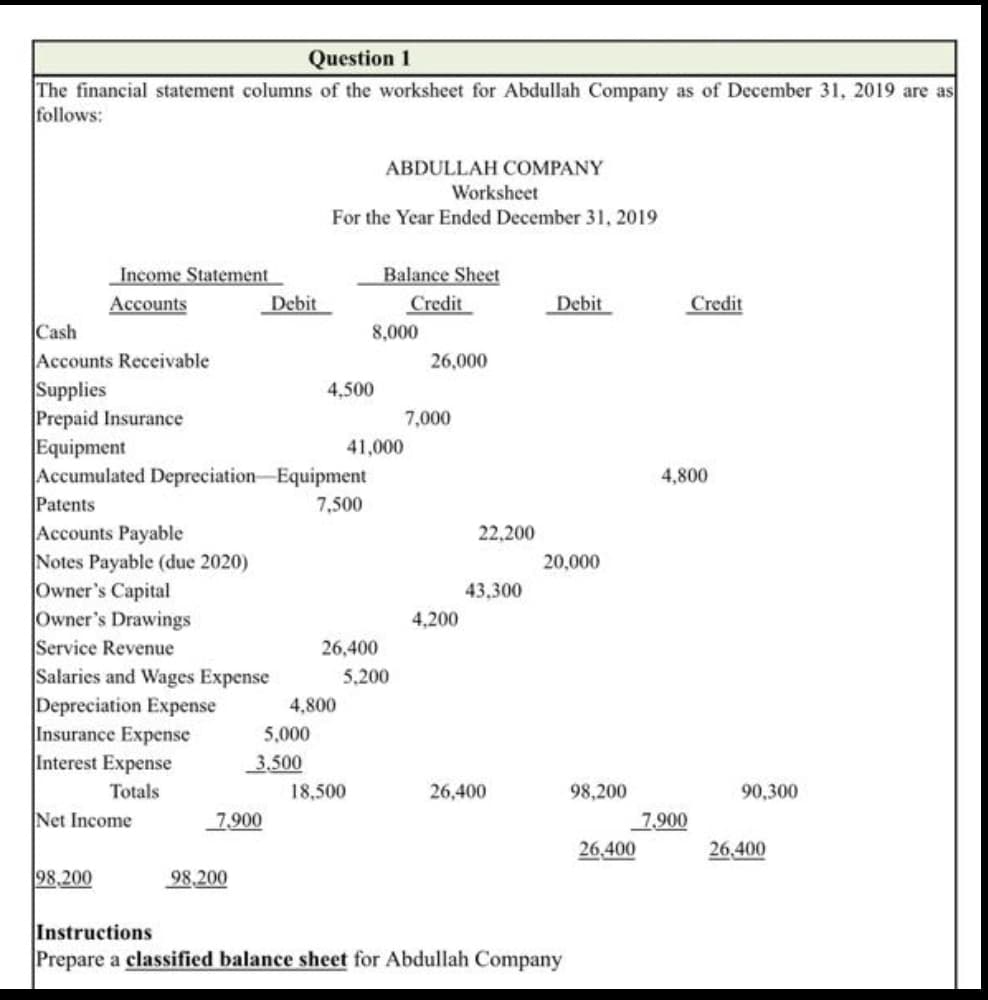

Question 1 The financial statement columns of the worksheet for Abdullah Company as of December 31, 2019 are as follows: ABDULLAH COMPANY Worksheet For the Year Ended December 31, 2019 Balance Sheet Credit Income Statement Accounts Debit Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Patents Accounts Payable Notes Payable (due 2020) Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Depreciation Expense Insurance Expense Interest Expense 8,000 26,000 4,500 7,000 41,000 4,800 7,500 22,200 20,000 43,300 4,200 26,400 5,200 4,800 5,000 3,500 18,500 Totals 26,400 98,200 90,300 Net Income 7,900 7,900 26,400 26,400 98,200 98,200 Instructions Prepare a classified balance sheet for Abdullah Company

Question 1 The financial statement columns of the worksheet for Abdullah Company as of December 31, 2019 are as follows: ABDULLAH COMPANY Worksheet For the Year Ended December 31, 2019 Balance Sheet Credit Income Statement Accounts Debit Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Patents Accounts Payable Notes Payable (due 2020) Owner's Capital Owner's Drawings Service Revenue Salaries and Wages Expense Depreciation Expense Insurance Expense Interest Expense 8,000 26,000 4,500 7,000 41,000 4,800 7,500 22,200 20,000 43,300 4,200 26,400 5,200 4,800 5,000 3,500 18,500 Totals 26,400 98,200 90,300 Net Income 7,900 7,900 26,400 26,400 98,200 98,200 Instructions Prepare a classified balance sheet for Abdullah Company

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 60APSA: Problem 1-60A Income Statement and Balance Sheet The following information for Rogers Enterprises is...

Related questions

Question

Can you help me with this question

Transcribed Image Text:Question 1

The financial statement columns of the worksheet for Abdullah Company as of December 31, 2019 are as

follows:

ABDULLAH COMPANY

Worksheet

For the Year Ended December 31, 2019

Balance Sheet

Credit

Income Statement

Accounts

Debit

Debit

Credit

Cash

8,000

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accumulated Depreciation-Equipment

Patents

26,000

4,500

7,000

41,000

4,800

7,500

Accounts Payable

Notes Payable (due 2020)

Owner's Capital

Owner's Drawings

Service Revenue

Salaries and Wages Expense

Depreciation Expense

Insurance Expense

Interest Expense

22,200

20,000

43,300

4.200

26,400

5,200

4,800

5,000

3.500

Totals

18,500

26,400

98,200

90,300

Net Income

7,900

7,900

26,400

26,400

98,200

98,200

Instructions

Prepare a classified balance sheet for Abdullah Company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning