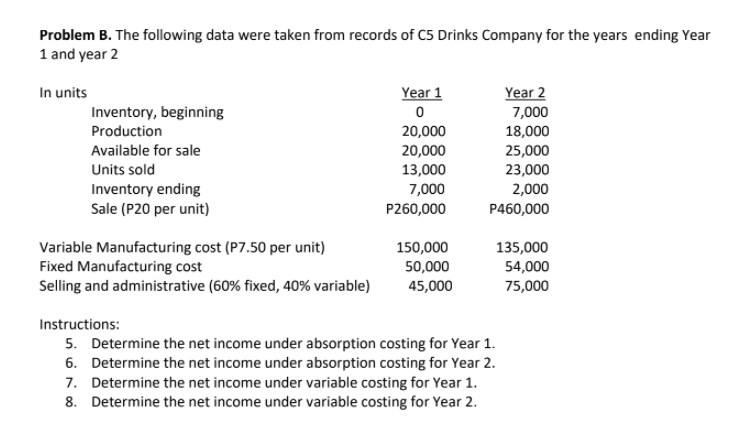

Problem B. The following data were taken from records of CS Drinks Company for the years ending Year 1 and year 2 In units Year 1 Year 2 Inventory, beginning Production 7,000 20,000 18,000 Available for sale 20,000 13,000 25,000 23,000 Units sold Inventory ending Sale (P20 per unit) 7,000 P260,000 2,000 P460,000 Variable Manufacturing cost (P7.50 per unit) Fixed Manufacturing cost Selling and administrative (60% fixed, 40% variable) 150,000 135,000 50,000 54,000 45,000 75,000 Instructions: 5. Determine the net income under absorption costing for Year 1. 6. Determine the net income under absorption costing for Year 2. 7. Determine the net income under variable costing for Year 1.

Problem B. The following data were taken from records of CS Drinks Company for the years ending Year 1 and year 2 In units Year 1 Year 2 Inventory, beginning Production 7,000 20,000 18,000 Available for sale 20,000 13,000 25,000 23,000 Units sold Inventory ending Sale (P20 per unit) 7,000 P260,000 2,000 P460,000 Variable Manufacturing cost (P7.50 per unit) Fixed Manufacturing cost Selling and administrative (60% fixed, 40% variable) 150,000 135,000 50,000 54,000 45,000 75,000 Instructions: 5. Determine the net income under absorption costing for Year 1. 6. Determine the net income under absorption costing for Year 2. 7. Determine the net income under variable costing for Year 1.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 18MCQ: 2-18 Use the following information for Multiple- Choice Questions 2-13 through 2-18: Last year,...

Related questions

Question

Transcribed Image Text:Problem B. The following data were taken from records of C5 Drinks Company for the years ending Year

1 and year 2

In units

Year 1

Year 2

Inventory, beginning

Production

7,000

20,000

18,000

Available for sale

20,000

13,000

25,000

23,000

Units sold

Inventory ending

Sale (P20 per unit)

7,000

P260,000

2,000

P460,000

Variable Manufacturing cost (P7.50 per unit)

Fixed Manufacturing cost

Selling and administrative (60% fixed, 40% variable)

150,000

135,000

50,000

54,000

45,000

75,000

Instructions:

5. Determine the net income under absorption costing for Year 1.

6. Determine the net income under absorption costing for Year 2.

7. Determine the net income under variable costing for Year 1.

8. Determine the net income under variable costing for Year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning