Project A has a net present value of zero when the discount factor of 20% is used. How much return is the project earning? If project A above is earning K150, 000 per year in perpetuity, what is the initial investment cost of the project? Company A expects to generate K150, 000 cash flows per year in perpetuity and the risk adjusted discount rate is 20%. What should be the certainty equivalent cash flows when the risk free rate is 10%

Project A has a net present value of zero when the discount factor of 20% is used. How much return is the project earning? If project A above is earning K150, 000 per year in perpetuity, what is the initial investment cost of the project? Company A expects to generate K150, 000 cash flows per year in perpetuity and the risk adjusted discount rate is 20%. What should be the certainty equivalent cash flows when the risk free rate is 10%

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5MC

Related questions

Question

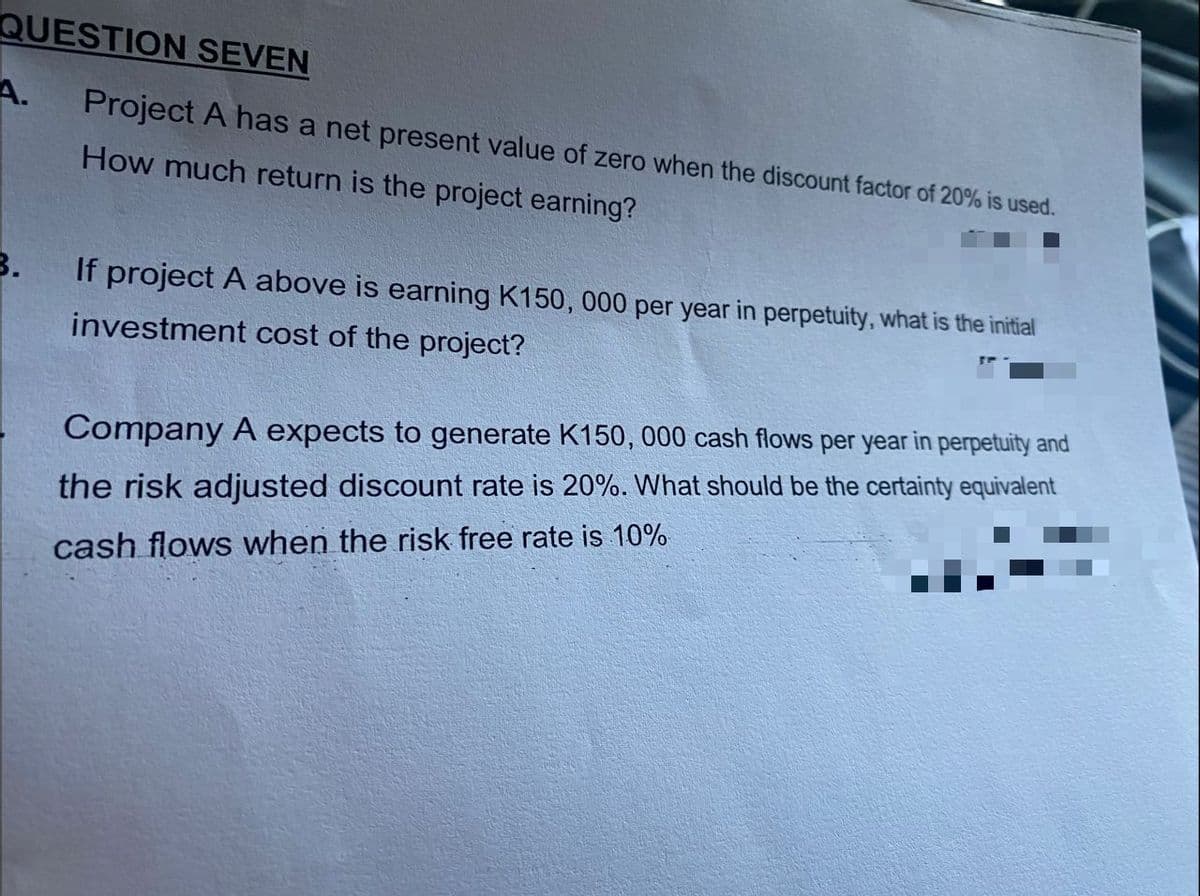

Transcribed Image Text:QUESTION SEVEN

A.

Project A has a net present value of zero when the discount factor of 20% is used.

How much return is the project earning?

3.

If project A above is earning K150, 000 per year in perpetuity, what is the initial

investment cost of the project?

Company A expects to generate K150, 000 cash flows per year in perpetuity and

the risk adjusted discount rate is 20%. What should be the certainty equivalent

cash flows when the risk free rate is 10%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning