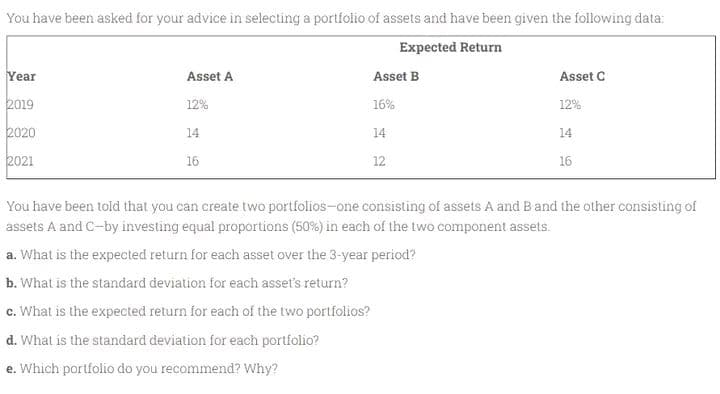

You have been asked for your advice in selecting a portfolio of assets and have been given the following data: Expected Return Year 2019 2020 2021 Asset A 12% 14 16 Asset B 16% 14 12 Asset C 12% 14 16 You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50%) in each of the two component assets. a. What is the expected return for each asset over the 3-year period? b. What is the standard deviation for each asset's return? c. What is the expected return for each of the two portfolios? d. What is the standard deviation for each portfolio? e. Which portfolio do you recommend? Why?

You have been asked for your advice in selecting a portfolio of assets and have been given the following data: Expected Return Year 2019 2020 2021 Asset A 12% 14 16 Asset B 16% 14 12 Asset C 12% 14 16 You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50%) in each of the two component assets. a. What is the expected return for each asset over the 3-year period? b. What is the standard deviation for each asset's return? c. What is the expected return for each of the two portfolios? d. What is the standard deviation for each portfolio? e. Which portfolio do you recommend? Why?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter3: Data Visualization

Section: Chapter Questions

Problem 18P: The Ajax Company uses a portfolio approach to manage their research and development (RD) projects....

Related questions

Question

Subject name: Principles of Insurance and Risk Management, Answer it fast please.

Transcribed Image Text:You have been asked for your advice in selecting a portfolio of assets and have been given the following data:

Expected Return

Year

2019

2020

2021

Asset A

12%

14

16

Asset B

16%

14

12

Asset C

12%

14

16

You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of

assets A and C-by investing equal proportions (50%) in each of the two component assets.

a. What is the expected return for each asset over the 3-year period?

b. What is the standard deviation for each asset's return?

c. What is the expected return for each of the two portfolios?

d. What is the standard deviation for each portfolio?

e. Which portfolio do you recommend? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning