Question 1 The following costs were extracted from Red's company book at the end of December 2014 and presented to you the cost accountant for classification. Details $ 500,000 800,000 Required: Administrative charges Production supervisors salaries Salaries of production workers Depreciation of factory machinery Direct materials Depreciation of office furniture etc. Warehouse supervisors salaries Advertising charges Direct expenses Wages of truck drivers Commission paid to salesmen Office salaries Janitorial factory wages Training expenses for sales clerks (a) Prime cost. (b) Factory overheads. (c) Production cost. 250,000 20,000 300,000 50,000 200,000 350,000 100,000 200,000 500,000 350,000 300,000 180,000

Question 1 The following costs were extracted from Red's company book at the end of December 2014 and presented to you the cost accountant for classification. Details $ 500,000 800,000 Required: Administrative charges Production supervisors salaries Salaries of production workers Depreciation of factory machinery Direct materials Depreciation of office furniture etc. Warehouse supervisors salaries Advertising charges Direct expenses Wages of truck drivers Commission paid to salesmen Office salaries Janitorial factory wages Training expenses for sales clerks (a) Prime cost. (b) Factory overheads. (c) Production cost. 250,000 20,000 300,000 50,000 200,000 350,000 100,000 200,000 500,000 350,000 300,000 180,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.2E: Identify cost graphs The following cost graphs illustrate various types of cost behavior: For each...

Related questions

Question

Transcribed Image Text:DOC-20221204-WA0015. - Unsaved

Required:

G

This document contains ink, shapes and images that ar...

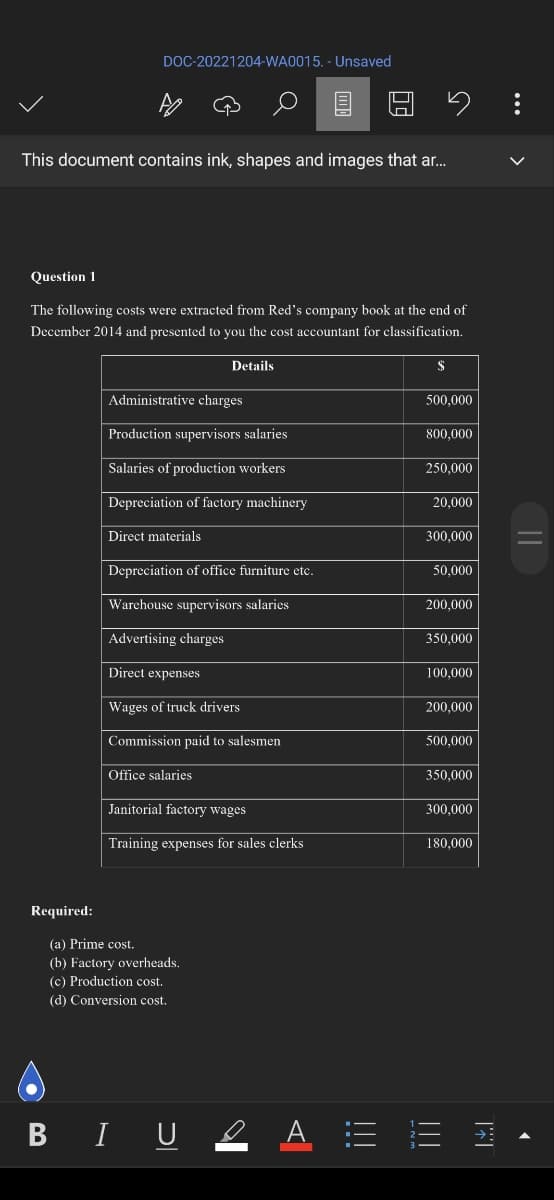

Question 1

The following costs were extracted from Red's company book at the end of

December 2014 and presented to you the cost accountant for classification.

Details

Administrative charges

Production supervisors salaries

Salaries of production workers

Depreciation of factory machinery

Direct materials

Depreciation of office furniture etc.

Warehouse supervisors salaries

Advertising charges

Direct expenses

Wages of truck drivers

Commission paid to salesmen

Office salaries

mi

Janitorial factory wages

Training expenses for sales clerks

(a) Prime cost.

(b) Factory overheads.

(c) Production cost.

(d) Conversion cost.

60

5

$

500,000

800,000

250,000

20.000

300,000

50,000

200,000

350,000

100,000

200,000

500,000

350.000

300,000

180,000

B IU 2 Α Ξ Ξ Ξ

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning