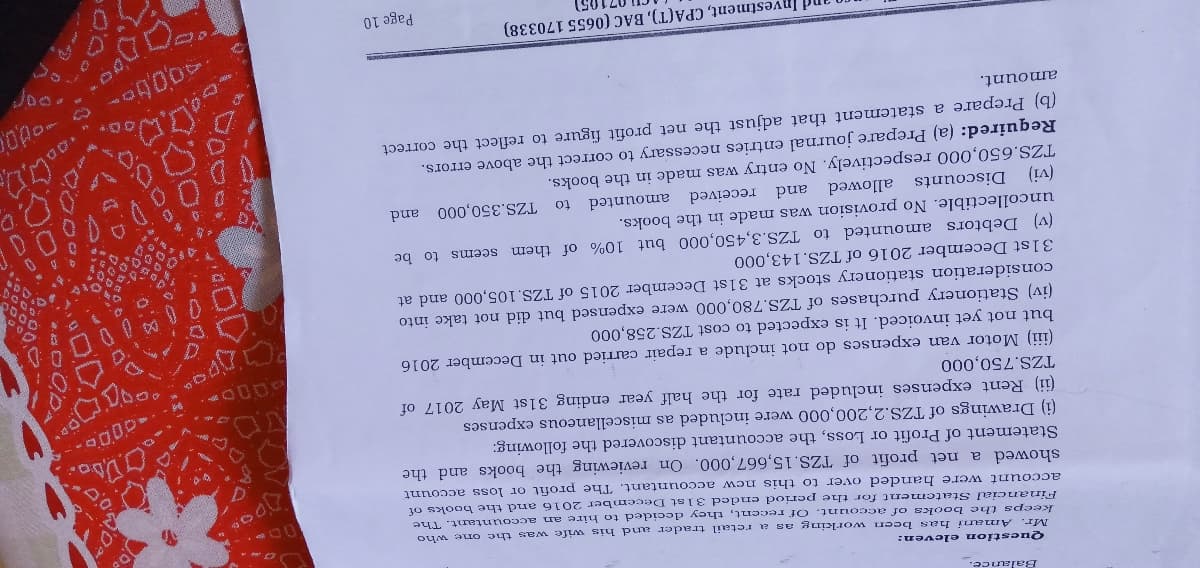

Question eleven: Mr. Amani has been working as a retail trader and his wife was the one who keeps the books of account. Of recent, they decided to hire an accountant. The Financial Statement for the period ended 31 st December 2016 and the books of account were handed over to this new accountant. The profit or loss account showed a net profit of TZS.15,667,000. On reviewing the books and the Statement of Profit or Loss, the accountant discovered the following: (i) Drawings of TZS.2,200,000 were included as miscellaneous expenses (ii) Rent expenses included rate for the half year ending 31st May 2017 of TZS.750,000 (iii) Motor van expenses do not include a repair carried out in December 2016 but not yet invoiced. It is expected to cost TZS.258,000 (iv) Stationery purchases of TZS.780,000 were expensed but did not take into consideration stationery stocks at 31st December 2015 of TZS. 105,000 and at 31st December 2016 of TZS.143,000 (v) Debtors amounted to TZS.3,450,000 but 10% of them seems to be uncollectible. No provision was made in the books. (vi) Discounts TZS.650,000 respectively. No entry was made in the books. Required: (a) Prepare journal entries necessary to correct the above errors. (b) Prepare a statement that adjust the net profit figure to reflect the correct allowed and received amounted to TZS.350,000 and amount.

Question eleven: Mr. Amani has been working as a retail trader and his wife was the one who keeps the books of account. Of recent, they decided to hire an accountant. The Financial Statement for the period ended 31 st December 2016 and the books of account were handed over to this new accountant. The profit or loss account showed a net profit of TZS.15,667,000. On reviewing the books and the Statement of Profit or Loss, the accountant discovered the following: (i) Drawings of TZS.2,200,000 were included as miscellaneous expenses (ii) Rent expenses included rate for the half year ending 31st May 2017 of TZS.750,000 (iii) Motor van expenses do not include a repair carried out in December 2016 but not yet invoiced. It is expected to cost TZS.258,000 (iv) Stationery purchases of TZS.780,000 were expensed but did not take into consideration stationery stocks at 31st December 2015 of TZS. 105,000 and at 31st December 2016 of TZS.143,000 (v) Debtors amounted to TZS.3,450,000 but 10% of them seems to be uncollectible. No provision was made in the books. (vi) Discounts TZS.650,000 respectively. No entry was made in the books. Required: (a) Prepare journal entries necessary to correct the above errors. (b) Prepare a statement that adjust the net profit figure to reflect the correct allowed and received amounted to TZS.350,000 and amount.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 26P

Related questions

Question

100%

Transcribed Image Text:Balance.

