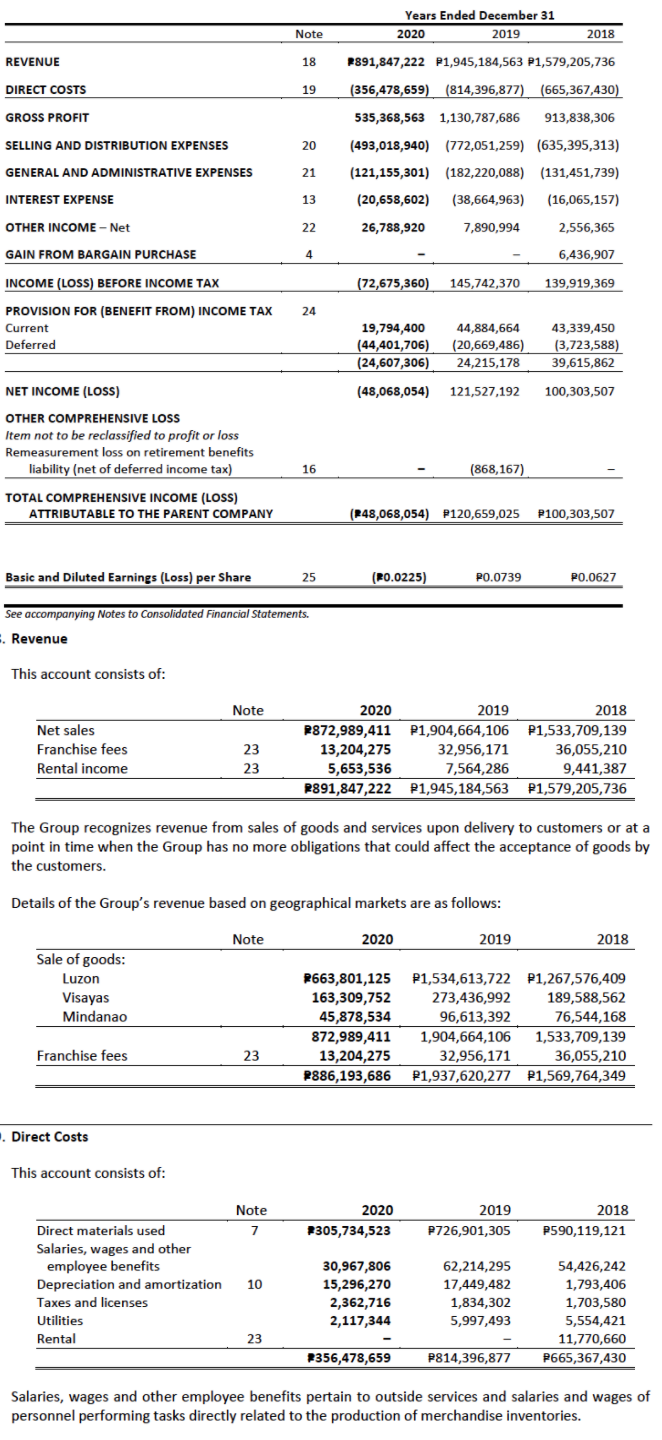

Profitability Ratio) What is the Return on Asset Ratio in 2020?

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter22: Budgeting

Section: Chapter Questions

Problem 22.22EX: Capital expenditures budget On January 1, 2016, the controller of Omicron Inc. is planning capital...

Related questions

Question

(Profitability Ratio)

What is the Return on Asset Ratio in 2020?

Transcribed Image Text:Years Ended December 31

Note

2020

2019

2018

REVENUE

18

P891,847,222 P1,945,184,563 P1,579,205,736

DIRECT COSTS

19

(356,478,659) (814,396,877) (665,367,430)

GROSS PROFIT

535,368,563 1,130,787,686

913,838,306

SELLING AND DISTRIBUTION EXPENSES

20

(493,018,940)

(772,051,259) (635,395,313)

GENERAL AND ADMINISTRATIVE EXPENSES

21

(121,155,301)

(182,220,088)

(131,451,739)

INTEREST EXPENSE

13

(20,658,602)

(38,664,963)

(16,065,157)

OTHER INCOME – Net

22

26,788,920

7,890,994

2,556,365

GAIN FROM BARGAIN PURCHASE

4

6,436,907

INCOME (LOSS) BEFORE INCOME TAX

(72,675,360)

145,742,370

139,919,369

PROVISION FOR (BENEFIT FROM) INCOME TAX

24

Current

19,794,400

(44,401,706)

44,884,664

43,339,450

(20,669,486)

24,215,178

Deferred

(3,723,588)

(24,607,306)

39,615,862

NET INCOME (LOSS)

(48,068,054)

121,527,192

100,303,507

OTHER COMPREHENSIVE LOSS

Item not to be reclassified to profit or loss

Remeasurement loss on retirement benefits

liability (net of deferred income tax)

16

(868,167)

TOTAL COMPREHENSIVE INCOME (LOSS)

ATTRIBUTABLE TO THE PARENT COMPANY

(248,068,054) P120,659,025

P100,303,507

Basic and Diluted Earnings (Loss) per Share

25

(P0.0225)

PO.0739

PO.0627

See accompanying Notes to Consolidated Financial Statements.

: Revenue

This account consists of:

Note

2020

2019

2018

Net sales

P872,989,411

13,204,275

5,653,536

P1,904,664,106

P1,533,709,139

Franchise fees

23

32,956,171

36,055,210

Rental income

23

7,564,286

9,441,387

P891,847,222 P1,945,184,563

P1,579,205,736

The Group recognizes revenue from sales of goods and services upon delivery to customers or at a

point in time when the Group has no more obligations that could affect the acceptance of goods by

the customers.

Details of the Group's revenue based on geographical markets are as follows:

Note

2020

2019

2018

Sale of goods:

Luzon

P663,801,125

163,309,752

45,878,534

P1,534,613,722 P1,267,576,409

273,436,992

96,613,392

Visayas

189,588,562

Mindanao

76,544,168

872,989,411

1,904,664,106

1,533,709,139

Franchise fees

23

32,956,171

P1,937,620,277 P1,569,764,349

13,204,275

36,055,210

P886,193,686

. Direct Costs

This account consists of:

Note

2020

2019

2018

Direct materials used

7

2305,734,523

P726,901,305

P590,119,121

Salaries, wages and other

employee benefits

Depreciation and amortization

30,967,806

62,214,295

54,426,242

1,793,406

1,703,580

10

15,296,270

17,449,482

2,362,716

2,117,344

Taxes and licenses

1,834,302

Utilities

5,997,493

5,554,421

Rental

23

11,770,660

2356,478,659

P814,396,877

P665,367,430

Salaries, wages and other employee benefits pertain to outside services and salaries and wages of

personnel performing tasks directly related to the production of merchandise inventories.

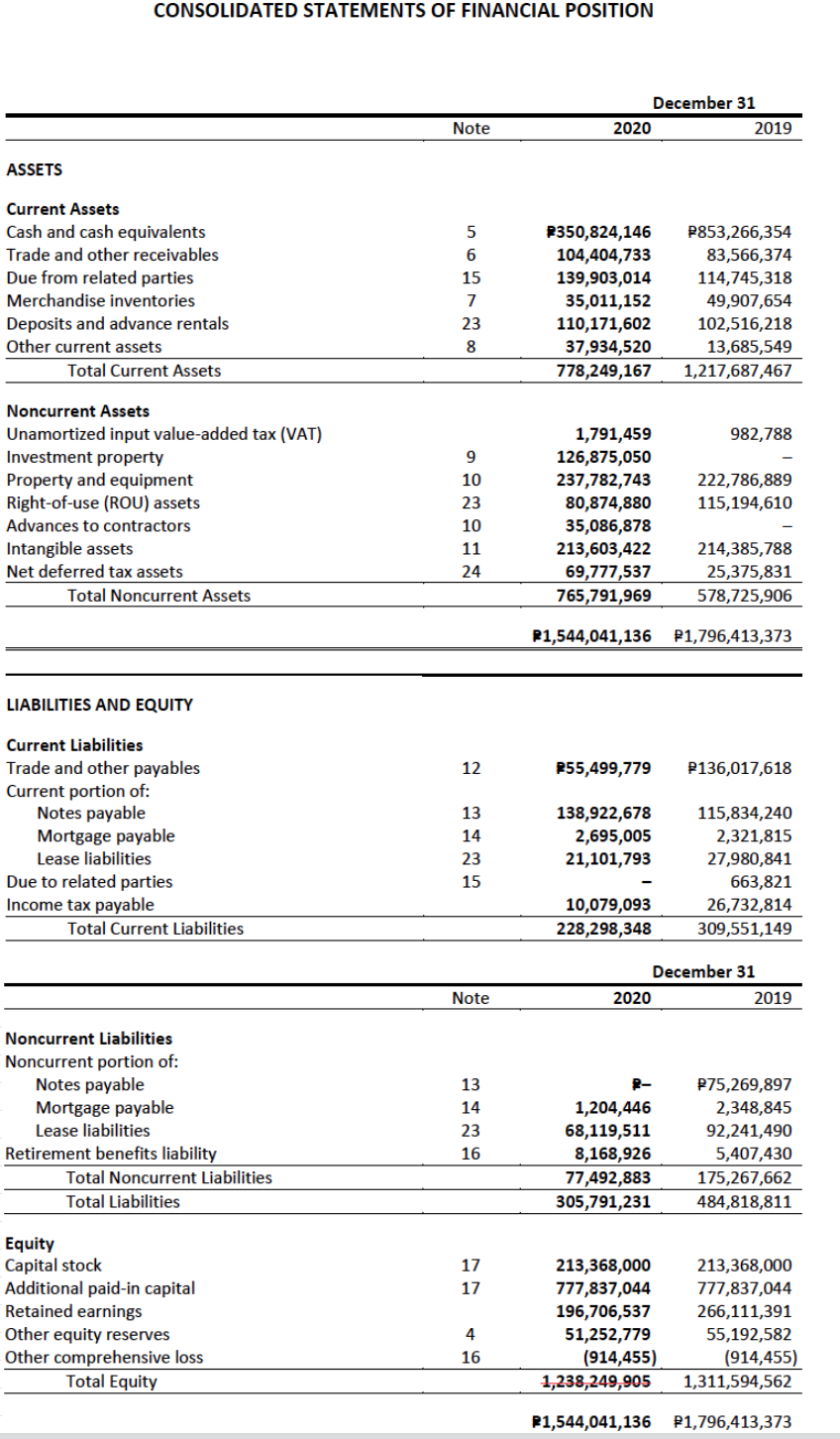

Transcribed Image Text:CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

December 31

Note

2020

2019

ASSETS

Current Assets

Cash and cash equivalents

P350,824,146

P853,266,354

Trade and other receivables

104,404,733

83,566,374

Due from related parties

15

114,745,318

139,903,014

35,011,152

110,171,602

37,934,520

778,249,167

Merchandise inventories

49,907,654

Deposits and advance rentals

Other current assets

102,516,218

13,685,549

23

8

Total Current Assets

1,217,687,467

Noncurrent Assets

Unamortized input value-added tax (VAT)

Investment property

Property and equipment

Right-of-use (ROU) assets

1,791,459

126,875,050

237,782,743

982,788

222,786,889

115,194,610

10

23

80,874,880

35,086,878

213,603,422

69,777,537

Advances to contractors

10

Intangible assets

11

214,385,788

Net deferred tax assets

24

25,375,831

Total Noncurrent Assets

765,791,969

578,725,906

P1,544,041,136

P1,796,413,373

LIABILITIES AND EQUITY

Current Liabilities

Trade and other payables

Current portion of:

Notes payable

Mortgage payable

12

P55,499,779

P136,017,618

138,922,678

2,695,005

21,101,793

13

115,834,240

14

2,321,815

Lease liabilities

23

27,980,841

Due to related parties

Income tax payable

15

663,821

10,079,093

228,298,348

26,732,814

Total Current Liabilities

309,551,149

December 31

Note

2020

2019

Noncurrent Liabilities

Noncurrent portion of:

Notes payable

Mortgage payable

Lease liabilities

13

R-

P75,269,897

14

1,204,446

68,119,511

8,168,926

77,492,883

305,791,231

2,348,845

23

92,241,490

Retirement benefits liability

16

5,407,430

Total Noncurrent Liabilities

175,267,662

Total Liabilities

484,818,811

Equity

Capital stock

Additional paid-in capital

Retained earnings

Other equity reserves

Other comprehensive loss

17

213,368,000

777,837,044

213,368,000

17

777,837,044

196,706,537

266,111,391

4

51,252,779

55,192,582

(914,455)

1,238,249,905

16

(914,455)

Total Equity

1,311,594,562

P1,544,041,136 P1,796,413,373

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning