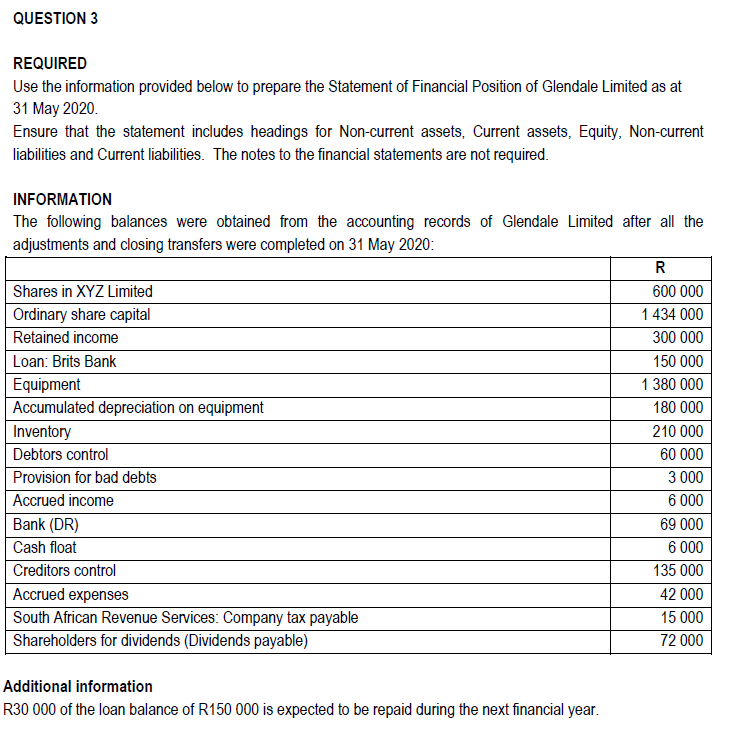

QUESTION 3 REQUIRED Use the information provided below to prepare the Statement of Financial Position of Glendale Limited as at 31 May 2020. Ensure that the statement includes headings for Non-current assets, Current assets, Equity, Non-current liabilities and Current liabilities. The notes to the financial statements are not required. INFORMATION The following balances were obtained from the accounting records of Glendale Limited after all the adjustments and closing transfers were completed on 31 May 2020: Shares in XYZ Limited Ordinary share capital Retained income 600 000 1 434 000 300 000 Loan: Brits Bank 150 000 Equipment Accumulated depreciation on equipment Inventory 1 380 000 180 000 210 000 Debtors control 60 000 Provision for bad debts Accrued income Bank (DR) Cash float Creditors control Accrued expenses South African Revenue Services: Company tax payable Shareholders for dividends (Dividends payable) 3 000 6 000 69 000 6 000 135 000 42 000 15 000 72 000 Additional information R30 000 of the loan balance of R150 000 is expected to be repaid during the next financial year.

QUESTION 3 REQUIRED Use the information provided below to prepare the Statement of Financial Position of Glendale Limited as at 31 May 2020. Ensure that the statement includes headings for Non-current assets, Current assets, Equity, Non-current liabilities and Current liabilities. The notes to the financial statements are not required. INFORMATION The following balances were obtained from the accounting records of Glendale Limited after all the adjustments and closing transfers were completed on 31 May 2020: Shares in XYZ Limited Ordinary share capital Retained income 600 000 1 434 000 300 000 Loan: Brits Bank 150 000 Equipment Accumulated depreciation on equipment Inventory 1 380 000 180 000 210 000 Debtors control 60 000 Provision for bad debts Accrued income Bank (DR) Cash float Creditors control Accrued expenses South African Revenue Services: Company tax payable Shareholders for dividends (Dividends payable) 3 000 6 000 69 000 6 000 135 000 42 000 15 000 72 000 Additional information R30 000 of the loan balance of R150 000 is expected to be repaid during the next financial year.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 56APSA: Problem 1-56A Applying the Fundamental Accounting Equation At the beginning of 2019 Huffer...

Related questions

Question

Transcribed Image Text:QUESTION 3

REQUIRED

Use the information provided below to prepare the Statement of Financial Position of Glendale Limited as at

31 May 2020.

Ensure that the statement includes headings for Non-current assets, Current assets, Equity, Non-current

liabilities and Current liabilities. The notes to the financial statements are not required.

INFORMATION

The following balances were obtained from the accounting records of Glendale Limited after all the

adjustments and closing transfers were completed on 31 May 2020:

Shares in XYZ Limited

600 000

Ordinary share capital

1 434 000

Retained income

300 000

Loan: Brits Bank

150 000

Equipment

Accumulated depreciation on equipment

1 380 000

180 000

Inventory

210 000

Debtors control

60 000

Provision for bad debts

Accrued income

3 000

6 000

Bank (DR)

69 000

Cash float

6 000

Creditors control

135 000

Accrued expenses

South African Revenue Services: Company tax payable

Shareholders for dividends (Dividends payable)

42 000

15 000

72 000

Additional information

R30 000 of the loan balance of R150 000 is expected to be repaid during the next financial year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning