Question 2 Brioche Furnishers is a business started by Mr Parker during 2017. Brioche Fumishers perpetual inventory (stock) system and all goods are sold at a 45% markup on cost. Fumishers is NOT a registered VAT vendor. The following transactions took place February 2021: Date Transaction Mr Parker made an additional capital contribution, R20 000. This amount w deposited directly in the bank account of Brioche Furmishers. Paid the business rent via a debit order to Rental Boss, R9 500. Purchased inventory on credit from Delish Dealers and received their cre invoice no. DX5, R84 102

Question 2 Brioche Furnishers is a business started by Mr Parker during 2017. Brioche Fumishers perpetual inventory (stock) system and all goods are sold at a 45% markup on cost. Fumishers is NOT a registered VAT vendor. The following transactions took place February 2021: Date Transaction Mr Parker made an additional capital contribution, R20 000. This amount w deposited directly in the bank account of Brioche Furmishers. Paid the business rent via a debit order to Rental Boss, R9 500. Purchased inventory on credit from Delish Dealers and received their cre invoice no. DX5, R84 102

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 40P

Related questions

Question

please make

debtor /sales journal

creditor/purchase journal

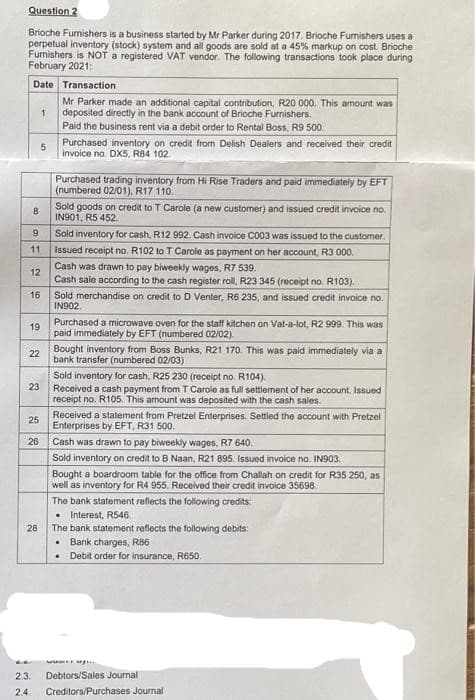

Transcribed Image Text:Question 2

Brioche Furnishers is a business started by Mr Parker during 2017. Brioche Furnishers uses a

perpetual inventory (stock) system and all goods are sold at a 45% markup on cost. Brioche

Fumishers is NOT a registered VAT vendor. The following transactions took place during

February 2021:

Date Transaction

Mr Parker made an additional capital contribution, R20 000. This amount was

deposited directly in the bank account of Brioche Furnishers.

Paid the business rent via a debit order to Rental Boss, R9 500.

Purchased inventory on credit from Delish Dealers and received their credit

invoice no. DX5, R84 102.

Purchased trading inventory from Hi Rise Traders and paid immediately by EFT

(numbered 02/01), R17 110.

Sold goods on credit to T Carole (a new customer) and issued credit invoice no.

8

IN901, R5 452.

Sold inventory for cash, R12 992. Cash invoice C003 was issued to the customer.

Issued receipt no. R102 to T Carole as payment on her account, R3 000.

Cash was drawn to pay biweekly wages, R7 539.

11

12

Cash sale according to the cash register roll, R23 345 (receipt no. R103).

16

Sold merchandise on credit to D Venter, R6 235, and issued credit invoice no.

IN902.

Purchased a microwave oven for the staff kitchern on Vat-a-lot, R2 999. This was

19

paid immediately by EFT (numbered 02/02).

Bought inventory from Boss Bunks, R21 170. This was paid immediately via a

bank transfer (numbered 02/03)

22

Sold inventory for cash, R25 230 (receipt no. R104).

23

Received a cash payment from T Carole as full settlerment of her account. Issued

receipt no. R105. This amount was deposited with the cash sales.

Received a statement from Pretzel Enterprises. Settled the account with Pretzel

25

Enterprises by EFT, R31 500.

26

Cash was drawn to pay biweekly wages, R7 640.

Sold inventory on credit to B Naan, R21 895. Issued invoice no. IN903.

Bought a boardroom table for the office from Challah on credit for R35 250, as

well as inventory for R4 955. Received their credit invoice 35698.

The bank statement reflects the following credits:

Interest, R546,

28

The bank statement reflects the folowing debits:

Bank charges, R86

Debit order for insurance, R650.

2.3.

Debtors/Sales Journal

2.4.

Creditors/Purchases Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you