Q No.1 Use the following selected financial data for Happy Valley Co. to answer questions. Net sales Rs.200,000 Cost of goods sold Operating expenses Net income 90,000 80,000 Total assets Total liabilities 10,000 180,000 120,000 Calculate (1) debt ratio (2) operating profit margin (3) return on equity (4) net profit margin (5) Gross Profit ratio (6) Operating expense ratio (7) Assets turnover

Q No.1 Use the following selected financial data for Happy Valley Co. to answer questions. Net sales Rs.200,000 Cost of goods sold Operating expenses Net income 90,000 80,000 Total assets Total liabilities 10,000 180,000 120,000 Calculate (1) debt ratio (2) operating profit margin (3) return on equity (4) net profit margin (5) Gross Profit ratio (6) Operating expense ratio (7) Assets turnover

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

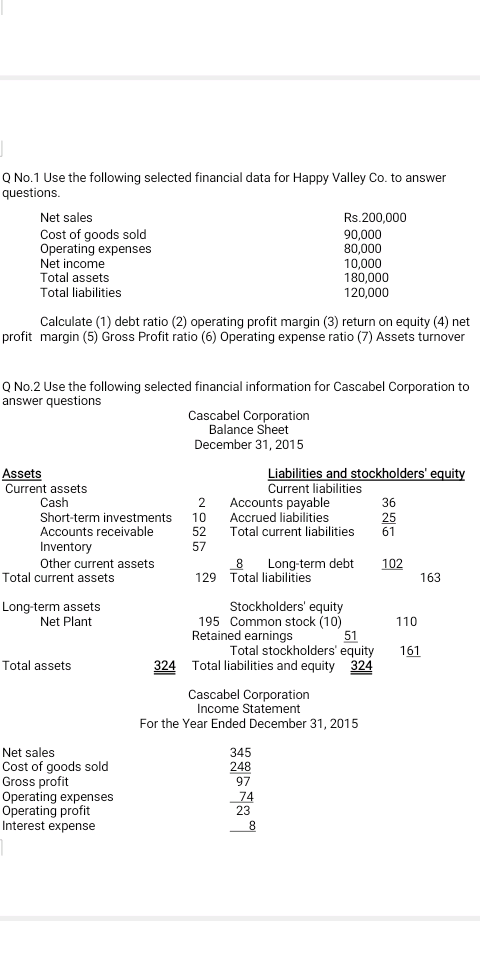

Transcribed Image Text:Q No.1 Use the following selected financial data for Happy Valley Co. to answer

questions.

Net sales

Rs.200,000

Cost of goods sold

Operating expenses

90,000

80,000

10,000

180,000

120,000

Net income

Total assets

Total liabilities

Calculate (1) debt ratio (2) operating profit margin (3) return on equity (4) net

profit margin (5) Gross Profit ratio (6) Operating expense ratio (7) Assets turnover

Q No.2 Use the following selected financial information for Cascabel Corporation to

answer questions

Cascabel Corporation

Balance Sheet

December 31, 2015

Liabilities and stockholders' equity

Current liabilities

Accounts payable

Accrued liabilities

Assets

Current assets

Cash

Short-term investments

Accounts receivable

36

10

25

61

52

Total current liabilities

Inventory

Other current assets

57

Long-term debt

102

Total current assets

129 Total liabilities

163

Stockholders' equity

195 Common stock (10)

51

Total stockholders' equity

324 Total liabilities and equity 324

Long-term assets

Net Plant

110

Retained earnings

161

Total assets

Cascabel Corporation

Income Statement

For the Year Ended December 31, 2015

Net sales

Cost of goods sold

Gross profit

Operating expenses

Operating profit

Interest expense

345

248

97

74

23

8.

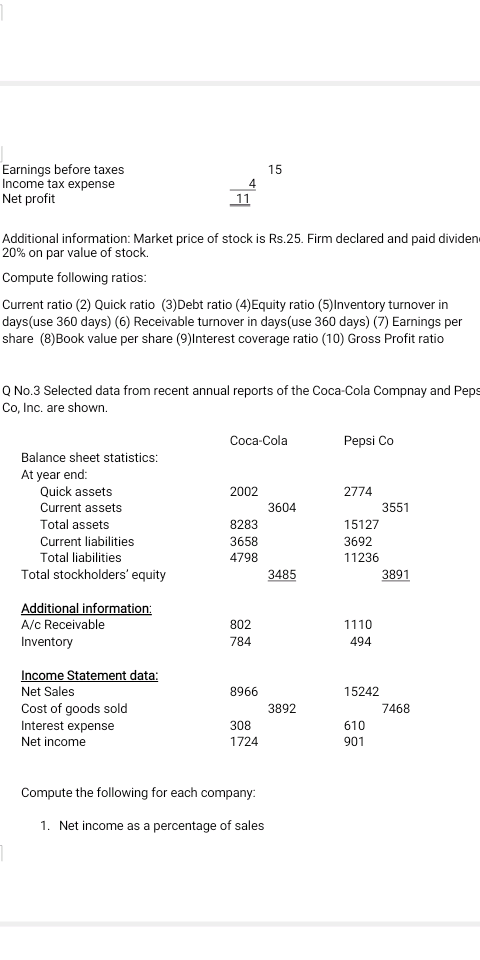

Transcribed Image Text:Earnings before taxes

Income tax expense

Net profit

15

11

Additional information: Market price of stock is Rs.25. Firm declared and paid dividen

20% on par value of stock.

Compute following ratios:

Current ratio (2) Quick ratio (3)Debt ratio (4)Equity ratio (5)Inventory turnover in

days(use 360 days) (6) Receivable turnover in days(use 360 days) (7) Earnings per

share (8)Book value per share (9)Interest coverage ratio (10) Gross Profit ratio

Q No.3 Selected data from recent annual reports of the Coca-Cola Compnay and Peps

Co, Inc. are shown.

Coca-Cola

Pepsi Co

Balance sheet statistics:

At year end:

Quick assets

2002

2774

Current assets

3604

3551

Total assets

8283

15127

Current liabilities

Total liabilities

3658

3692

4798

11236

Total stockholders' equity

3485

3891

Additional information:

A/c Receivable

802

1110

Inventory

784

494

Income Statement data:

Net Sales

8966

15242

Cost of goods sold

Interest expense

Net income

3892

7468

308

610

1724

901

Compute the following for each company:

1. Net income as a percentage of sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning