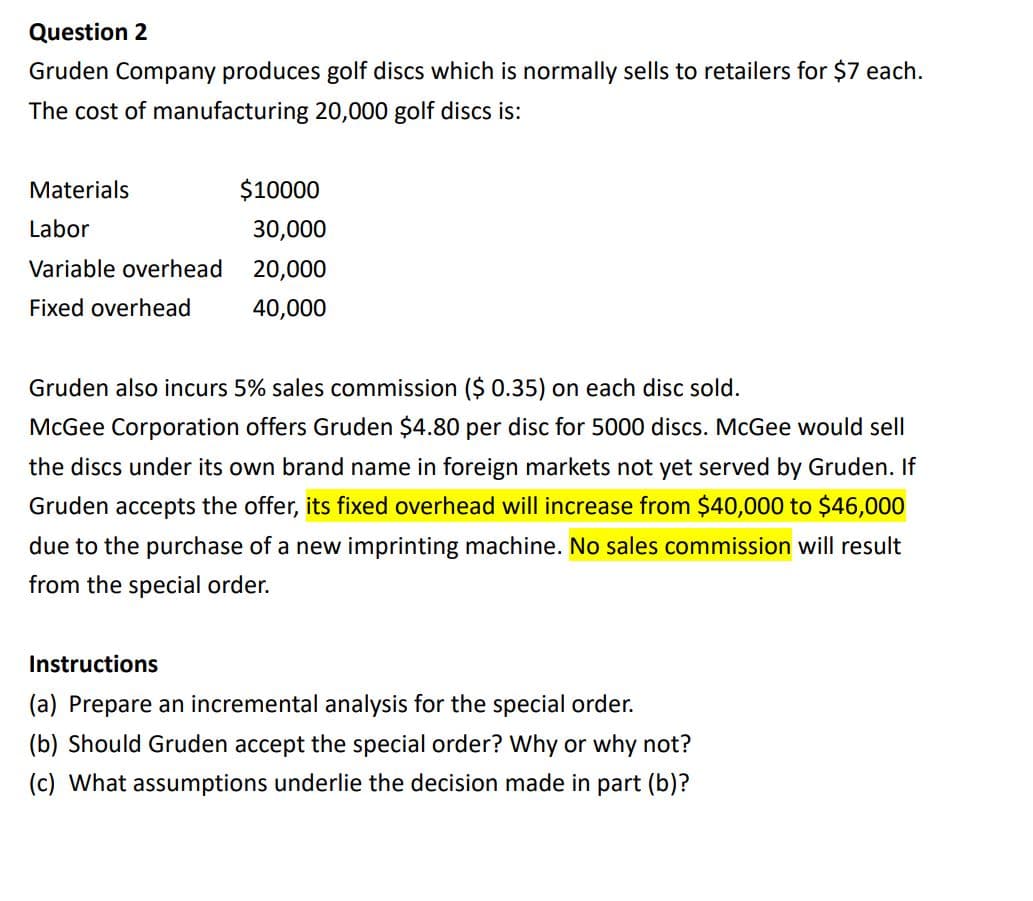

Question 2 Gruden Company produces golf discs which is normally sells to retailers for $7 each. The cost of manufacturing 20,000 golf discs is: Materials $10000 Labor 30,000 Variable overhead 20,000 Fixed overhead 40,000 Gruden also incurs 5% sales commission ($ 0.35) on each disc sold. McGee Corporation offers Gruden $4.80 per disc for 5000 discs. McGee would sell the discs under its own brand name in foreign markets not yet served by Gruden. If Gruden accepts the offer, its fixed overhead will increase from $40,000 to $46,000 due to the purchase of a new imprinting machine. No sales commission will result from the special order. Instructions (a) Prepare an incremental analysis for the special order. (b) Should Gruden accept the special order? Why or why not? (c) What assumptions underlie the decision made in part (b)?

Question 2 Gruden Company produces golf discs which is normally sells to retailers for $7 each. The cost of manufacturing 20,000 golf discs is: Materials $10000 Labor 30,000 Variable overhead 20,000 Fixed overhead 40,000 Gruden also incurs 5% sales commission ($ 0.35) on each disc sold. McGee Corporation offers Gruden $4.80 per disc for 5000 discs. McGee would sell the discs under its own brand name in foreign markets not yet served by Gruden. If Gruden accepts the offer, its fixed overhead will increase from $40,000 to $46,000 due to the purchase of a new imprinting machine. No sales commission will result from the special order. Instructions (a) Prepare an incremental analysis for the special order. (b) Should Gruden accept the special order? Why or why not? (c) What assumptions underlie the decision made in part (b)?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 3PA: Marcotti Cupcakes bakes and sells a basic cupcake for $1.25. The cost of producing 600,000 cupcakes...

Related questions

Question

Transcribed Image Text:Question 2

Gruden Company produces golf discs which is normally sells to retailers for $7 each.

The cost of manufacturing 20,000 golf discs is:

Materials

$10000

Labor

30,000

Variable overhead

20,000

Fixed overhead

40,000

Gruden also incurs 5% sales commission ($ 0.35) on each disc sold.

McGee Corporation offers Gruden $4.80 per disc for 5000 discs. McGee would sell

the discs under its own brand name in foreign markets not yet served by Gruden. If

Gruden accepts the offer, its fixed overhead will increase from $40,000 to $46,000

due to the purchase of a new imprinting machine. No sales commission will result

from the special order.

Instructions

(a) Prepare an incremental analysis for the special order.

(b) Should Gruden accept the special order? Why or why not?

(c) What assumptions underlie the decision made in part (b)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning