Question 2 Suppose that an economy has the following average annual growth rates of its real GDP Y, capital stock K, and population N over a decade. Variable GDP (Y) | Capital stock (K I Do

Question 2 Suppose that an economy has the following average annual growth rates of its real GDP Y, capital stock K, and population N over a decade. Variable GDP (Y) | Capital stock (K I Do

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter20: Economic Growth

Section: Chapter Questions

Problem 20RQ: For a high-income economy like the United States, what aggregate production function elements are...

Related questions

Question

Can you help me with this question please. Thank you!

All help is hugely appreciated.

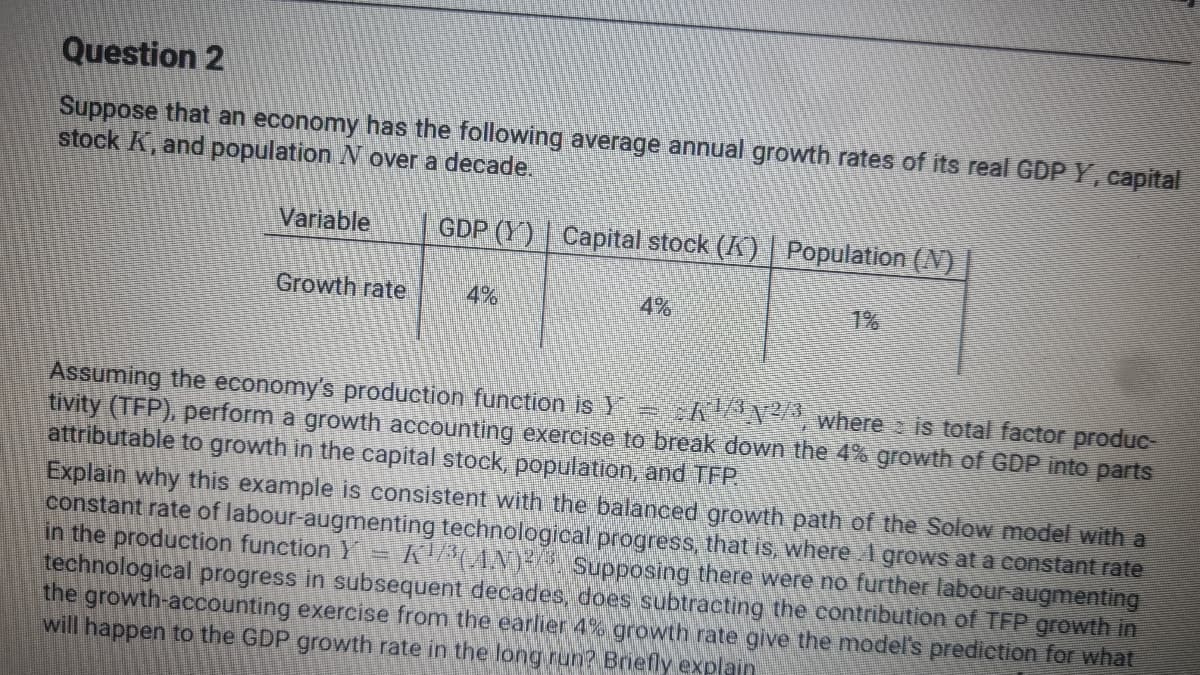

Transcribed Image Text:Question 2

Suppose that an economy has the following average annual growth rates of its real GDP Y, capital

stock K, and population N over a decade.

Variable

GDP (Y) | Capital stock (K) | Population (N)

Growth rate

4%

4%

1%

Assuming the ēconomy's production function is Y AN² where is total factor produc-

tivity (TFP), perform a growth accounting exercise to break down the 4% growth of GDP into parts

attributable to growth in the capital stock, population, and TFP.

Explain why this example is consistent with the balanced growth path of the Solow model with a

constant rate of labour-augmenting technological progress, that is, where A grows at a constant rate

in the production function Y

technological progress in subsequent decades, does subtracting the contribution of TFP growth in

the growth-accounting exercise from the earlier 4% growth rate give the model's prediction for what

will happen to the GDP growth rate in the long run? Briefly explain

K ANY Supposing there were no further labour-augmenting

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning