Problem 4 On July 21, 2021, there was a fire that destroyed PIRENA Company's warehouse and inventory records. The following information about sales and salvaged documents revealed the following: Inventory, Jan. 1 - P485,000 • Purchases - January to July 21 o Cost of purchases P1,560,300 o Freight-in -P39,700 o Purchase returns P80,000 o Purchase discounts P20,000 • Sales - January to July 21 o Sales - P2,000 o Sales discounts P500,000 o Sales discounts forfeited P20,000 • The gross profit is 20% for the last five years. The company also provided information: o Goods out on consignment, at cost - P30,000 o Goods purchased still in transit, FOB destination P25,000 o Cost of undamaged goods at selling price - P100,000

Problem 4 On July 21, 2021, there was a fire that destroyed PIRENA Company's warehouse and inventory records. The following information about sales and salvaged documents revealed the following: Inventory, Jan. 1 - P485,000 • Purchases - January to July 21 o Cost of purchases P1,560,300 o Freight-in -P39,700 o Purchase returns P80,000 o Purchase discounts P20,000 • Sales - January to July 21 o Sales - P2,000 o Sales discounts P500,000 o Sales discounts forfeited P20,000 • The gross profit is 20% for the last five years. The company also provided information: o Goods out on consignment, at cost - P30,000 o Goods purchased still in transit, FOB destination P25,000 o Cost of undamaged goods at selling price - P100,000

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter5: Accounting For Retailing Businesses

Section: Chapter Questions

Problem 5.41EX: Appendix Cost of goods sold and related items The following data were extracted from the accounting...

Related questions

Question

The problem is stated in the picture.

Here is the question:

1. How much is the estimated inventory losses?

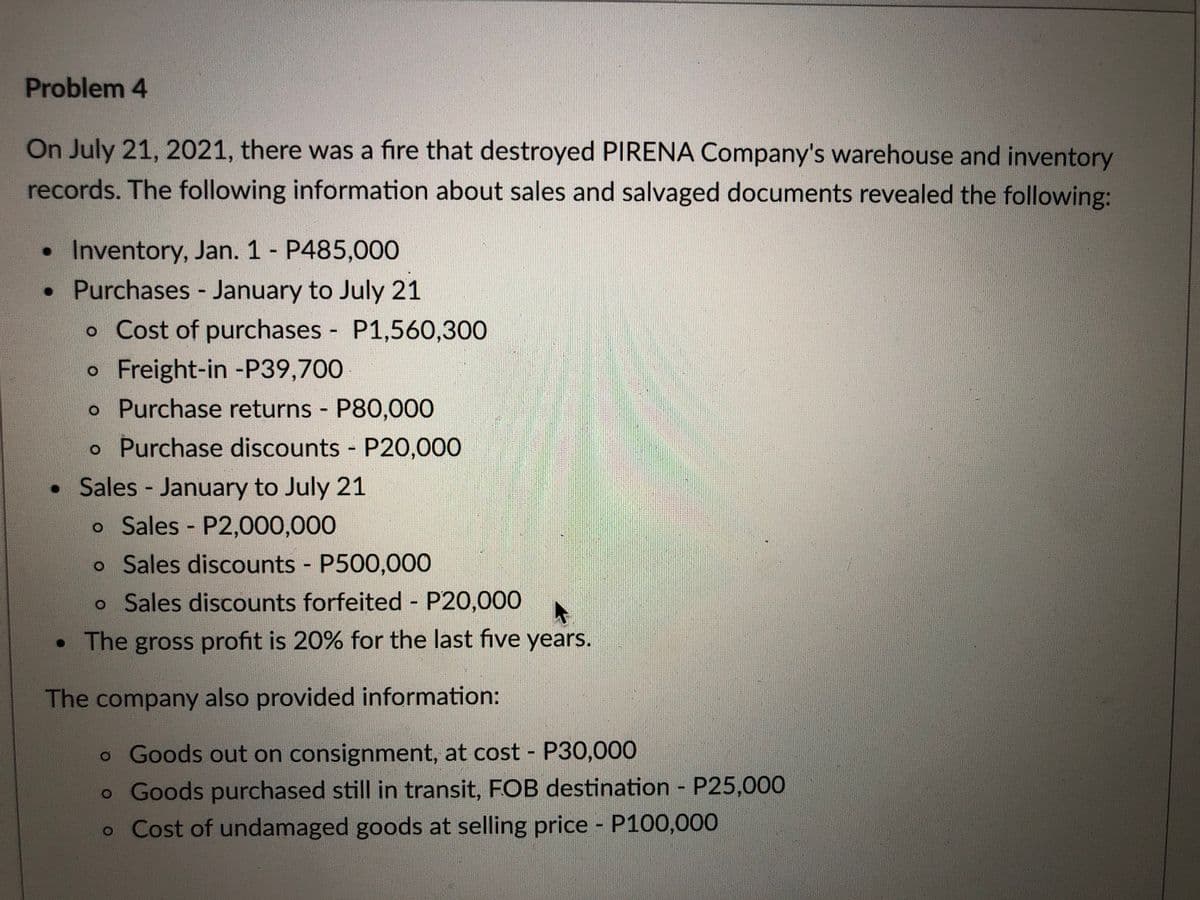

Transcribed Image Text:Problem 4

On July 21, 2021, there was a fire that destroyed PIRENA Company's warehouse and inventory

records. The following information about sales and salvaged documents revealed the following:

• Inventory, Jan. 1 - P485,000

• Purchases - January to July 21

o Cost of purchases - P1,560,300

o Freight-in -P39,700

o Purchase returns P80,000

o Purchase discounts P20,000

• Sales - January to July 21

%3D

o Sales P2,000,000

%3D

o Sales discounts P500,000

o Sales discounts forfeited P20,000

• The gross profit is 20% for the last five years.

The company also provided information:

o Goods out on consignment, at cost - P30,000

o Goods purchased still in transit, FOB destination P25,000

o Cost of undamaged goods at selling price P100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning