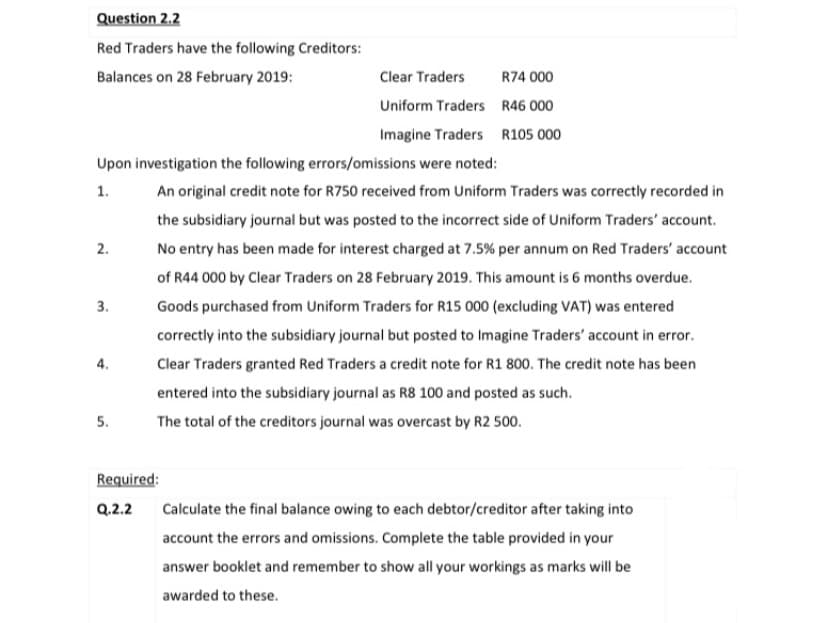

Question 2.2 Red Traders have the following Creditors: Balances on 28 February 2019: Clear Traders R74 000 Uniform Traders R46 000 Imagine Traders R105 000 Upon investigation the following errors/omissions were noted: 1. An original credit note for R750 received from Uniform Traders was correctly recorded in the subsidiary journal but was posted to the incorrect side of Uniform Traders' account. 2. No entry has been made for interest charged at 7.5% per annum on Red Traders' account of R44 000 by Clear Traders on 28 February 2019. This amount is 6 months overdue. 3. Goods purchased from Uniform Traders for R15 000 (excluding VAT) was entered correctly into the subsidiary journal but posted to Imagine Traders' account in error. 4. Clear Traders granted Red Traders a credit note for R1 800. The credit note has been entered into the subsidiary journal as R8 100 and posted as such. 5. The total of the creditors journal was overcast by R2 500. Required: Q.2.2 Calculate the final balance owing to each debtor/creditor after taking into account the errors and omissions. Complete the table provided in your answer booklet and remember to show all your workings as marks will be awarded to these.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 2 steps