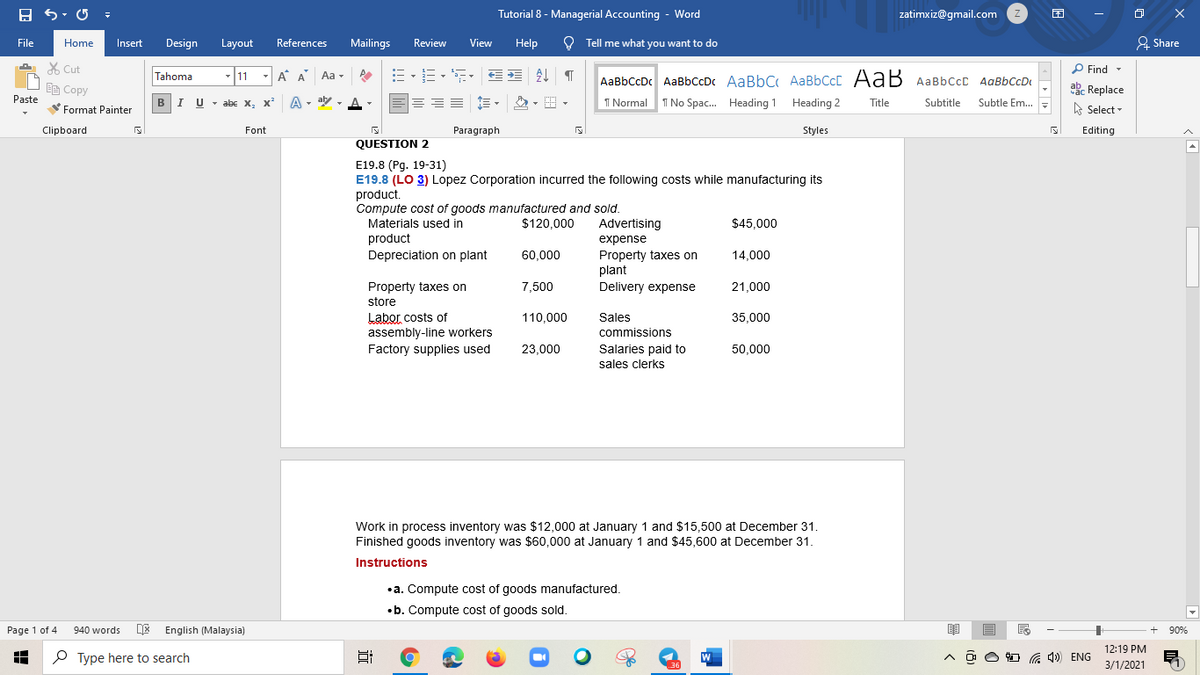

QUESTION 2 E19.8 (Pg. 19-31) E19.8 (LO 3) Lopez Corporation incurred the following costs while manufacturing its product. Compute cost of goods manufactured and sold. Materials used in $120,000 Advertising $45,000 product Depreciation on plant expense Property taxes on plant Delivery expense 60,000 14,000 Property taxes on store Labor costs of assembly-line workers Factory supplies used 7,500 21,000 110,000 Sales commissions 35,000 23,000 Salaries paid to sales clerks 50,000 Work in process inventory was $12,000 at January 1 and $15,500 at December 31. Finished goods inventory was $60,000 at January 1 and $45,600 at December 31. Instructions •a. Compute cost of goods manufactured. •b. Compute cost of goods sold.

QUESTION 2 E19.8 (Pg. 19-31) E19.8 (LO 3) Lopez Corporation incurred the following costs while manufacturing its product. Compute cost of goods manufactured and sold. Materials used in $120,000 Advertising $45,000 product Depreciation on plant expense Property taxes on plant Delivery expense 60,000 14,000 Property taxes on store Labor costs of assembly-line workers Factory supplies used 7,500 21,000 110,000 Sales commissions 35,000 23,000 Salaries paid to sales clerks 50,000 Work in process inventory was $12,000 at January 1 and $15,500 at December 31. Finished goods inventory was $60,000 at January 1 and $45,600 at December 31. Instructions •a. Compute cost of goods manufactured. •b. Compute cost of goods sold.

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter1: Introduction To Accounting Information System

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Tutorial 8 - Managerial Accounting - Word

zatimxiz@gmail.com

File

Mailings

View

Help

O Tell me what you want to do

& Share

Home

Insert

Design

Layout

References

Review

X Cut

P Find -

Tahoma

11

- A A

Aa -

AaBbCcDc AaBbCcDc AaBbC AaBbCcC AaB AaBbccC AqBbCcD

E Copy

ab. Replace

Paste

BIU - abe x, x

A - aly ,

I Normal

I No Spac. Heading 1 Heading 2

Title

Subtitle

Subtle Em..

Format Painter

A Select -

Clipboard

Font

Paragraph

Styles

Editing

QUESTION 2

E19.8 (Pg. 19-31)

E19.8 (LO 3) Lopez Corporation incurred the following costs while manufacturing its

product.

Compute cost of goods manufactured and sold.

Materials used in

product

Depreciation on plant

$120,000

Advertising

$45,000

expense

60,000

Property taxes on

plant

Delivery expense

14.000

Property taxes on

store

Labor costs of

assembly-line workers

Factory supplies used

7,500

21.000

110,000

Sales

35,000

commissions

Salaries paid to

sales clerks

23.000

50.000

Work in process inventory was $12,000 at January 1 and $15,500 at December 31.

Finished goods inventory was $60,000 at January 1 and $45,600 at December 31.

Instructions

•a. Compute cost of goods manufactured.

•b. Compute cost of goods sold.

Page 1 of 4

940 words

English (Malaysia)

90%

12:19 PM

P Type here to search

4)) ENG

3/1/2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning