QUESTION 5. Santos Company currently manufactures one of its crucial parts at a cost of $3.40 per unit. This cost is based on a normal production rate of 50,000 units per year. Variable costs are S1.50 per unit, fixed costs related to making this part are $50,000 per year, and allocated fixed costs are $45,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Santos is considering buying the part from a supplier for a quoted price of $2.70 per unit guaranteed for a three-year period. Should the company continue to manufacture the part, or should it-buy the part from the outside supplier? Support your answer with analyses.

QUESTION 5. Santos Company currently manufactures one of its crucial parts at a cost of $3.40 per unit. This cost is based on a normal production rate of 50,000 units per year. Variable costs are S1.50 per unit, fixed costs related to making this part are $50,000 per year, and allocated fixed costs are $45,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Santos is considering buying the part from a supplier for a quoted price of $2.70 per unit guaranteed for a three-year period. Should the company continue to manufacture the part, or should it-buy the part from the outside supplier? Support your answer with analyses.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 40P

Related questions

Question

100%

Please help me do excercise 5

Transcribed Image Text:Det e T

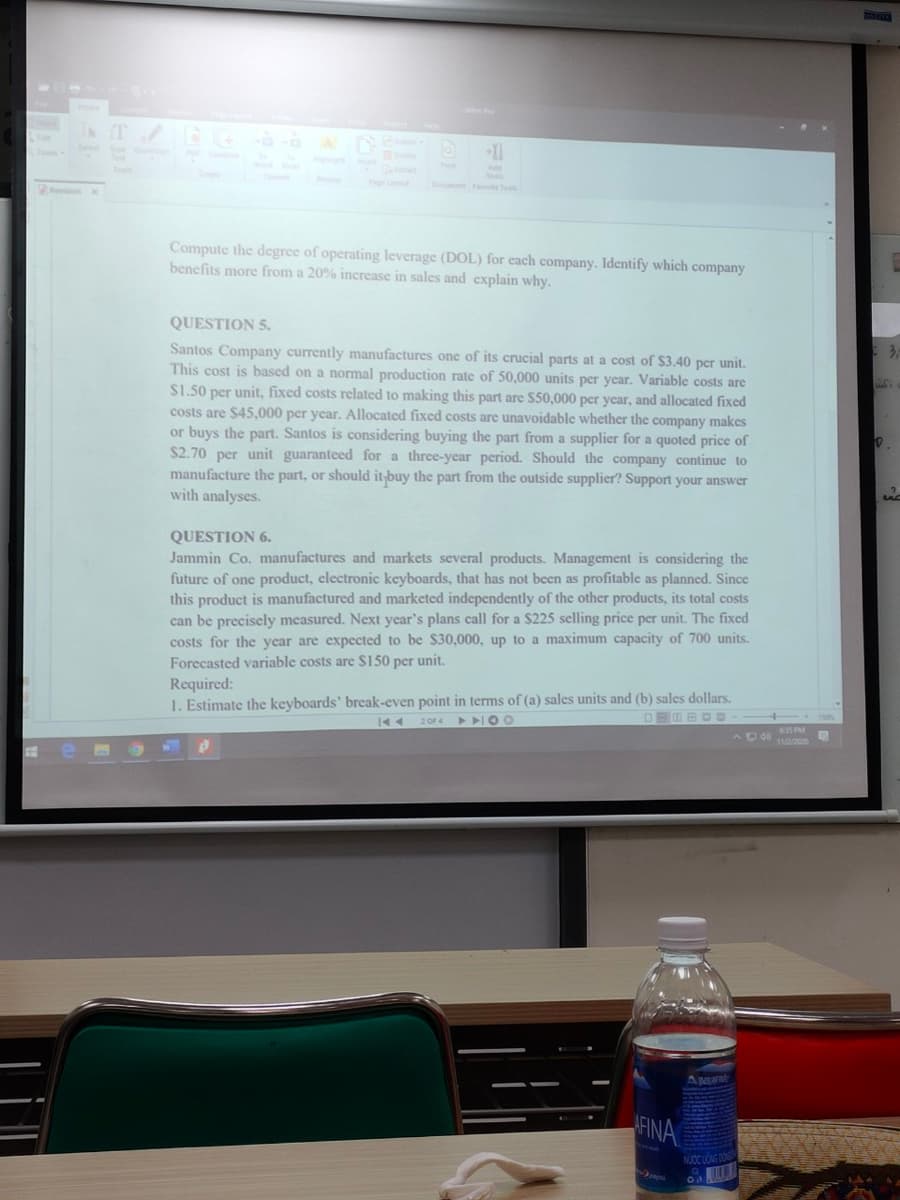

Compute the degree of operating leverage (DOL) for each company. Identify which company

benefits more from a 20% increase in sales and explain why.

QUESTION 5.

Santos Company currently manufactures one of its crucial parts at a cost of $3.40 per unit.

This cost is based on a normal production rate of 50,000 units per year. Variable costs are

S1.50 per unit, fixed costs related to making this part are $50,000 per year, and allocated fixed

costs are $45,000 per year. Allocated fixed costs are unavoidable whether the company makes

or buys the part. Santos is considering buying the part from a supplier for a quoted price of

$2.70 per unit guaranteed for a three-year period. Should the company continue to

manufacture the part, or should it-buy the part from the outside supplier? Support your answer

with analyses.

QUESTION 6.

Jammin Co. manufactures and markets several products. Management is considering the

future of one product, electronic keyboards, that has not been as profitable as planned. Since

this product is manufactured and marketed independently of the other products, its total costs

can be precisely measured. Next year's plans call for a $225 selling price per unit. The fixed

costs for the year are expected to be $30,000, up to a maximum capacity of 700 units.

Forecasted variable costs are S150 per unit.

Required:

1. Estimate the keyboards' break-even point in terms of (a) sales units and (b) sales dollars.

2 of4

3 PM

FINA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT