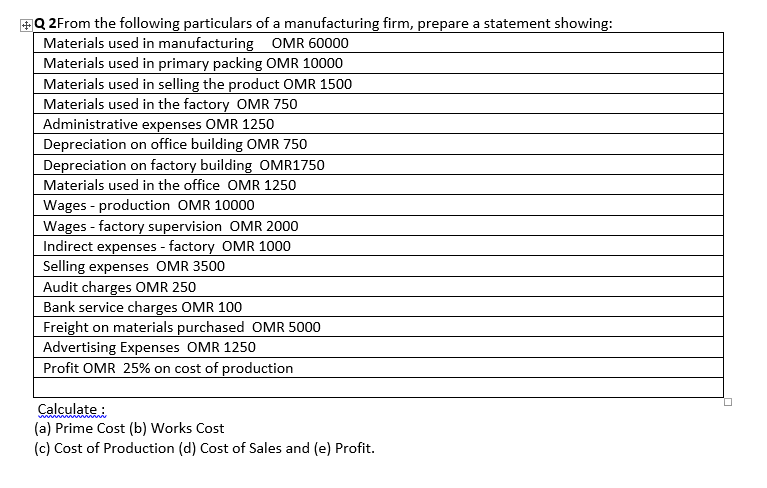

+Q 2From the following particulars of a manufacturing firm, prepare a statement showing: Materials used in manufacturing OMR 60000 Materials used in primary packing OMR 10000 Materials used in selling the product OMR 1500 Materials used in the factory OMR 750 Administrative expenses OMR 1250 Depreciation on office building OMR 750 Depreciation on factory building OMR1750 Materials used in the office OMR 1250 Wages - production OMR 10000 Wages - factory supervision OMR 2000 Indirect expenses - factory OMR 1000 Selling expenses OMR 3500 Audit charges OMR 250 Bank service charges OMR 100 Freight on materials purchased OMR 5000 Advertising Expenses OMR 1250 Profit OMR 25% on cost of production Calculate: (a) Prime Cost (b) Works Cost (c) Cost of Production (d) Cost of Sales and (e) Profit.

+Q 2From the following particulars of a manufacturing firm, prepare a statement showing: Materials used in manufacturing OMR 60000 Materials used in primary packing OMR 10000 Materials used in selling the product OMR 1500 Materials used in the factory OMR 750 Administrative expenses OMR 1250 Depreciation on office building OMR 750 Depreciation on factory building OMR1750 Materials used in the office OMR 1250 Wages - production OMR 10000 Wages - factory supervision OMR 2000 Indirect expenses - factory OMR 1000 Selling expenses OMR 3500 Audit charges OMR 250 Bank service charges OMR 100 Freight on materials purchased OMR 5000 Advertising Expenses OMR 1250 Profit OMR 25% on cost of production Calculate: (a) Prime Cost (b) Works Cost (c) Cost of Production (d) Cost of Sales and (e) Profit.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 23DQ: LO.6 Largo Company is an engineering consulting business that uses the accrual method of accounting...

Related questions

Question

100%

Transcribed Image Text:+Q 2From the following particulars of a manufacturing firm, prepare a statement showing:

Materials used in manufacturing OMR 60000

Materials used in primary packing OMR 10000

Materials used in selling the product OMR 1500

Materials used in the factory OMR 750

Administrative expenses OMR 1250

Depreciation on office building OMR 750

Depreciation on factory building OMR1750

Materials used in the office OMR 1250

Wages - production OMR 10000

Wages - factory supervision OMR 2000

Indirect expenses - factory OMR 1000

Selling expenses OMR 3500

Audit charges OMR 250

Bank service charges OMR 100

Freight on materials purchased OMR 5000

Advertising Expenses OMR 1250

Profit OMR 25% on cost of production

Calculate :

(a) Prime Cost (b) Works Cost

(c) Cost of Production (d) Cost of Sales and (e) Profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT