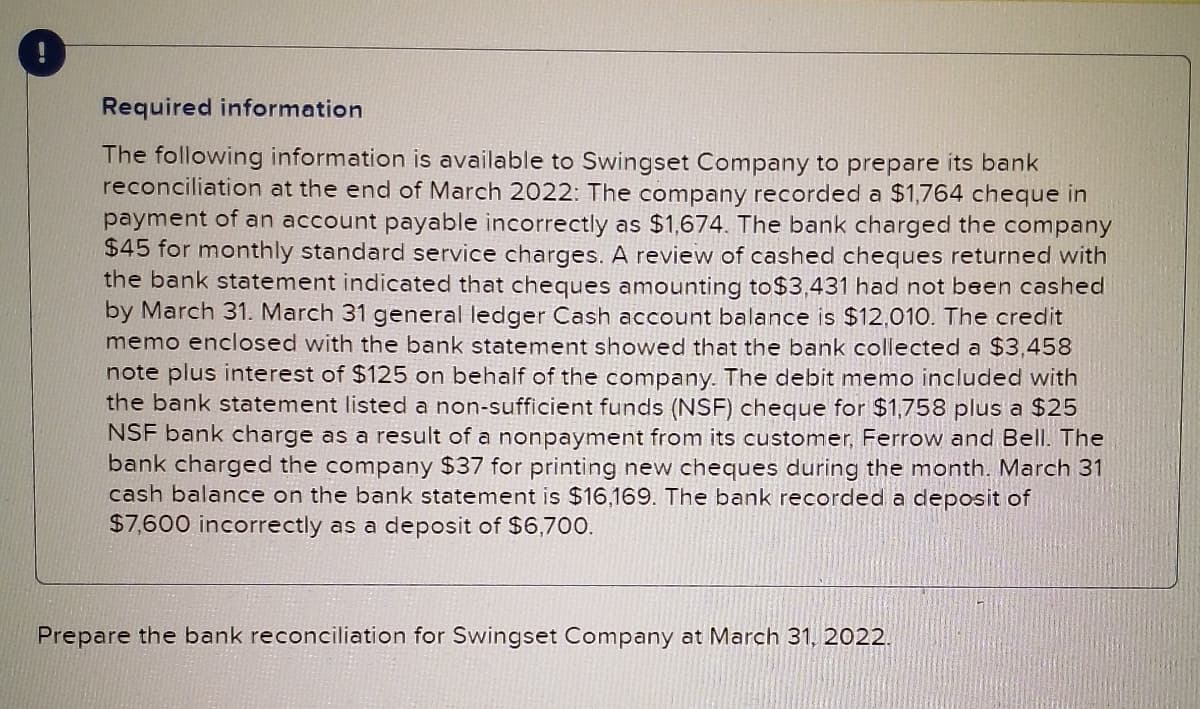

Required information The following information is available to Swingset Company to prepare its bank reconciliation at the end of March 2022: The company recorded a $1,764 cheque in payment of an account payable incorrectly as $1,674. The bank charged the company $45 for monthly standard service charges. A review of cashed cheques returned with the bank statement indicated that cheques amounting to$3,431 had not been cashed by March 31. March 31 general ledger Cash account balance is $12,010. The credit memo enclosed with the bank statement showed that the bank collected a $3,458 note plus interest of $125 on behalf of the company. The debit memo included with the bank statement listed a non-sufficient funds (NSF) cheque for $1,758 plus a $25 NSF bank charge as a result of a nonpayment from its customer, Ferrow and Bell. The bank charged the company $37 for printing new cheques during the month. March 31 cash balance on the bank statement is $16,169. The bank recorded a deposit of $7,600 incorrectly as a deposit of $6,70O. pare the bank reconciliation for Swingset Company at March 31, 2022.

Required information The following information is available to Swingset Company to prepare its bank reconciliation at the end of March 2022: The company recorded a $1,764 cheque in payment of an account payable incorrectly as $1,674. The bank charged the company $45 for monthly standard service charges. A review of cashed cheques returned with the bank statement indicated that cheques amounting to$3,431 had not been cashed by March 31. March 31 general ledger Cash account balance is $12,010. The credit memo enclosed with the bank statement showed that the bank collected a $3,458 note plus interest of $125 on behalf of the company. The debit memo included with the bank statement listed a non-sufficient funds (NSF) cheque for $1,758 plus a $25 NSF bank charge as a result of a nonpayment from its customer, Ferrow and Bell. The bank charged the company $37 for printing new cheques during the month. March 31 cash balance on the bank statement is $16,169. The bank recorded a deposit of $7,600 incorrectly as a deposit of $6,70O. pare the bank reconciliation for Swingset Company at March 31, 2022.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter8: Sarbanes-oxley, Internal Control, And Cash

Section: Chapter Questions

Problem 18E

Related questions

Question

Part 1. Prepare bank reconciliation for swing set company at march 31 2022

Transcribed Image Text:Required information

The following information is available to Swingset Company to prepare its bank

reconciliation at the end of March 2022: The company recorded a $1,764 cheque in

payment of an account payable incorrectly as $1,674. The bank charged the company

$45 for monthly standard service charges. A review of cashed cheques returned with

the bank statement indicated that cheques amounting to$3,431 had not been cashed

by March 31. March 31 general ledger Cash account balance is $12,010. The credit

memo enclosed with the bank statement showed that the bank collected a $3,458

note plus interest of $125 on behalf of the company. The debit memo included with

the bank statement listed a non-sufficient funds (NSF) cheque for $1,758 plus a $25

NSF bank charge as a result of a nonpayment from its customer, Ferrow and Bell. The

bank charged the company $37 for printing new cheques during the month. March 31

cash balance on the bank statement is $16,169. The bank recorded a deposit of

$7,600 incorrectly as a deposit of $6,700.

Prepare the bank reconciliation for Swingset Company at March 31, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning