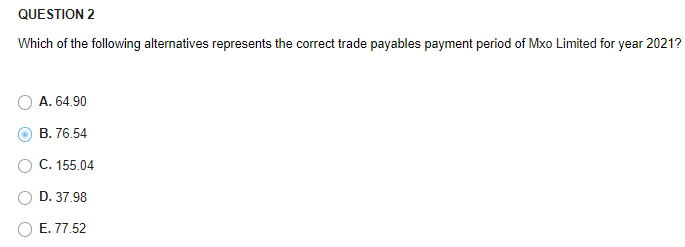

QUESTION 2 Which of the following alternatives represents the correct trade payables payment period of Mxo Limited for year 2021?

QUESTION 2 Which of the following alternatives represents the correct trade payables payment period of Mxo Limited for year 2021?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

Transcribed Image Text:QUESTION 2

Which of the following alternatives represents the correct trade payables payment period of Mxo Limited for year 2021?

A. 64.90

B. 76.54

C. 155.04

D. 37.98

E. 77.52

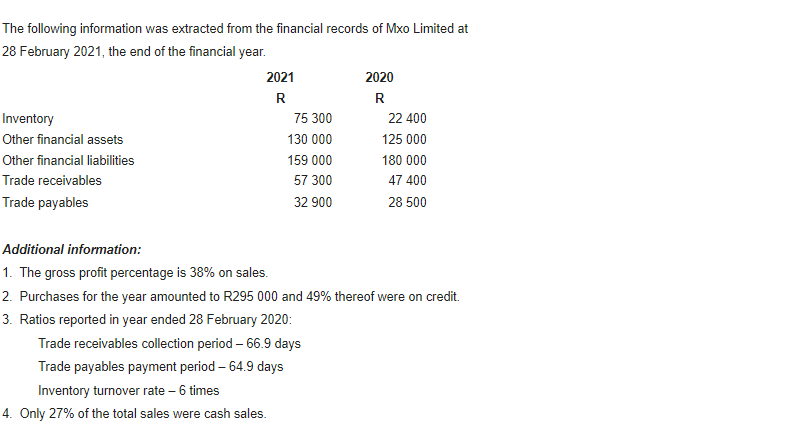

Transcribed Image Text:The following information was extracted from the financial records of Mxo Limited at

28 February 2021, the end of the financial year.

2021

2020

R

R

Inventory

75 300

22 400

Other financial assets

130 000

125 000

Other financial liabilities

159 000

180 000

Trade receivables

57 300

47 400

Trade payables

32 900

28 500

Additional information:

1. The gross profit percentage is 38% on sales.

2. Purchases for the year amounted to R295 000 and 49% thereof were on credit.

3. Ratios reported in year ended 28 February 2020:

Trade receivables collection period – 66.9 days

Trade payables payment period – 64.9 days

Inventory turnover rate – 6 times

4. Only 27% of the total sales were cash sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning