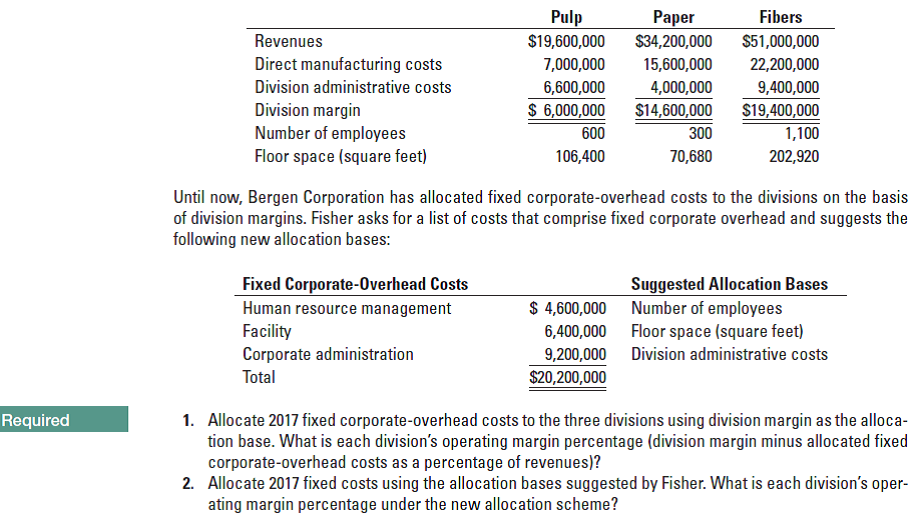

Pulp $19,600,000 Paper Fibers Revenues $34,200,000 $51,000,000 Direct manufacturing costs Division administrative costs 7,000,000 15,600,000 22,200,000 6,600,000 $ 6,000,000 600 4,000,000 9,400,000 Division margin Number of employees Floor space (square feet) $14,600,000 300 $19,400,000 1,100 106,400 70,680 202,920 Until now, Bergen Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Fisher asks for a list of costs that comprise fixed corporate overhead and suggests the following new allocation bases: Fixed Corporate-Overhead Costs Suggested Allocation Bases Number of employees Floor space (square feet) $ 4,600,000 Human resource management Facility Corporate administration 6,400,000 Division administrative costs 9,200,000 Total $20,200,000 Required 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the alloca- tion base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Fisher. What is each division's oper- ating margin percentage under the new allocation scheme? 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Bergen Corporation use? Why? How might Fisher overcome any objec- tions that may arise from the divisions?

Process Costing

Process costing is a sort of operation costing which is employed to determine the value of a product at each process or stage of producing process, applicable where goods produced from a series of continuous operations or procedure.

Job Costing

Job costing is adhesive costs of each and every job involved in the production processes. It is an accounting measure. It is a method which determines the cost of specific jobs, which are performed according to the consumer’s specifications. Job costing is possible only in businesses where the production is done as per the customer’s requirement. For example, some customers order to manufacture furniture as per their needs.

ABC Costing

Cost Accounting is a form of managerial accounting that helps the company in assessing the total variable cost so as to compute the cost of production. Cost accounting is generally used by the management so as to ensure better decision-making. In comparison to financial accounting, cost accounting has to follow a set standard ad can be used flexibly by the management as per their needs. The types of Cost Accounting include – Lean Accounting, Standard Costing, Marginal Costing and Activity Based Costing.

Cost allocation to divisions. Bergen Corporation has three divisions: pulp, paper, and fibers. Bergen’s new controller, David Fisher, is reviewing the allocation of fixed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2017:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images