Problem 8-4A (Algo) Record payroll (LO8-3) Hal's Heavenly Creations offers its employees the option of contributing up to 6% of their salaries to a voluntary retirement plan, with the employer matching their contribution. The company also pays 100% of medical and life insurance premiums. Assume that no employee's cumulative wages exceed the relevant wage bases. Payroll information for the first biweekly payroll period ending February 14 is listed below. Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Life insurance premiums paid by employer Federal and state income tax withheld Social Security tax rate Medicare tax rate Federal and state unemployment tax rate Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. View transaction list Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet < 1 2 Record the employee salary expense, withholdings, and salaries payable. Date February 14 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit $1,150,000 48,300 24,150 4,600 287,500 Credit View general Journal 6.208 1.458 6.208 > Journal entry worksheet < 1 2 Record the employer-provided fringe benefits. Note: Enter debits before credits. Date February 14 Record entry 3 Date February 14 Journal entry worksheet Note: Enter debits before credits. General Journal Record the employer payroll taxes. Record entry Clear entry General Journal Clear entry Debit Debit Credit View general Journal Credit View general Journal

Problem 8-4A (Algo) Record payroll (LO8-3) Hal's Heavenly Creations offers its employees the option of contributing up to 6% of their salaries to a voluntary retirement plan, with the employer matching their contribution. The company also pays 100% of medical and life insurance premiums. Assume that no employee's cumulative wages exceed the relevant wage bases. Payroll information for the first biweekly payroll period ending February 14 is listed below. Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Life insurance premiums paid by employer Federal and state income tax withheld Social Security tax rate Medicare tax rate Federal and state unemployment tax rate Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. View transaction list Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet < 1 2 Record the employee salary expense, withholdings, and salaries payable. Date February 14 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit $1,150,000 48,300 24,150 4,600 287,500 Credit View general Journal 6.208 1.458 6.208 > Journal entry worksheet < 1 2 Record the employer-provided fringe benefits. Note: Enter debits before credits. Date February 14 Record entry 3 Date February 14 Journal entry worksheet Note: Enter debits before credits. General Journal Record the employer payroll taxes. Record entry Clear entry General Journal Clear entry Debit Debit Credit View general Journal Credit View general Journal

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EB: In EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You...

Related questions

Question

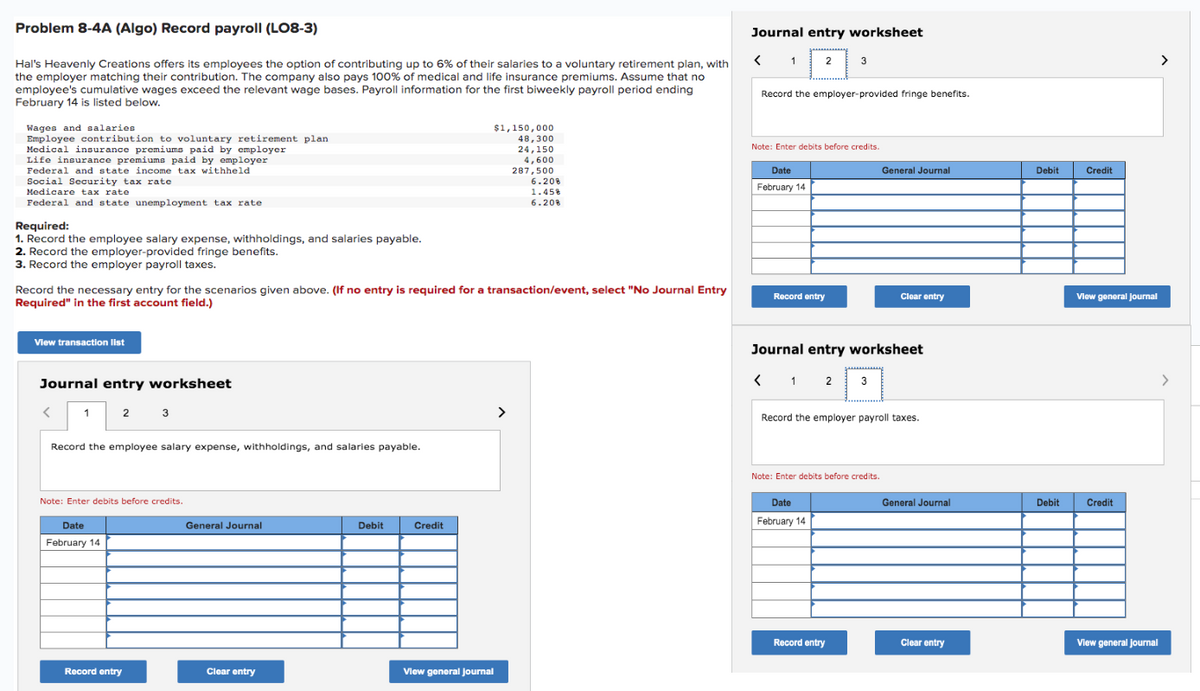

Transcribed Image Text:Problem 8-4A (Algo) Record payroll (LO8-3)

Hal's Heavenly Creations offers its employees the option of contributing up to 6% of their salaries to a voluntary retirement plan, with

the employer matching their contribution. The company also pays 100% of medical and life insurance premiums. Assume that no

employee's cumulative wages exceed the relevant wage bases. Payroll information for the first biweekly payroll period ending

February 14 is listed below.

Wages and salaries

Employee contribution to voluntary retirement plan

Medical insurance premiums paid by employer

Life insurance premiums paid by employer

Federal and state income tax withheld

Social Security tax rate

Medicare tax rate

Federal and state unemployment tax rate

Required:

1. Record the employee salary expense, withholdings, and salaries payable.

2. Record the employer-provided fringe benefits.

3. Record the employer payroll taxes.

View transaction list

Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

Journal entry worksheet

<

1

2

Record the employee salary expense, withholdings, and salaries payable.

Date

February 14

3

Note: Enter debits before credits.

Record entry

General Journal

Clear entry

Debit

$1,150,000

48,300

24,150

4,600

287,500

Credit

6.208

1.45%

6.20%

View general Journal

Journal entry worksheet

< 1 2

Record the employer-provided fringe benefits.

Note: Enter debits before credits.

Date

February 14

Record entry

3

Journal entry worksheet

< 1 2 3

Note: Enter debits before credits.

Date

February 14

General Journal

Record the employer payroll taxes.

Record entry

Clear entry

General Journal

Clear entry

Debit

Debit

Credit

View general Journal

Credit

View general Journal

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,