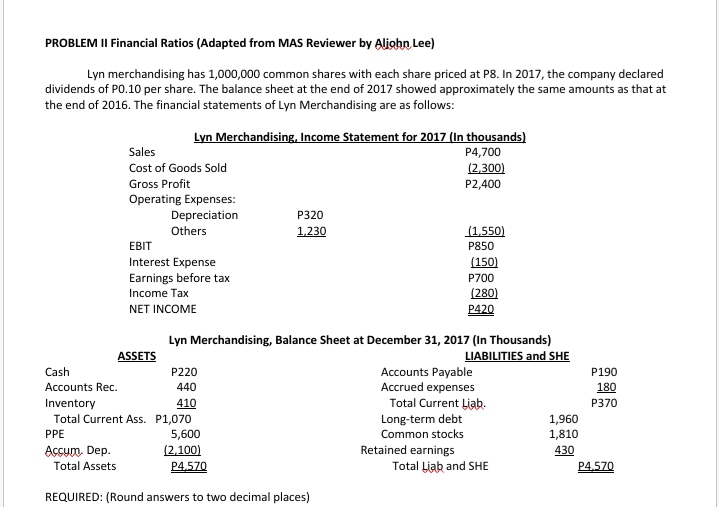

PROBLEM II Financial Ratios (Adapted from MAS Reviewer by Aljohn Lee) Lyn merchandising has 1,000,000 common shares with each share priced at P8. In 2017, the company declared dividends of PO.10 per share. The balance sheet at the end of 2017 showed approximately the same amounts as that at the end of 2016. The financial statements of Lyn Merchandising are as follows: Lyn Merchandising, Income Statement for 2017 (In thousands) Sales P4,700 Cost of Goods Sold (2,300) Gross Profit P2,400 Operating Expenses: Depreciation P320 Others 1,23 (1,550) EBIT P850 (150) P700 (280) Interest Expense Earnings before tax Income Tax NET INCOME P420 Lyn Merchandising, Balance Sheet at December 31, 2017 (In Thousands) ASSETS LIABILITIES and SHE Cash Accounts Payable Accrued expenses Total Current Liab. Long-term debt P220 P190 Accounts Rec. 440 180 Inventory 410 Total Current Ass. P1,070 5,600 (2,100) P370 1,960 1,810 PPE Common stocks Accum. Dep. Total Assets Retained earnings 430 P4.570 Total Liab and SHE P4.570 REQUIRED: (Round answers to two decimal places)

PROBLEM II Financial Ratios (Adapted from MAS Reviewer by Aljohn Lee) Lyn merchandising has 1,000,000 common shares with each share priced at P8. In 2017, the company declared dividends of PO.10 per share. The balance sheet at the end of 2017 showed approximately the same amounts as that at the end of 2016. The financial statements of Lyn Merchandising are as follows: Lyn Merchandising, Income Statement for 2017 (In thousands) Sales P4,700 Cost of Goods Sold (2,300) Gross Profit P2,400 Operating Expenses: Depreciation P320 Others 1,23 (1,550) EBIT P850 (150) P700 (280) Interest Expense Earnings before tax Income Tax NET INCOME P420 Lyn Merchandising, Balance Sheet at December 31, 2017 (In Thousands) ASSETS LIABILITIES and SHE Cash Accounts Payable Accrued expenses Total Current Liab. Long-term debt P220 P190 Accounts Rec. 440 180 Inventory 410 Total Current Ass. P1,070 5,600 (2,100) P370 1,960 1,810 PPE Common stocks Accum. Dep. Total Assets Retained earnings 430 P4.570 Total Liab and SHE P4.570 REQUIRED: (Round answers to two decimal places)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4AP

Related questions

Question

100%

Dividends Yield

Payout ratio

Transcribed Image Text:PROBLEM II Financial Ratios (Adapted from MAS Reviewer by Alighn Lee)

Lyn merchandising has 1,000,000 common shares with each share priced at P8. In 2017, the company declared

dividends of PO.10 per share. The balance sheet at the end of 2017 showed approximately the same amounts as that at

the end of 2016. The financial statements of Lyn Merchandising are as follows:

Lyn Merchandising, Income Statement for 2017 (In thousands)

Sales

P4,700

Cost of Goods Sold

(2,300)

Gross Profit

P2,400

Operating Expenses:

Depreciation

P320

Others

23

(1,550)

ЕBIT

P850

Interest Expense

(150)

Earnings before tax

P700

Income Tax

(280)

NET INCOME

P420

Lyn Merchandising, Balance Sheet at December 31, 2017 (In Thousands)

ASSETS

LIABILITIES and SHE

Cash

Accounts Payable

Accrued expenses

Total Current Liab.

P220

P190

Accounts Rec.

440

180

Inventory

Total Current Ass. P1,070

410

P370

Long-term debt

Common stocks

1,960

PPE

5,600

1,810

Accum. Dep.

Total Assets

(2,100)

P4.570

Retained earnings

Total Liab and SHE

430

P4.570

REQUIRED: (Round answers to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning