Product Pricing using the Cost-Plus Approach Concepts; Differential Analysis for Accepting Additional Business Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,620,000 in assets. The costs of producing and selling 8,100 units of flat panel displays are estimated as follows: Variable costs per unit: Fixed costs: Direct materials $81 Factory overhead $324,000 Direct labor 18 Selling and administrative expenses 162,000 Factory overhead 36 Selling and administrative expenses 32 Total $167 Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the

Product Pricing using the Cost-Plus Approach Concepts; Differential Analysis for Accepting Additional Business Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,620,000 in assets. The costs of producing and selling 8,100 units of flat panel displays are estimated as follows: Variable costs per unit: Fixed costs: Direct materials $81 Factory overhead $324,000 Direct labor 18 Selling and administrative expenses 162,000 Factory overhead 36 Selling and administrative expenses 32 Total $167 Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 16E

Related questions

Question

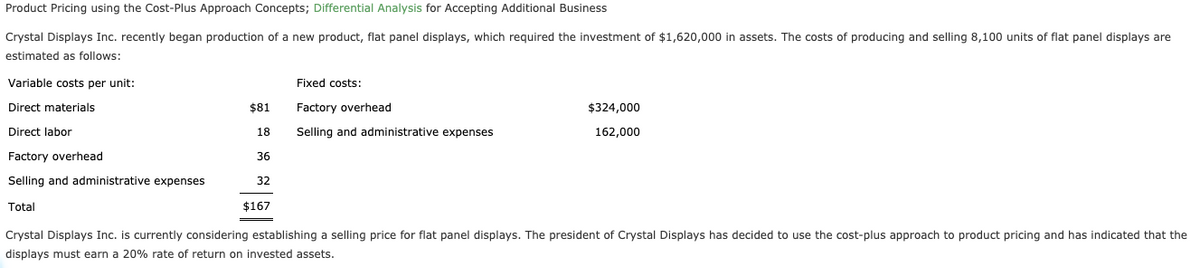

Transcribed Image Text:Product Pricing using the Cost-Plus Approach Concepts; Differential Analysis for Accepting Additional Business

Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,620,000 in assets. The costs of producing and selling 8,100 units of flat panel displays are

estimated as follows:

Variable costs per unit:

Fixed costs:

Direct materials

$81

Factory overhead

$324,000

Direct labor

18

Selling and administrative expenses

162,000

Factory overhead

36

Selling and administrative expenses

32

Total

$167

Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the

displays must earn a 20% rate of return on invested assets.

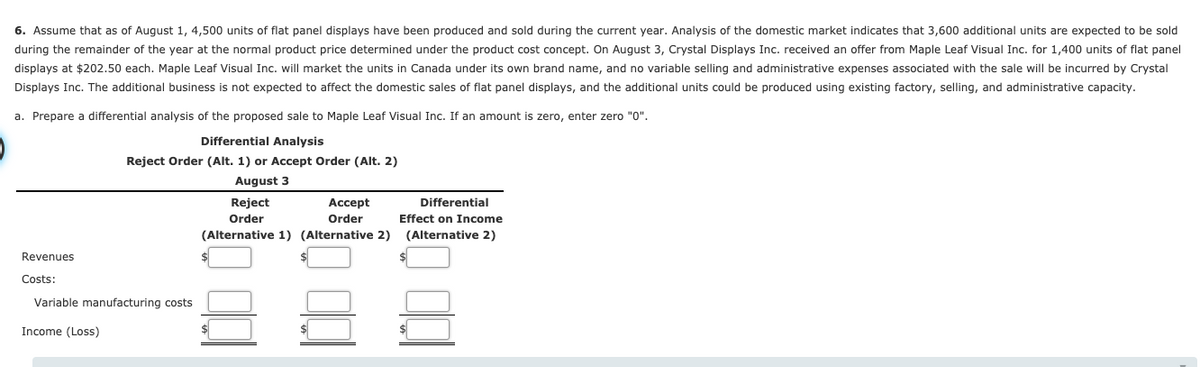

Transcribed Image Text:6. Assume that as of August 1, 4,500 units of flat panel displays have been produced and sold during the current year. Analysis of the domestic market indicates that 3,600 additional units are expected to be sold

during the remainder of the year at the normal product price determined under the product cost concept. On August 3, Crystal Displays Inc. received an offer from Maple Leaf Visual Inc. for 1,400 units of flat panel

displays at $202.50 each. Maple Leaf Visual Inc. will market the units in Canada under its own brand name, and no variable selling and administrative expenses associated with the sale will be incurred by Crystal

Displays Inc. The additional business is not expected to affect the domestic sales of flat panel displays, and the additional units could be produced using existing factory, selling, and administrative capacity.

a. Prepare a differential analysis of the proposed sale to Maple Leaf Visual Inc. If an amount is zero, enter zero "0".

Differential Analysis

Reject Order (Alt. 1) or Accept Order (Alt. 2)

August 3

Reject

Аcсept

Differential

Order

Order

Effect on Income

(Alternative 1) (Alternative 2)

(Alternative 2)

Revenues

Costs:

Variable manufacturing costs

Income (Loss)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College