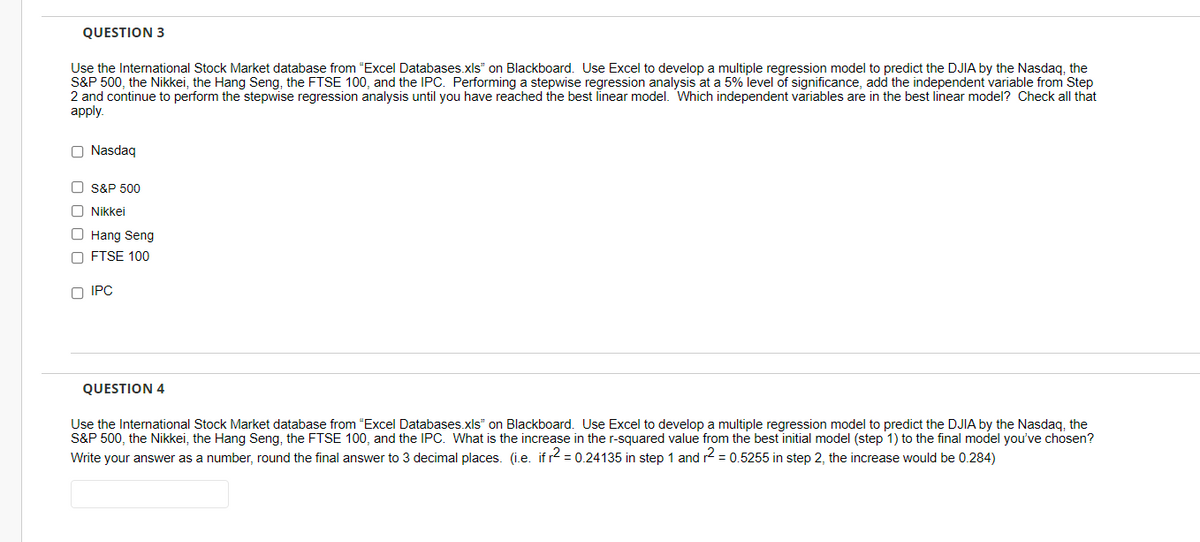

QUESTION 3 Use the International Stock Market database from "Excel Databases.xls" on Blackboard. Use Excel to develop a multiple regression model to predict the DJIA by the Nasdaq, the S&P 500, the Nikkei, the Hang Seng, the FTSE 100, and the IPC. Performing a stepwise regression analysis at a 5% level of significance, add the independent variable from Step 2 and continue to perform the stepwise regression analysis until you have reached the best linear model. Which independent variables are in the best linear model? Check all that apply. O Nasdag O S&P 500 O Nikkei O Hang Seng O FTSE 100 O IPC

QUESTION 3 Use the International Stock Market database from "Excel Databases.xls" on Blackboard. Use Excel to develop a multiple regression model to predict the DJIA by the Nasdaq, the S&P 500, the Nikkei, the Hang Seng, the FTSE 100, and the IPC. Performing a stepwise regression analysis at a 5% level of significance, add the independent variable from Step 2 and continue to perform the stepwise regression analysis until you have reached the best linear model. Which independent variables are in the best linear model? Check all that apply. O Nasdag O S&P 500 O Nikkei O Hang Seng O FTSE 100 O IPC

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter1: Equations And Graphs

Section: Chapter Questions

Problem 10T: Olympic Pole Vault The graph in Figure 7 indicates that in recent years the winning Olympic men’s...

Related questions

Question

Here is the link for the excel https://docs.google.com/spreadsheets/d/10QitIiY-vJVaC88bhhduSVoBw0cXRzsYbPZ-vCZx_Kg/edit?usp=sharing

Transcribed Image Text:QUESTION 3

Use the International Stock Market database from "Excel Databases.xls" on Blackboard. Use Excel to develop a multiple regression model to predict the DJIA by the Nasdaq, the

S&P 500, the Nikkei, the Hang Seng, the FTSE 100, and the IPC. Performing a stepwise regression analysis at a 5% level of significance, add the independent variable from Step

2 and continue to perform the stepwise regression analysis until you have reached the best linear model. Which independent variables are in the best linear model? Check all that

apply.

O Nasdaq

O S&P 500

O Nikkei

O Hang Seng

O FTSE 100

O IPC

QUESTION 4

Use the International Stock Market database from “Excel Databases.xls" on Blackboard. Use Excel to develop a multiple regression model to predict the DJIA by the Nasdaq, the

S&P 500, the Nikkei, the Hang Seng, the FTSE 100, and the IPC. What is the increase in the r-squared value from the best initial model (step 1) to the final model you've chosen?

Write your answer as a number, round the final answer to 3 decimal places. (i.e. if r = 0.24135 in step 1 and r2 = 0.5255 in step 2, the increase would be 0.284)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 10 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill