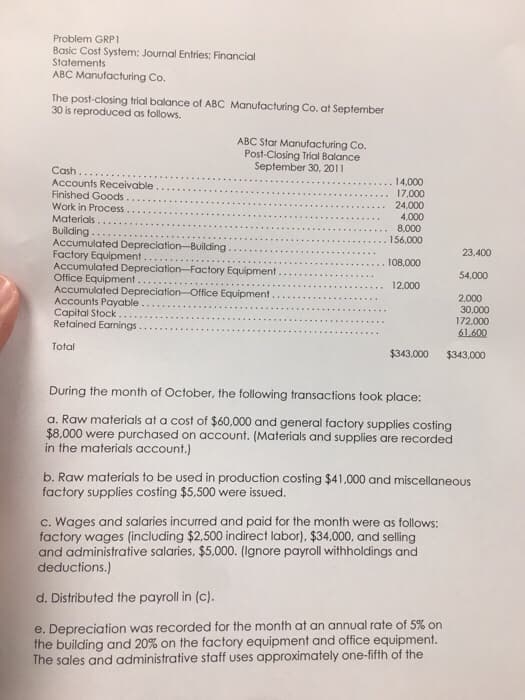

Problem GRP1 Basic Cost System: Journal Entries: Financial Statements ABC Manufacturing Co. The post-closing trial balance of ABC Manufacturing Co. at September 30 is reproduced as follows. ABC Star Manufacturing Co. Post-Closing Trial Balance September 30, 2011 Cash.. 14,000 17,000 24,000 4.000 8,000 156.000 Accounts Receivable Finished Goods Work in Process. Materials.. Building Accumulated Depreciation-Building. Factory Equipment Accumulated Depreciation-Factory Equipment Office Equipment.. Accumulated Depreciation-Office Equipment Accounts Payable.. Capital Stock Retained Earnings ........ ....... 23,400 108,000 54,000 ....... 12.000 2,000 30.000 172.000 61.600 ...... ............ Total $343,000 $343,000 During the month of October, the following transactions took place: a. Raw materials at a cost of $60,000 and general factory supplies costing $8.000 were purchased on account. (Materials and supplies are recorded in the materials account.) b. Raw materials to be used in production costing $41,000 and miscellaneous factory supplies costing $5,500 were issued. c. Wages and salaries incurred and paid for the month were as follows: factory wages (including $2,500 indirect labor), $34,000, and selling and administrative salaries, $5.000. (Ignore payroll withholdings and deductions.) d. Distributed the payroll in (c). e. Depreciation was recorded for the month at an annual rate of 5% on the building and 20% on the factory equipment and office equipment. The sales and administrative staff uses approximately one-fifth of the

Problem GRP1 Basic Cost System: Journal Entries: Financial Statements ABC Manufacturing Co. The post-closing trial balance of ABC Manufacturing Co. at September 30 is reproduced as follows. ABC Star Manufacturing Co. Post-Closing Trial Balance September 30, 2011 Cash.. 14,000 17,000 24,000 4.000 8,000 156.000 Accounts Receivable Finished Goods Work in Process. Materials.. Building Accumulated Depreciation-Building. Factory Equipment Accumulated Depreciation-Factory Equipment Office Equipment.. Accumulated Depreciation-Office Equipment Accounts Payable.. Capital Stock Retained Earnings ........ ....... 23,400 108,000 54,000 ....... 12.000 2,000 30.000 172.000 61.600 ...... ............ Total $343,000 $343,000 During the month of October, the following transactions took place: a. Raw materials at a cost of $60,000 and general factory supplies costing $8.000 were purchased on account. (Materials and supplies are recorded in the materials account.) b. Raw materials to be used in production costing $41,000 and miscellaneous factory supplies costing $5,500 were issued. c. Wages and salaries incurred and paid for the month were as follows: factory wages (including $2,500 indirect labor), $34,000, and selling and administrative salaries, $5.000. (Ignore payroll withholdings and deductions.) d. Distributed the payroll in (c). e. Depreciation was recorded for the month at an annual rate of 5% on the building and 20% on the factory equipment and office equipment. The sales and administrative staff uses approximately one-fifth of the

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:Problem GRP1

Basic Cost System: Journal Entries: Financial

Statements

ABC Manufacturing Co.

The post-closing trial balance of ABC Manufacturing Co. at September

30 is reproduced as follows.

ABC Star Manufacturing Co.

Post-Closing Trial Balance

September 30, 2011

Cash.

Accounts Receivable

Finished Goods.

Work in Process

Materials.

Building

Accumulated DepreciationBuilding

Factory Equipment

Accumulated Depreciation-Factory Equipment

Office Equipment.

Accumulated Depreciation Office Equipment

Accounts Payable

Capital Stock

Retained Earnings

14,000

17,000

24,000

4,000

8,000

156.000

23,400

108,000

54,000

12,000

2.000

30,000

172.000

61.600

Total

$343,000

$343,000

During the month of October, the following transactions took place:

a. Raw materials at a cost of $60,000 and general factory supplies costing

$8.000 were purchased on account. (Materials and supplies are recorded

in the materials account.)

b. Raw materials to be used in production costing $41,000 and miscellaneous

factory supplies costing $5,500 were issued.

c. Wages and salaries incurred and paid for the month were as follows:

factory wages (including $2,500 indirect labor), $34,000, and selling

and administrative salaries, $5,000. (Ignore payroll withholdings and

deductions.)

d. Distributed the payroll in (c).

e. Depreciation was recorded for the month at an annual rate of 5% on

the building and 20% on the factory equipment and office equipment.

The sales and administrative staff uses approximately one-fifth of the

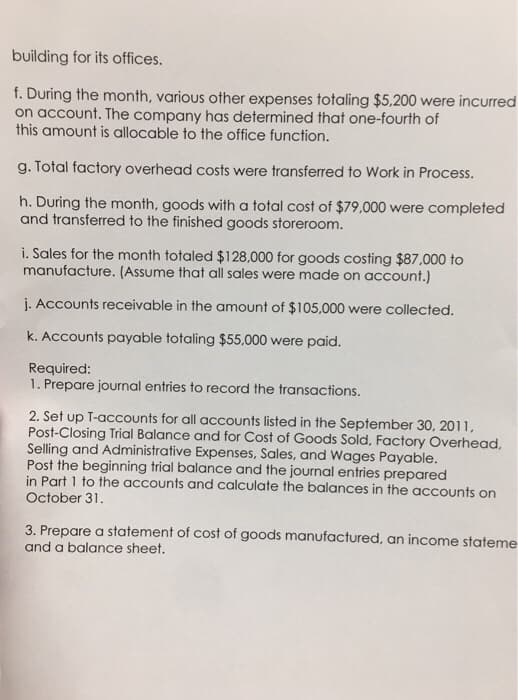

Transcribed Image Text:building for its offices.

f. During the month, various other expenses totaling $5,200 were incurred

on account. The company has determined that one-fourth of

this amount is allocable to the office function.

g. Total factory overhead costs were transferred to Work in Process.

h. During the month, goods with a total cost of $79,000 were completed

and transferred to the finished goods storeroom.

i. Sales for the month totaled $128,000 for goods costing $87,000 to

manufacture. (Assume that all sales were made on account.)

j. Accounts receivable in the amount of $105,000 were collected.

k. Accounts payable totaling $55,000 were paid.

Required:

1. Prepare journal entries to record the transactions.

2. Set up T-accounts for all accounts listed in the September 30, 2011,

Post-Closing Trial Balance and for Cost of Goods Sold, Factory Overhead,

Selling and Administrative Expenses, Sales, and Wages Payable.

Post the beginning trial balance and the journal entries prepared

in Part 1 to the accounts and calculate the balances in the accounts on

October 31.

3. Prepare a statement of cost of goods manufactured, an income stateme

and a balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education