QUESTION 4 Using information from problem 3, suppose that the financial crisis worsens and now the supply curve for USD is 91+e bln dollars per week and the demand curve is 155 - e bln dollars per week. The central bank still commits to its pledge to support the exchange rate if Peso depreciates by over 20% from the original level (more specifically, in this case the fixed exchange rate will be 20% higher than the original level). To maintain the fixed exchange rate, the central bank will have to spend billion dollars of foreign exchange reserves per week. Note: Type in your answer rounded to two decimal places, i.e., your answer must be of the form "999.99". I will not be able to fix correct answers that were entered incorrectly, such as "999.999" or "999,99" or "999". In case the last digit in the correct answer is zero, e.g., "999.90" or "999.00", Blackboard may automatically delete it and you should not do anything about it. In case of percentages, do not type in the percentage symbol "%". If your answer is a negative number, type a dash in front of your answer, i.e, "-999.99".

QUESTION 4 Using information from problem 3, suppose that the financial crisis worsens and now the supply curve for USD is 91+e bln dollars per week and the demand curve is 155 - e bln dollars per week. The central bank still commits to its pledge to support the exchange rate if Peso depreciates by over 20% from the original level (more specifically, in this case the fixed exchange rate will be 20% higher than the original level). To maintain the fixed exchange rate, the central bank will have to spend billion dollars of foreign exchange reserves per week. Note: Type in your answer rounded to two decimal places, i.e., your answer must be of the form "999.99". I will not be able to fix correct answers that were entered incorrectly, such as "999.999" or "999,99" or "999". In case the last digit in the correct answer is zero, e.g., "999.90" or "999.00", Blackboard may automatically delete it and you should not do anything about it. In case of percentages, do not type in the percentage symbol "%". If your answer is a negative number, type a dash in front of your answer, i.e, "-999.99".

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 6PA

Related questions

Question

Question 3 included for your information (Asking for question 4)

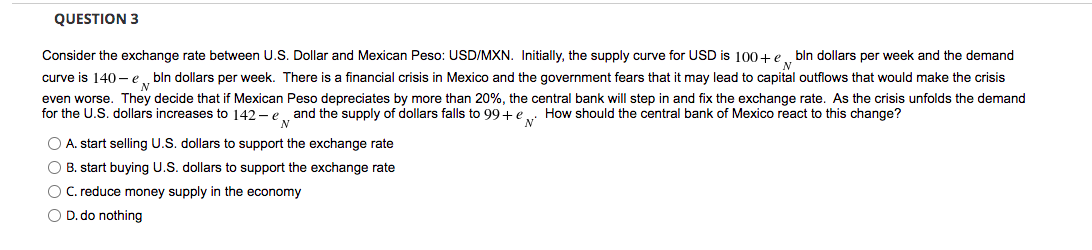

Transcribed Image Text:QUESTION 3

Consider the exchange rate between U.S. Dollar and Mexican Peso: USD/MXN. Initially, the supply curve for USD is 100+ e . bln dollars per week and the demand

curve is 140 - e

bln dollars per week. There is a financial crisis in Mexico and the government fears that it may lead to capital outflows that would make the crisis

even worse. They decide that if Mexican Peso depreciates by more than 20%, the central bank will step in and fix the exchange rate. As the crisis unfolds the demand

for the U.S. dollars increases to 142 - e and the supply of dollars falls to 99+e . How should the central bank of Mexico react to this change?

O A. start selling U.S. dollars to support the exchange rate

O B. start buying U.S. dollars to support the exchange rate

O C. reduce money supply in the economy

O D. do nothing

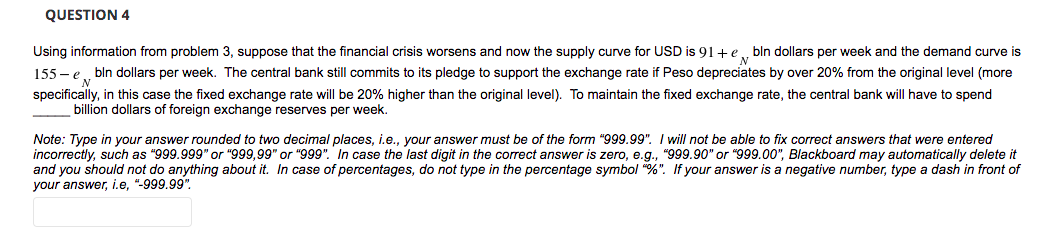

Transcribed Image Text:QUESTION 4

Using information from problem 3, suppose that the financial crisis worsens and now the supply curve for USD is 91+e. bln dollars per week and the demand curve is

155 - e bln dollars per week. The central bank still commits to its pledge to support the exchange rate if Peso depreciates by over 20% from the original level (more

specifically, in this case the fixed exchange rate will be 20% higher than the original level). To maintain the fixed exchange rate, the central bank will have to spend

billion dollars of foreign exchange reserves per week.

Note: Type in your answer rounded to two decimal places, i.e., your answer must be of the form "999.99". I will not be able to fix correct answers that were entered

incorrectly, such as "999.999" or "999,99" or "999". In case the last digit in the correct answer is zero, e.g., "999.90" or "999.00", Blackboard may automatically delete it

and you should not do anything about it. In case of percentages, do not type in the percentage symbol "%". If your answer is a negative number, type a dash in front of

your answer, i.e, "-999.99".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning