 1.75 0.500 0 $6 million. $21 million. 15 $30…

A: Import quota is a kind of restriction imposed by the Government so that the importers would not able…

Q: What are some arguments in favour of free trade?

A: Introduction - As a result of free trade, the overall size of the economy grows. It allows for more…

Q: Suppose a firm possesses monopoly power in two distinct markets with the following inverse-demand…

A: A monopoly firm opeartes in two distinct markets and maximizes profit at the following point. i.e.,…

Q: An equipment costs P4433082 with the estimated salvage value of P542566 at the end of 10 years. What…

A: Given The first cost of the equipment (P)= P4433082 Salvage value (F)=P542566 Life of the equipment…

Q: Xo Xo O X1 X2 X3 Xmax $ Xo ABDE A CF B What outcome can we expect to prevail in after bargaining…

A: MAC - Marginal Abatement Cost measures the cost to reduce an additional unit of environmental…

Q: worth box and the endowment point. act curve yA = f(xA), and plot it on the graph. optimal…

A: *Answer:

Q: What is the difference between commodity money and fiat money? Is there a scenario you can think of…

A: Money is used for exchange purposes. Money is also used as unit of account and store of value.

Q: 1. The function of a company's product to produce output at the level of input use is Q=-1/3x3 +9x3+…

A: Given, The production function is: Q = -1/3x3 + 9x3 + 70 The input price is = IDR 800 per unit The…

Q: When it engages in quantitative tightening, the Wakandan Central Bank bonds. This commercial-bank…

A:

Q: Your software startup has just completed the latest version of BrainType, a mind-reading word…

A: A competitive analysis ought to give the business person data about how contenders market their…

Q: When there are fixed costs and a constant marginal cost a. The average fixed cost function is…

A: The fixed cost does not change with change in the output level. The variable cost changes with…

4

Step by step

Solved in 2 steps

- A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm uses the straight-line depreciation method with a zero salvage value and has a (marginal) income tax rate of 40 percent. The firms cost of capital is 12 percent. Compute the IRR and the NPV. Should the firm accept or reject the project?Ten years ago, Johnson Recovery purchased a wrecker for $330, 000 to move disabled 18-wheelers. He received a salvage value of $25, 000 after 10 years of use. During this 10-year period, his average annual revenue totaled $60, 000. a) Did he recover his investment at 12% per year return? In other words, does the Annual Equivalent Value of the benefits exceed the Capital Recovery cost at an interest rate of 12%? b) Suppose Johnson moves, on average, 250 disabled 18-wheelers each year. What is his average equivalent benefit/cost per vehicle moved? c) Now, incorporate annual operating and maintenance costs into your analysis. If the annual O&M cost was $5, 000 the first year and increased by a constant 10% per year, what is the annual equivalent worth at 12% per year?Part 1Please calculate the payback period, IRR, MIRR, NPV, and PI for the following two mutuallyexclusive projects. The required rate of return is 15% and the target payback is 4 years.Explain which project is preferable under each of the four capital budgeting methodsmentioned above: Cash flows for two mutually exclusive projects Year Investment A Investment B 0 -$5,000,000 -5,000,000 1 $1,500,000 $1,250,000 2 $1,500,000 $1,250,000 3 $1,500,000 $1,250,000 4 $1,500,000 $1,250,000 5 $1,500,000 $1,250,000 6 $1,500,000 $1,250,000 7 $2,000,000 $1,250,000 8 0 $1,600,000 Part 2 Please study the following capital budgeting project and then provide explanations for thequestions outlined below:You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ),manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in…

- A machine that costs $12,000 is expected to operate for 10 years. The estimated salvage value at the end of 10 years is $0. The machine is expected to save the company $2,331 per year before taxes and depreciation. The company depreciates its assets on a straight-line basis and has a marginal tax rate of 40 percent. The firm’s cost of capital is 14 percent. What is the internal rate of return (IRR) for the machine? Based on the IRR criterion, should this machine be purchased?n Project A Project B 0 -$7,000 -$5,000 1 -$2,500 -$2,000 2 -$2,000 -$2,000 3 -$1,500 -$2,000 4 -$1,500 -$2,000 5 -$1,500 -$2,000 6 -$1,500 -$2,000 7 - -$2,000 8 - - Suppose projects A and B are mutually exclusive. The required service period is 8 years and comparable equipment will be leased for $3,000 per year payable at the end of each year for the remaining years of the required service period. Which project is a better choice at 15%? Use PW(15%) criterion and show your equation with numbers plugged into factors and your numerical result for each option.You are considering the following project: It pays you $2,500 at the end of the first year, costs $8,500 by the end of the second year and brings $6,800 a year after. What is the project's internal rate of return(s), exact external rate of return and the approximate external rate of return it current MARR is 14%?

- The company uses a 10% discount rate and the total-cost approach to capital budgeting analysis. The working capital required under the new system would be released for use elsewhere at the conclusion of the project. Both alternatives are expected to have a useful life of ten years.1. The net present value of the overhaul alternative (rounded to the nearest hundred pesos) is: P(750,300) P(987,400) P(725,800) P(975,800) 2. The net present value of the new system alternative (rounded to the nearest hundred pesos) is: P(552,900) P(758,400) P(862,900) P(987,400)A company is currently paying its employees$0.56 per mile to drive their own cars on companybusiness. The company is considering supplyingemployees with cars, which would involve purchasing at $25,000 with an estimated three-year life, a netsalvage value of $8,000, taxes and insurance at a costof $1,200 per year, and operating and maintenanceexpenses of $0.30 per mile. If the interest rate is 10%and the company anticipates an employee’s annualtravel to be 30,000 miles, what is the equivalent costper mile (neglecting income taxes)A chemical plant worth P 110M has an estimated life of 6 years and a projected scrap value of P 10M. after 3 years of operation an explosion made it a total loss. How much money would have to be raised to put up a new plant costing P 150M, if depreciation reserved had been maintained during its 3 years of operation by Sinking Fund Method at 6%?

- A proposed project will require the immediate investment of $50,000 and is estimated to have year-end revenues and costs as follows: Year Revenue Costs 1 2 3 4 5 $ 75,000 90,000 100,000 95,000 60,000 $ 60,000 77,500 75,000 80,000 47,500 An additional investment of $20,000 will be required at the end of the second year. The project would terminate at the end of the 5th year, and the assets are estimated to have a salvage value of $25,000 at the time. Solve for the IRR of the project by PW using 15% and 16% rates. A. 15.68% B. 15.28% C. 15.88% D. 15.48%An investment of P 250,000 can be made in a project that will produce a uniform annual revenue of P 192,800 for 5 years and then have a salvage value of 10% of the first cost. Operation and maintenance will be P 72,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn 20% before income taxes. Show whether or not the investment is justified economically using1. ROR method2. payout methodGiven the following cash flows for project X and project Y, Year Project X Project Y 0 -55000 -100000 1 20000 15000 2 13500 17000 3 11000 19000 4 10000 25000 5 9000 30000 6 7500 35000 Calculate the NPV, IRR, MIRR and traditional payback period for each project, assuming a required rate of return of 7 percent If the projects are independent, which project(s) should be selected? If they are mutually exclusive, which project should be selected?