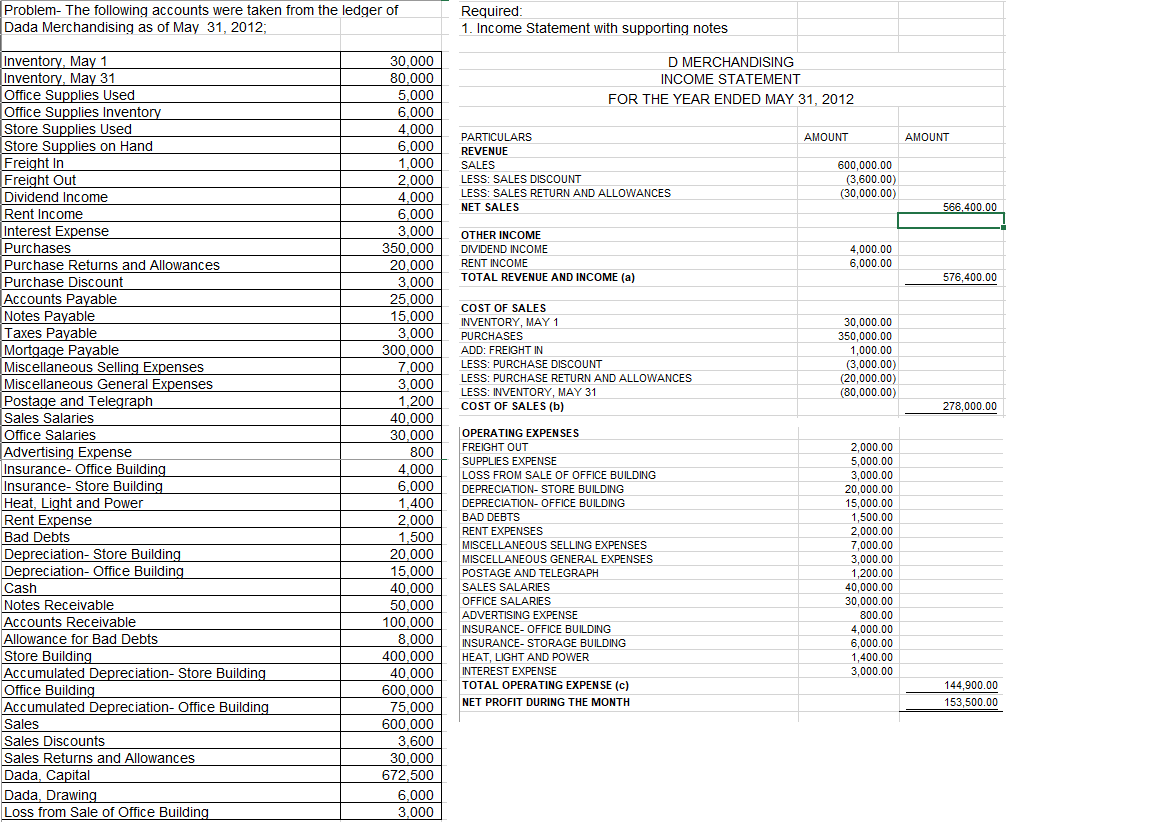

Problem- The following accounts were taken from the ledger of Dada Merchandising as of May 31, 2012; Required: 1. Income Statement with supporting notes Inventory, May 1 Inventory, May 31 Office Supplies Used Office Supplies Inventory Store Supplies Used Store Supplies on Hand Freight In Freight Out Dividend Income D MERCHANDISING 30,000 80,000 INCOME STATEMENT 5,000 6,000 4,000 6.000 FOR THE YEAR ENDED MAY 31, 2012 PARTICULARS AMOUNT AMOUNT REVENUE 1,000 2,000 4,000 600,000.00 (3,600.00) (30,000.00) SALES LESS: SALES DISCOUNT LESS: SALES RETURN AND ALLOWANCES NET SALES 566,400.00 6,000 3,000 Rent Income Interest Expense OTHER INCOME Purchases 350.000 4,000.00 6,000.00 DIVIDEND INCOME 20,000 3,000 25,000 15,000 3.000 300.000 RENT INCOME TOTAL REVENUE AND INCOME (a) Purchase Returns and Allowances Purchase Discount 576,400.00 Accounts Payable Notes Payable Taxes Payable Mortgage Payable Miscellaneous Selling Expenses Miscellaneous General Expenses Postage and Telegraph Sales Salaries Office Salaries Advertising Expense Insurance- Office Building Insurance- Store Building Heat, Light and Power Rent Expense Bad Debts Depreciation- Store Building Depreciation- Office Building COST OF SALES INVENTORY, MAY 1 PURCHASES 30,000.00 350,000.00 1,000.00 (3,000.00) (20,000.00) (80,000.00) ADD: FREIGHT INI LESS: PURCHASE DISCOUNT 7,000 3,000 1,200 40,000 30,000 800 LESS: PURCHASE RETURN AND ALLOWANCES LESS: INVENTORY, MAY 31 COST OF SALES (b) 278,000.00 OPERATING EXPENSES 2,000.00 5,000.00 3,000.00 20,000.00 15,000.00 1,500.00 2,000.00 7,000.00 3,000.00 1,200.00 40,000.00 30,000.00 800.00 FREIGHT OUT SUPPLIES EXPENSE LOSS FROM SALE OF OFFICE BUILDING DEPRECIATION- STORE BUILDING 4,000 6.000 1,400 2,000 1,500 20,000 15,000 DEPRECIATION- OFFICE BUILDING BAD DEBTS RENT EXPENSES MISCELLANEOUS SELLING EXPENSES MISCELLANEOUS GENERAL EXPENSES POSTAGE AND TELEGRAPH SALES SALARIES OFFICE SALARIES ADVERTISING EXPENSE INSURANCE- OFFICE BUILDING INSURANCE- STORAGE BUILDING HEAT, LIGHT AND POWER INTEREST EXPENSE Cash 40.000 50.000 100,000 8,000 400,000 40,000 600,000 75,000 600.000 3,600 30,000 672,500 Notes Receivable Accounts Receivable 4,000.00 6,000.00 1,400.00 3,000.00 Allowance for Bad Debts Store Building Accumulated Depreciation- Store Building Office Building Accumulated Depreciation- Office Building Sales Sales Discounts Sales Returns and Allowances Dada, Capital TOTAL OPERATING EXPENSE (c) 144,900.00 NET PROFIT DURING THE MONTH 153,500.00

Problem- The following accounts were taken from the ledger of Dada Merchandising as of May 31, 2012; Required: 1. Income Statement with supporting notes Inventory, May 1 Inventory, May 31 Office Supplies Used Office Supplies Inventory Store Supplies Used Store Supplies on Hand Freight In Freight Out Dividend Income D MERCHANDISING 30,000 80,000 INCOME STATEMENT 5,000 6,000 4,000 6.000 FOR THE YEAR ENDED MAY 31, 2012 PARTICULARS AMOUNT AMOUNT REVENUE 1,000 2,000 4,000 600,000.00 (3,600.00) (30,000.00) SALES LESS: SALES DISCOUNT LESS: SALES RETURN AND ALLOWANCES NET SALES 566,400.00 6,000 3,000 Rent Income Interest Expense OTHER INCOME Purchases 350.000 4,000.00 6,000.00 DIVIDEND INCOME 20,000 3,000 25,000 15,000 3.000 300.000 RENT INCOME TOTAL REVENUE AND INCOME (a) Purchase Returns and Allowances Purchase Discount 576,400.00 Accounts Payable Notes Payable Taxes Payable Mortgage Payable Miscellaneous Selling Expenses Miscellaneous General Expenses Postage and Telegraph Sales Salaries Office Salaries Advertising Expense Insurance- Office Building Insurance- Store Building Heat, Light and Power Rent Expense Bad Debts Depreciation- Store Building Depreciation- Office Building COST OF SALES INVENTORY, MAY 1 PURCHASES 30,000.00 350,000.00 1,000.00 (3,000.00) (20,000.00) (80,000.00) ADD: FREIGHT INI LESS: PURCHASE DISCOUNT 7,000 3,000 1,200 40,000 30,000 800 LESS: PURCHASE RETURN AND ALLOWANCES LESS: INVENTORY, MAY 31 COST OF SALES (b) 278,000.00 OPERATING EXPENSES 2,000.00 5,000.00 3,000.00 20,000.00 15,000.00 1,500.00 2,000.00 7,000.00 3,000.00 1,200.00 40,000.00 30,000.00 800.00 FREIGHT OUT SUPPLIES EXPENSE LOSS FROM SALE OF OFFICE BUILDING DEPRECIATION- STORE BUILDING 4,000 6.000 1,400 2,000 1,500 20,000 15,000 DEPRECIATION- OFFICE BUILDING BAD DEBTS RENT EXPENSES MISCELLANEOUS SELLING EXPENSES MISCELLANEOUS GENERAL EXPENSES POSTAGE AND TELEGRAPH SALES SALARIES OFFICE SALARIES ADVERTISING EXPENSE INSURANCE- OFFICE BUILDING INSURANCE- STORAGE BUILDING HEAT, LIGHT AND POWER INTEREST EXPENSE Cash 40.000 50.000 100,000 8,000 400,000 40,000 600,000 75,000 600.000 3,600 30,000 672,500 Notes Receivable Accounts Receivable 4,000.00 6,000.00 1,400.00 3,000.00 Allowance for Bad Debts Store Building Accumulated Depreciation- Store Building Office Building Accumulated Depreciation- Office Building Sales Sales Discounts Sales Returns and Allowances Dada, Capital TOTAL OPERATING EXPENSE (c) 144,900.00 NET PROFIT DURING THE MONTH 153,500.00

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter14: Adjustments And The Work Sheet For A Merchandising Business

Section: Chapter Questions

Problem 4SEB: WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following...

Related questions

Question

TRANSFORM IT TO FUNCTIONAL PRESENTATION USING THE FORMAT ON THE SECOND PICTURE

Transcribed Image Text:Problem- The following accounts were taken from the ledger of

Dada Merchandising as of May 31, 2012;

Required:

1. Income Statement with supporting notes

Inventory, May 1

Inventory, May 31

Office Supplies Used

Office Supplies Inventory

Store Supplies Used

Store Supplies on Hand

Freight In

Freight Out

Dividend Income

Rent Income

Interest Expense

Purchases

Purchase Returns and Allowances

Purchase Discount

Accounts Payable

Notes Payable

Taxes Payable

Mortgage Payable

Miscellaneous Selling Expenses

Miscellaneous General Expenses

Postage and Telegraph

Sales Salaries

Office Salaries

Advertising Expense

30,000

D MERCHANDISING

80,000

5,000

INCOME STATEMENT

FOR THE YEAR ENDED MAY 31, 2012

6,000

4,000

PARTICULARS

AMOUNT

AMOUNT

6,000

REVENUE

1,000

2,000

4,000

SALES

LESS: SALES DISCOUNT

LESS: SALES RETURN AND ALLOWANCES

NET SALES

600,000.00

(3,600.00)

(30,000.00)

566.400.00

6,000

3,000

OTHER INCOME

350,000

4,000.00

6,000.00

DIVIDEND INCOME

20,000

RENT INCOME

TOTAL REVENUE AND INCOME (a)

576,400.00

3,000

25,000

COST OF SALES

15,000

3,000

INVENTORY, MAY 1

30,000.00

PURCHASES

350,000.00

1,000.00

(3,000.00)

(20,000.00)

(80,000.00)

300,000

7,000

ADD: FREIGHT IN

LESS: PURCHASE DISCOUNT

LESS: PURCHASE RETURN AND ALLOWANCES

3,000

LESS: INVENTORY, MAY 31

COST OF SALES (b)

1,200

40,000

30.000

278,000.00

OPERATING EXPENSES

FREIGHT OUT

SUPPLIES EXPENSE

LOSS FROM SALE OF OFFICE BUILDING

DEPRECIATION- STORE BUILDING

DEPRECIATION- OFFICE BUILDING

2,000.00

5,000.00

3,000.00

20,000.00

15,000.00

1,500.00

2,000.00

7,000.00

800

Insurance- Office Building

Insurance- Store Building

Heat, Light and Power

Rent Expense

Bad Debts

Depreciation- Store Building

Depreciation- Office Building

Cash

Notes Receivable

Accounts Receivable

4,000

6,000

1,400

2,000

1,500

20,000

BAD DEBTS

RENT EXPENSES

MISCELLANEOUS SELLING EXPENSES

MISCELLANEOUS GENERAL EXPENSES

POSTAGE AND TELEGRAPH

SALES SALARIES

3,000.00

15,000

40,000

50.000

100,000

1,200.00

40,000.00

30,000.00

OFFICE SALARIES

ADVERTISING EXPENSE

800.00

INSURANCE- OFFICE BUILDING

4,000.00

Allowance for Bad Debts

8,000

INSURANCE- STORAGE BUILDING

HEAT, LIGHT AND POWER

INTEREST EXPENSE

TOTAL OPERATING EXPENSE (c)

6.000.00

Store Building

400,000

40,000

1,400.00

3,000.00

Accumulated Depreciation- Store Building

Office Building

Accumulated Depreciation- Office Building

600,000

144,900.00

NET PROFIT DURING THE MONTH

153,500.00

75,000

600,000

3,600

30,000

672,500

Sales

Sales Discounts

Sales Returns and Allowances

Dada, Capital

6,000

3,000

Dada, Drawing

Loss from Sale of Office Building

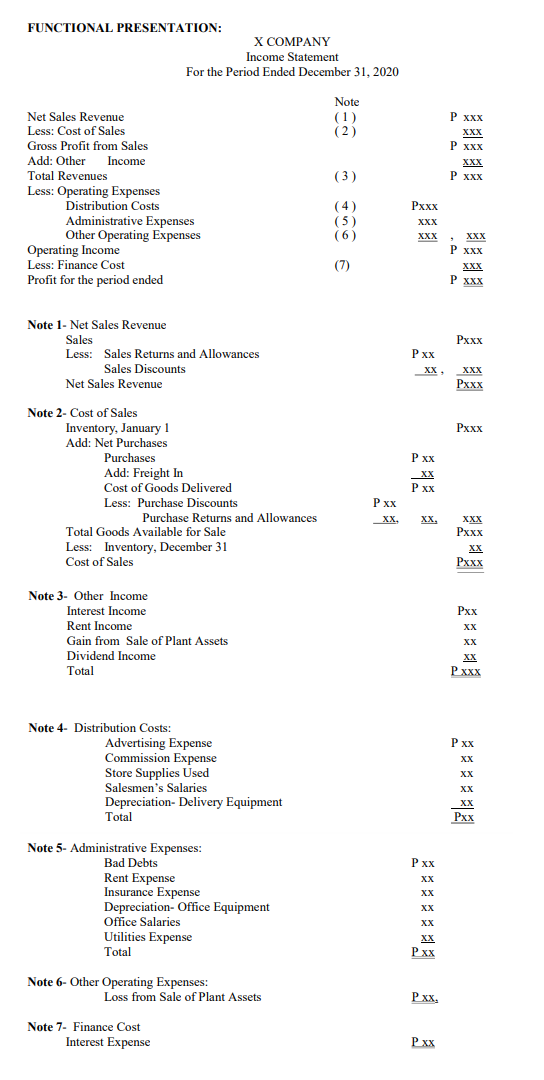

Transcribed Image Text:FUNCTIONAL PRESENTATION:

Х СОMРANY

Income Statement

For the Period Ended December 31, 2020

Note

Net Sales Revenue

Less: Cost of Sales

Р х

(1)

(2)

хXX

Р ххх

Gross Profit from Sales

Add: Other Income

Total Revenues

XXX

( 3 )

Р ххх

Less: Operating Expenses

Distribution Costs

Administrative Expenses

Other Operating Expenses

(4)

(5)

(6)

Pxxx

XXX

XXX ,

XXX

P XXX

Operating Income

Less: Finance Cost

(7)

XXX

Profit for the period ended

Р ххх

Note 1- Net Sales Revenue

Sales

Рххх

Less: Sales Returns and Allowances

Px

Sales Discounts

Net Sales Revenue

XX,

XXX

Pxxx

Note 2- Cost of Sales

Inventory, January 1

Add: Net Purchases

Purchases

Рххх

Р х

P xX

Add: Freight In

Cost of Goods Delivered

XX

Р хх

Less: Purchase Discounts

Р х

Purchase Returns and Allowances

XX,

XX,

XXX

Рххх

Total Goods Available for Sale

Less: Inventory, December 31

Cost of Sales

XX

Pxxx

Рххх

Note 3- Other Income

Interest Income

Pxx

Rent Income

XX

Gain from Sale of Plant Assets

XX

Dividend Income

XX

Рххх

Total

Note 4- Distribution Costs:

Advertising Expense

Commission Expense

Store Supplies Used

Salesmen's Salaries

Depreciation- Delivery Equipment

Total

Р х

XX

XX

XX

XX

Pxx

Note 5- Administrative Expenses:

Bad Debts

Rent Expense

Insurance Expense

Depreciation- Office Equipment

Office Salaries

Utilities Expense

Total

P xx

XX

XX

XX

XX

XX

Pxx

Note 6- Other Operating Expenses:

Loss from Sale of Plant Assets

P xx,

Note 7- Finance Cost

Interest Expense

P xx

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub