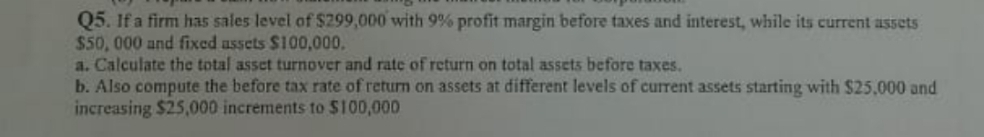

Q5. If a firm has sales level of $299,000 with 9% profit margin before taxes and interest, while its current assets $50, 000 and fixed assets $100,000. a. Calculate the total asset turnover and rate of return on total assets before taxes. b. Also compute the before tax rate of return on assets at different levels of current assets starting with $25,000 and increasing $25,000 increments to $100,000

Q5. If a firm has sales level of $299,000 with 9% profit margin before taxes and interest, while its current assets $50, 000 and fixed assets $100,000. a. Calculate the total asset turnover and rate of return on total assets before taxes. b. Also compute the before tax rate of return on assets at different levels of current assets starting with $25,000 and increasing $25,000 increments to $100,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.3MBA: Financial leverage MicrosoCortrepotied (MSFT) reported the following data (in millions) for a tern...

Related questions

Question

Transcribed Image Text:Q5. If a firm has sales level of $299,000 with 9% profit margin before taxes and interest, while its current assets

$50, 000 and fixed assets $100,000.

a. Calculate the total asset turnover and rate of return on total assets before taxes.

b. Also compute the before tax rate of return on assets at different levels of current assets starting with $25,000 and

increasing $25,000 increments to $100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning