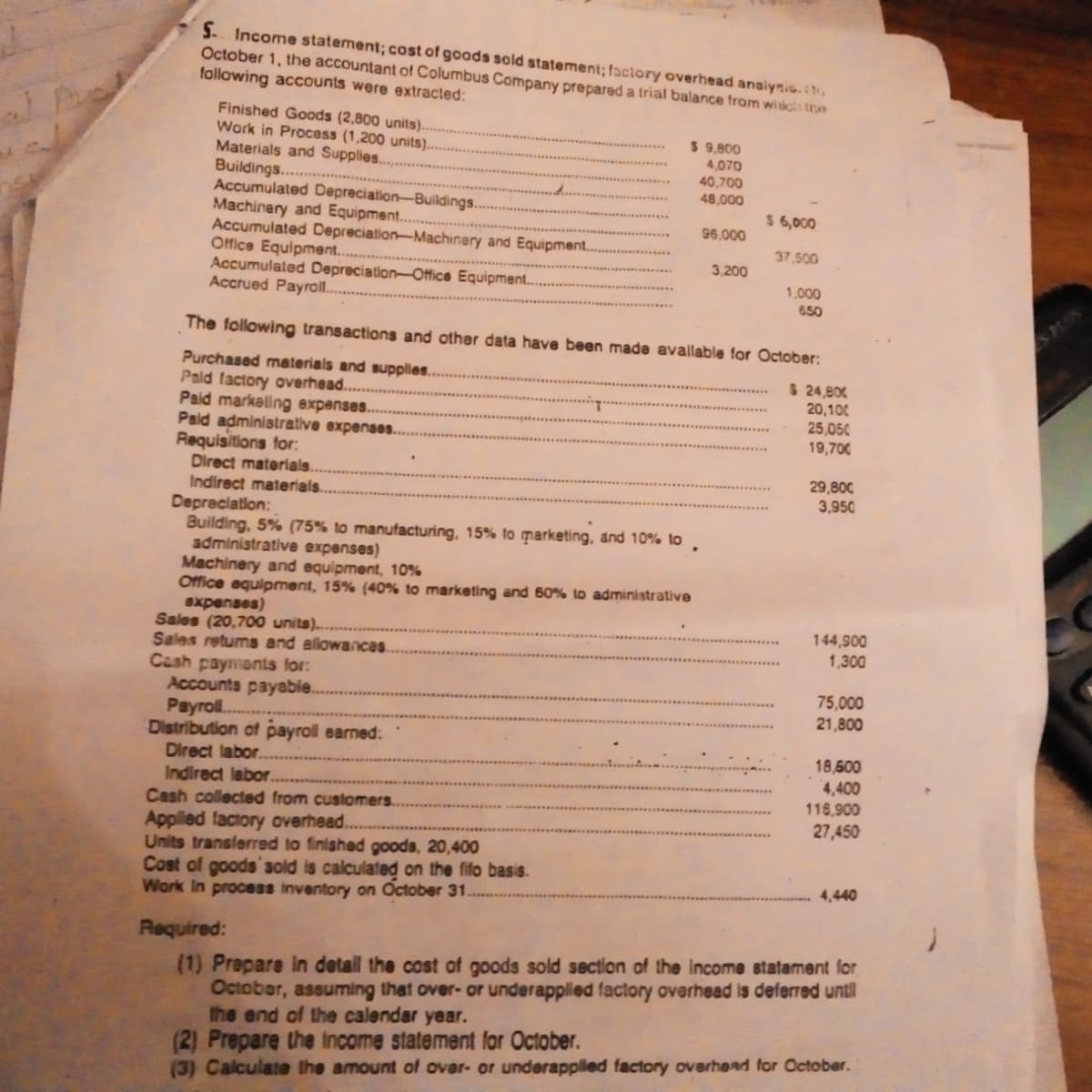

S. Income statement; cost of goods sold statement; faciory overhead anaiysis. October 1, the accountant of Columbus Company prepared a trial balance from wiic te following accounts were extracted: Finished Goods (2,800 units). Work in Process (1,200 units). $ 9,800 4,070 40,700 48,000 Materials and Supplies.. Buildings.. Accumulated Depreciation-Buildings. Machinery and Equipmen.. Accumulated Depreciation-Machinery and Equipment. Office Equipment... Accumulated Depreciation-Office Equipment. Accrued Payroll.. $ 6,000 96,000 37,500 3,200 1,000 650 The following transactions and other data have been made available for October: Purchased materials and supples. Pald factory overhead.. Paid markeling expenses.. Paid administrative expenses. Requisitions for: Direct materials. $ 24,800 20,100 25,050 19,700 29,800 3,950 Indirect materials.. Depreciation: Building, 5% (75% to manufacturing, 15% to marketing, and 10% to administrative expenses) Machinery and equipment, 10% Office equipment, 15% (40% to marketing and 60% to administrative expenses) Sales (20,700 units). Sales retums and allowances. Cash paymants for: Accounts payable. Payrol. Distribution of payroll earned: Direct labor. 144,900 1,300 75,000 21,800 18,500 4,400 Indirect labor. Cash collected from customers. 116,90 27,450 Applied factory overhead. Units transferred to finished goods, 20,400 Cost of goods'sold is calculated on the fifo basis. Work In process inventory on October 31. 4,440 Required: (1) Prepare In detall the cost of goods sold section of the income statament for October, assuming that over- or underapplied factory overhead is deferred until the end of the calendar year. (2) Prepare the income statement for October. (3) Calculate the amount of over- or underapplled factory overhend for October.

S. Income statement; cost of goods sold statement; faciory overhead anaiysis. October 1, the accountant of Columbus Company prepared a trial balance from wiic te following accounts were extracted: Finished Goods (2,800 units). Work in Process (1,200 units). $ 9,800 4,070 40,700 48,000 Materials and Supplies.. Buildings.. Accumulated Depreciation-Buildings. Machinery and Equipmen.. Accumulated Depreciation-Machinery and Equipment. Office Equipment... Accumulated Depreciation-Office Equipment. Accrued Payroll.. $ 6,000 96,000 37,500 3,200 1,000 650 The following transactions and other data have been made available for October: Purchased materials and supples. Pald factory overhead.. Paid markeling expenses.. Paid administrative expenses. Requisitions for: Direct materials. $ 24,800 20,100 25,050 19,700 29,800 3,950 Indirect materials.. Depreciation: Building, 5% (75% to manufacturing, 15% to marketing, and 10% to administrative expenses) Machinery and equipment, 10% Office equipment, 15% (40% to marketing and 60% to administrative expenses) Sales (20,700 units). Sales retums and allowances. Cash paymants for: Accounts payable. Payrol. Distribution of payroll earned: Direct labor. 144,900 1,300 75,000 21,800 18,500 4,400 Indirect labor. Cash collected from customers. 116,90 27,450 Applied factory overhead. Units transferred to finished goods, 20,400 Cost of goods'sold is calculated on the fifo basis. Work In process inventory on October 31. 4,440 Required: (1) Prepare In detall the cost of goods sold section of the income statament for October, assuming that over- or underapplied factory overhead is deferred until the end of the calendar year. (2) Prepare the income statement for October. (3) Calculate the amount of over- or underapplled factory overhend for October.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 39P

Related questions

Question

Solve all the Requirements

Transcribed Image Text:5.. Income statement; cost of goods sold statement; faciory overhead anaiysis.

October 1, the accountant of Columbus Company prepared a trial balance from wiich the

following accounts were extracted:

Finished Goods (2,800 units)..

Work in Process (1,200 units).

Materials and Supplies..

Buildings..

Accumulated Depreciation-Buildings.

Machinery and Equipmen..

Accumulated Depreciation-Machinery and Equipment..

Office Equipment..

Accumulated Depreciation-Office Equipment..

Accrued Payroll..

$ 9,800

4,070

40,700

48,000

$ 6,000

96,000

37,500

3,200

1,000

650

SPL

The following transactions and other data have been made available for October:

Purchased materials and supplles.

Pald factory overhead.

Paid markeling expenses.

Pald administrative expenses..

Requisitions for:

Direct materials..

Indirect materials.

Depreciation:

Building, 5% (75% to manufacturing, 15% to marketing, and 10% to

administrative expenses)

Machinery and equipment, 10%

Office equipment, 15% (40% to marketing and 60% to administrative

expenses)

Sales (20,700 units)...

Sales retums and allowances.

$ 24,806

20,100

25,050

19,700

29,800

3,950

144,900

1,300

Cash payments for:

Accounts payabie.

Рayrol..

Distribution of payroll earned:

Direct labor.

Indirect labor.

Cash collected from customers..

75,000

21,800

18,600

4,400

116,900

27,450

Appled factory overhead.

Units transferred to finished goods, 20,400

Cost of goods' old is calculated on the fifo basis.

Work In process inventory on October 31.

4,440

Required:

(1) Prepare In detal the cost of goods sold section of the income statament for

October, assuming that over- or underapplied factory overhead is deferred until

the end of the calendar year.

(2) Prepare the income statement for October.

(3) Calculate the amount of over- or underapplled factory overhend for October.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning