Purchases during 04: Purchase, 10/22, 650 units @ $55 Purchase, 11/5; 700 units @558 Purchase, 11/2; 1,100 units @ $62 Purchase, 12/5; 430 units@ $60 Purchase, 12/30; 750 units @ $65 The company made a sale of 900 units on 11/15 and a sale of 700 units on 12/18. 1. Determine cost of goods sold if the company uses a LIFO perpetual cost flow assumption. 2. Determine cost of goods sold if the company uses a LIFO periodic cost flow assumption: 3. Determine cost of goods sold if the company uses a weighted-average periodic sot flow assumption (do not round avera

Purchases during 04: Purchase, 10/22, 650 units @ $55 Purchase, 11/5; 700 units @558 Purchase, 11/2; 1,100 units @ $62 Purchase, 12/5; 430 units@ $60 Purchase, 12/30; 750 units @ $65 The company made a sale of 900 units on 11/15 and a sale of 700 units on 12/18. 1. Determine cost of goods sold if the company uses a LIFO perpetual cost flow assumption. 2. Determine cost of goods sold if the company uses a LIFO periodic cost flow assumption: 3. Determine cost of goods sold if the company uses a weighted-average periodic sot flow assumption (do not round avera

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.23MCE

Related questions

Question

220 units at $50 each

please answer only first three suparts thanx

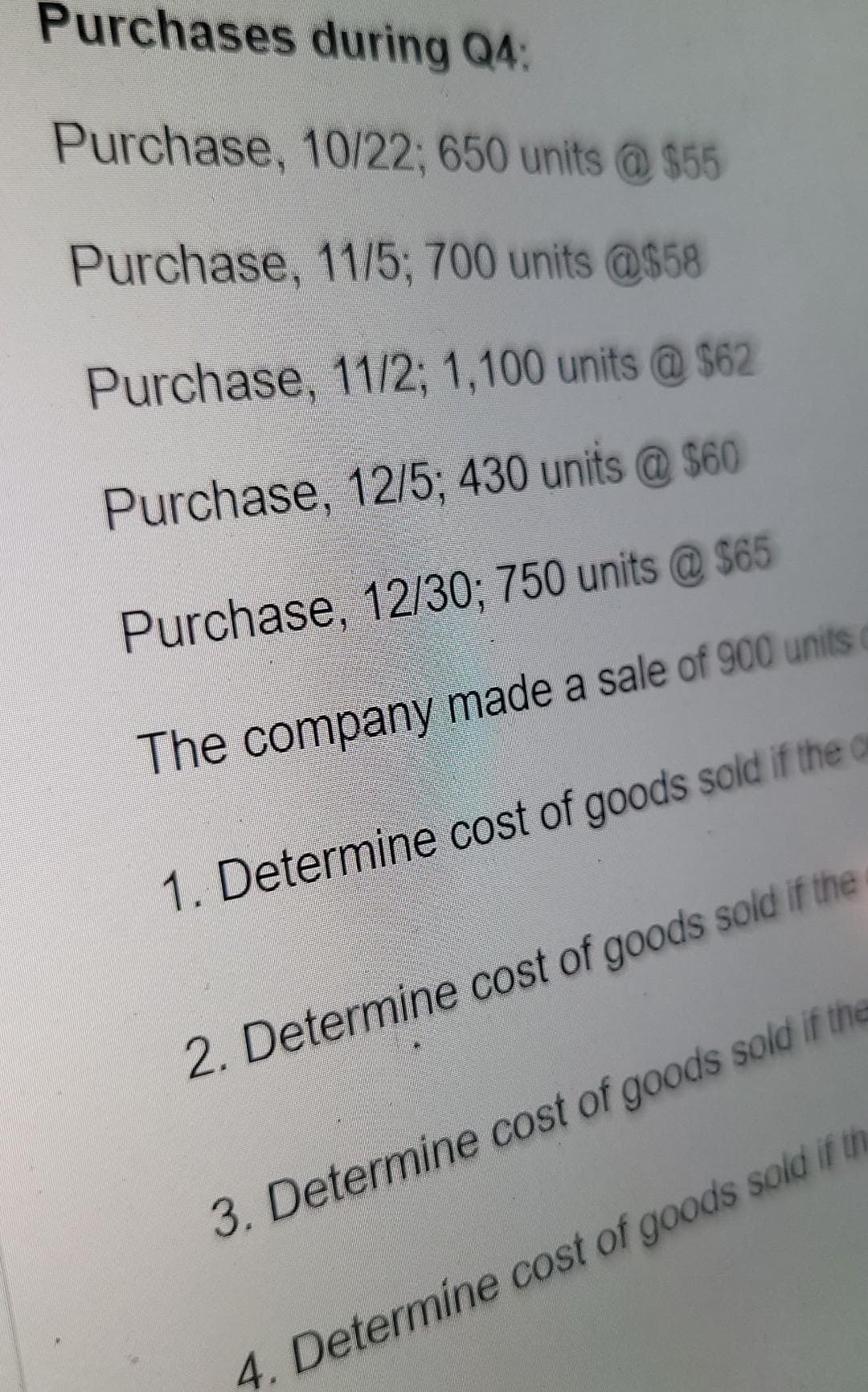

Transcribed Image Text:Purchases during Q4:

Purchase, 10/22; 650 units @ $55

Purchase, 11/5; 700 units @$58

Purchase, 11/2; 1,100 units @ $62

Purchase, 12/5; 430 units @ $60

Purchase, 12/30; 750 units @ $65

The company made a sale of 900 units

1. Determine cost of goods sold if the a

2. Determine cost of goods sold if the

3. Determine cost of goods sold if the

4. Determine cost of goods sold if the

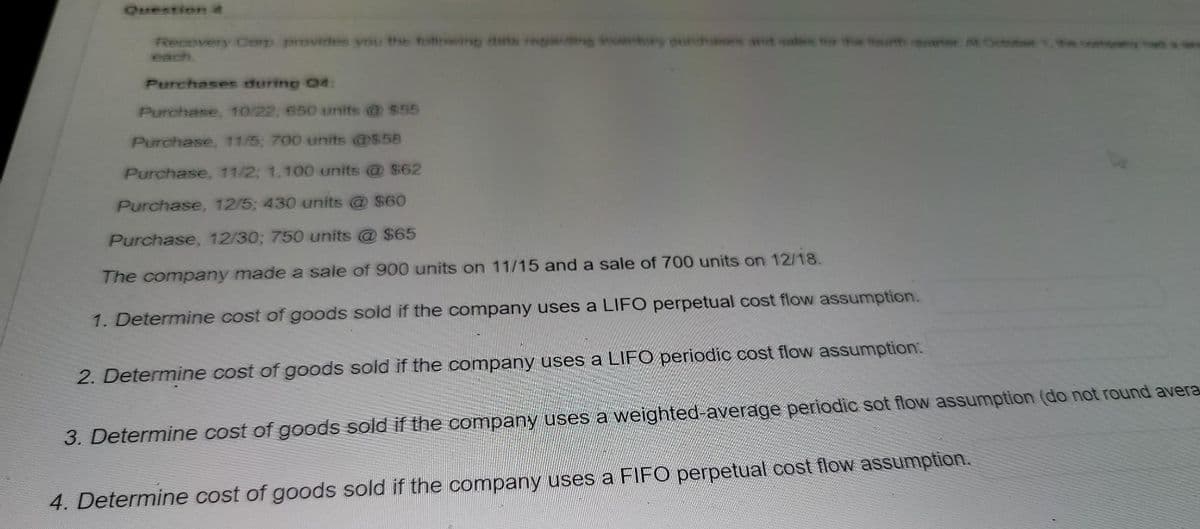

Transcribed Image Text:Purchases during 04:

Purchase, 10/22, 650 units @ $55

Purchase, 11/5; 700 units @$58

Purchase, 11/2: 1,100 units @ $62

Purchase, 12/5; 430 units @ $60

Purchase, 12/30; 750 units @ $65

The company made a sale of 900 units on 11/15 and a sale of 700 units on 12/18.

1. Determine cost of goods sold if the company uses a LIFO perpetual cost flow assumption.

2. Determine cost of goods sold if the company uses a LIFO periodic cost flow assumption:

3. Determine cost of goods sold if the company uses a weighted-average periodic sot flow assumption (do not round avera

4. Determine cost of goods sold if the company uses a FIFO perpetual cost flow assumption.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning