Question 30 of 50. Is Glen eligible to claim and receive the Earned Income Tax Credit for 2019? Yes. No. OMark for follow up

Question 30 of 50. Is Glen eligible to claim and receive the Earned Income Tax Credit for 2019? Yes. No. OMark for follow up

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 30P

Related questions

Question

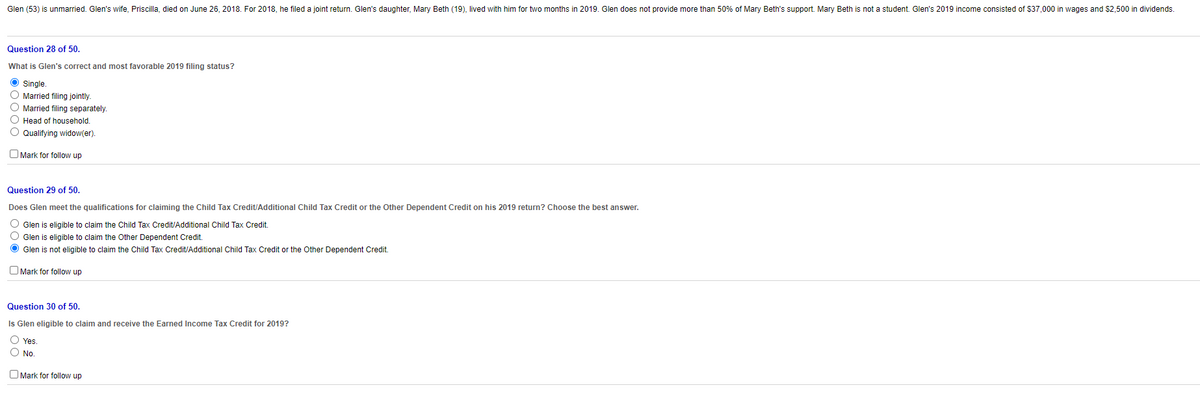

Transcribed Image Text:Glen (53) is unmarried. Glen's wife, Priscilla, died on June 26 , 2018. For 2018, he filed a joint return. Glen's daughter, Mary Beth (19), lived with him for two months in 2019. Glen does not provide more than 50% of Mary Beth's support. Mary Beth is not a student. Glen's 2019 income consisted of $37,000 in wages and $2,500 in dividends.

Question 28 of 50.

What is Glen's correct and most favorable 2019 filing status?

O single.

O Married filing jointly.

O Married filing separately.

O Head of household.

O Qualifying widow(er).

O Mark for follow up

Question 29 of 50.

Does Glen meet the qualifications for claiming the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit on his 2019 return? Choose the best answer.

O Glen is eligible to claim the Child Tax Credit/Additional Child Tax Credit.

O Glen is eligible to claim the Other Dependent Credit.

O Glen is not eligible to claim the Child Tax Credit/Additional Child Tax Credit or the Other Dependent Credit.

O Mark for follow up

Question 30 of 50.

Is Glen eligible to claim and receive the Earned Income Tax Credit for 2019?

O Yes

O No

O Mark for follow up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT