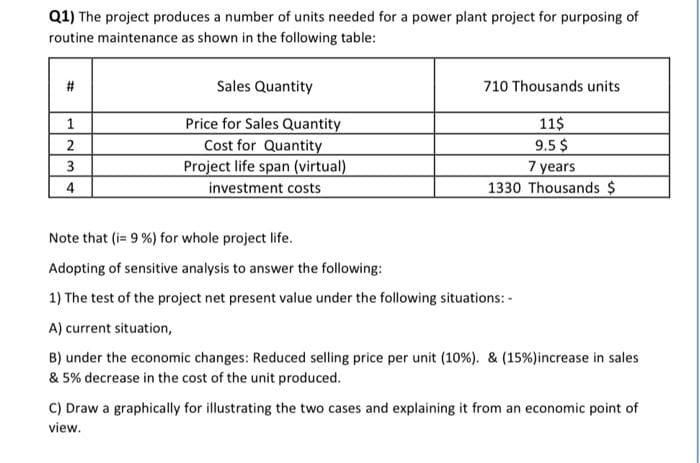

Q1) The project produces a number of units needed for a power plant project for purposing of routine maintenance as shown in the following table: Sales Quantity 710 Thousands units Price for Sales Quantity Cost for Quantity Project life span (virtual) investment costs 11$ 9.5 $ 7 years 1330 Thousands $ 2 3 4 Note that (i= 9 %) for whole project life. Adopting of sensitive analysis to answer the following: 1) The test of the project net present value under the following situations: - A) current situation, B) under the economic changes: Reduced selling price per unit (10%). & (15%)increase in sales & 5% decrease in the cost of the unit produced. C) Draw a graphically for illustrating the two cases and explaining it from an economic point of view.

Q1) The project produces a number of units needed for a power plant project for purposing of routine maintenance as shown in the following table: Sales Quantity 710 Thousands units Price for Sales Quantity Cost for Quantity Project life span (virtual) investment costs 11$ 9.5 $ 7 years 1330 Thousands $ 2 3 4 Note that (i= 9 %) for whole project life. Adopting of sensitive analysis to answer the following: 1) The test of the project net present value under the following situations: - A) current situation, B) under the economic changes: Reduced selling price per unit (10%). & (15%)increase in sales & 5% decrease in the cost of the unit produced. C) Draw a graphically for illustrating the two cases and explaining it from an economic point of view.

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 11P

Related questions

Question

Please help to solve this problem.

Transcribed Image Text:Q1) The project produces a number of units needed for a power plant project for purposing of

routine maintenance as shown in the following table:

Sales Quantity

710 Thousands units

Price for Sales Quantity

Cost for Quantity

Project life span (virtual)

investment costs

11$

9.5 $

7 years

1330 Thousands $

1

3

4

Note that (i= 9 %) for whole project life.

Adopting of sensitive analysis to answer the following:

1) The test of the project net present value under the following situations: -

A) current situation,

B) under the economic changes: Reduced selling price per unit (10%). & (15%)increase in sales

& 5% decrease in the cost of the unit produced.

C) Draw a graphically for illustrating the two cases and explaining it from an economic point of

view.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub