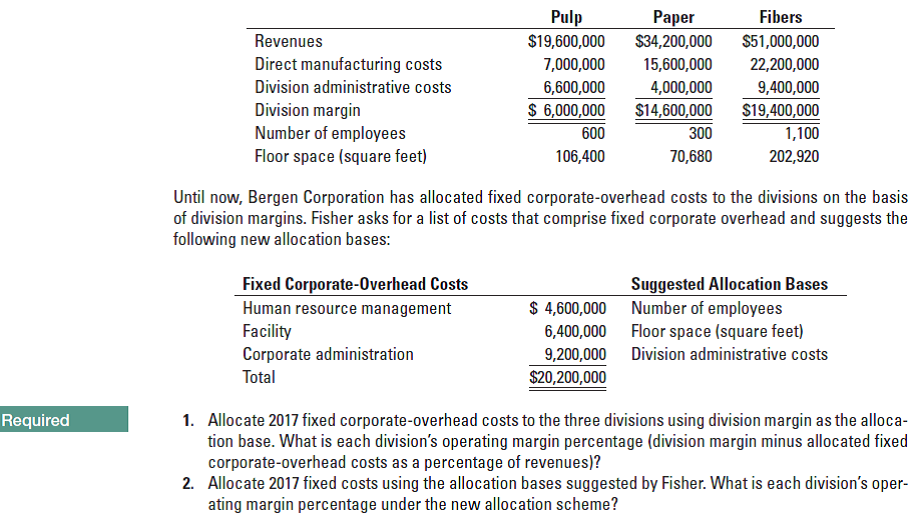

Pulp $19,600,000 Paper $34,200,000 Fibers Revenues $51,000,000 Direct manufacturing costs Division administrative costs 7,000,000 15,600,000 22,200,000 6,600,000 $ 6,000,000 600 4,000,000 9,400,000 Division margin Number of employees Floor space (square feet) $14,600,000 300 $19,400,000 1,100 106,400 70,680 202,920 Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases: Fixed Corporate-Overhead Costs Suggested Allocation Bases $ 4,600,000 Number of employees Human resource management Facility Corporate administration 6,400,000 Floor space (square feet) 9,200,000 Division administrative costs Total $20,200,000 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the alloca- tion base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division's oper- ating margin percentage under the new allocation scheme? Required 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objec- tions that may arise from the divisions?

Pulp $19,600,000 Paper $34,200,000 Fibers Revenues $51,000,000 Direct manufacturing costs Division administrative costs 7,000,000 15,600,000 22,200,000 6,600,000 $ 6,000,000 600 4,000,000 9,400,000 Division margin Number of employees Floor space (square feet) $14,600,000 300 $19,400,000 1,100 106,400 70,680 202,920 Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases: Fixed Corporate-Overhead Costs Suggested Allocation Bases $ 4,600,000 Number of employees Human resource management Facility Corporate administration 6,400,000 Floor space (square feet) 9,200,000 Division administrative costs Total $20,200,000 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the alloca- tion base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division's oper- ating margin percentage under the new allocation scheme? Required 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objec- tions that may arise from the divisions?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and bers. Bergen’s new controller, David Fisher, is reviewing the allocation of xed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Transcribed Image Text:Pulp

$19,600,000

Paper

$34,200,000

Fibers

Revenues

$51,000,000

Direct manufacturing costs

Division administrative costs

7,000,000

15,600,000

22,200,000

6,600,000

$ 6,000,000

600

4,000,000

9,400,000

Division margin

Number of employees

Floor space (square feet)

$14,600,000

300

$19,400,000

1,100

106,400

70,680

202,920

Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis

of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the

following new allocation bases:

Fixed Corporate-Overhead Costs

Suggested Allocation Bases

$ 4,600,000 Number of employees

Human resource management

Facility

Corporate administration

6,400,000 Floor space (square feet)

9,200,000

Division administrative costs

Total

$20,200,000

1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the alloca-

tion base. What is each division's operating margin percentage (division margin minus allocated fixed

corporate-overhead costs as a percentage of revenues)?

2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division's oper-

ating margin percentage under the new allocation scheme?

Required

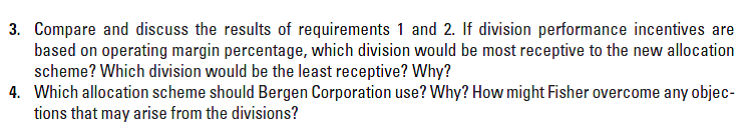

Transcribed Image Text:3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are

based on operating margin percentage, which division would be most receptive to the new allocation

scheme? Which division would be the least receptive? Why?

4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objec-

tions that may arise from the divisions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education