Question eleven:

Mr. Amani has been workking as a retail trader and his wife was the one who

keeps thae books of account. Of recent, they decided to hire an accountant. The

Financial Statement for the period ended 31st December 2016 and the books of

account were handed over to this ncw accountant. The profit or loss account

showed a net profit of TZS.15,667,000. On reviewing the books and the

Statement of Profit or Loss, the accountant discovered the following:

(i) Drawings of TZS.2,200,000 were included as miscellaneous expenses

(ii) Rent expenses included rate for the half year ending 3lst May 2017 of

TZS.750,000

(iii) Motor van expensess do not include a repair carried out in December 2016

but not yet invoiced. It is expected to cost TZS.258,000

(iv) Stationery purchases of TZS.780,000 were expensed but did not take into

consideration stationery stocks at 31st December 2015 of TZS, 105,000 and at

31st December 2016 of TZS.143,000

(v) Debtors amounted to TZS.3,450,000 but 10% of them seems

uncollectible. No provision was made in the books.

00p

to be

amounted

TZS.350,000 and

Discounts allowed and received

TZS.650,000 respectively. No entry was made in the books.

Required: (a) Prepare journal entries necessary to correct the above errors.

(b) Prepare a statement that adjust the net profit figure to reflect the correct

amount.

Investment, CPA(T), BAC (0655 170338)

Page 10

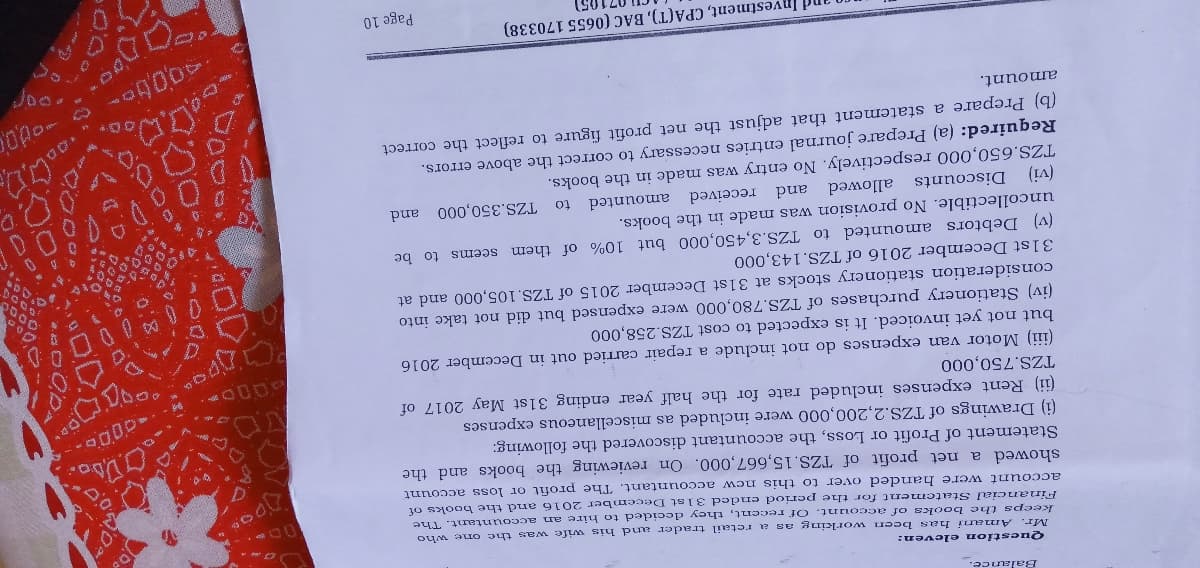

Transcribed Image Text:Balance.

Question eleven:

Mr. Amani has been workking as a retail trader and his wife was the one who

keeps thae books of account. Of recent, they decided to hire an accountant. The

Financial Statement for the period ended 31st December 2016 and the books of

account were handed over to this ncw accountant. The profit or loss account

showed a net profit of TZS.15,667,000. On reviewing the books and the

Statement of Profit or Loss, the accountant discovered the following:

(i) Drawings of TZS.2,200,000 were included as miscellaneous expenses

(ii) Rent expenses included rate for the half year ending 3lst May 2017 of

TZS.750,000

(iii) Motor van expensess do not include a repair carried out in December 2016

but not yet invoiced. It is expected to cost TZS.258,000

(iv) Stationery purchases of TZS.780,000 were expensed but did not take into

consideration stationery stocks at 31st December 2015 of TZS, 105,000 and at

31st December 2016 of TZS.143,000

(v) Debtors amounted to TZS.3,450,000 but 10% of them seems

uncollectible. No provision was made in the books.

00p

to be

amounted

TZS.350,000 and

Discounts allowed and received

TZS.650,000 respectively. No entry was made in the books.

Required: (a) Prepare journal entries necessary to correct the above errors.

(b) Prepare a statement that adjust the net profit figure to reflect the correct

amount.

Investment, CPA(T), BAC (0655 170338)

Page 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,