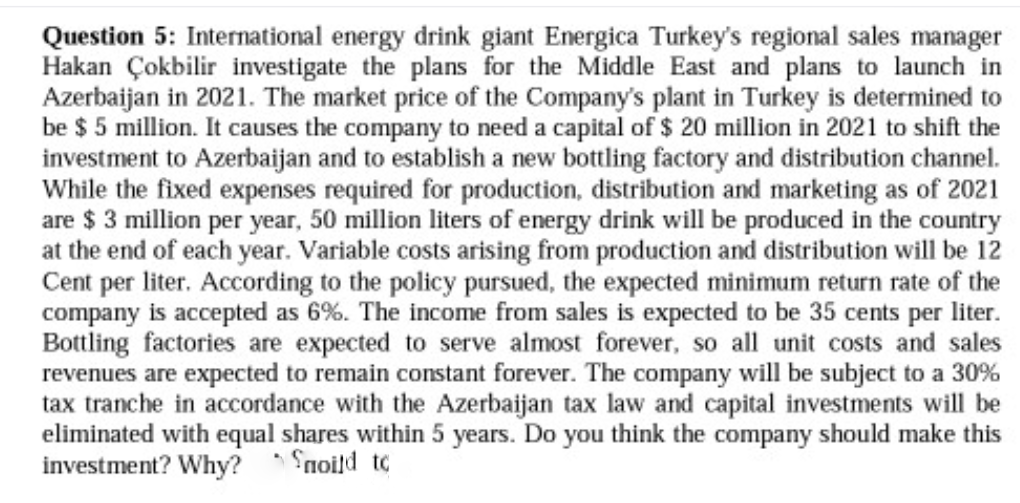

Question 5: International energy drink giant Energica Turkey's regional sales manager Hakan Çokbilir investigate the plans for the Middle East and plans to launch in Azerbaijan in 2021. The market price of the Company's plant in Turkey is determined to be $ 5 million. It causes the company to need a capital of $ 20 million in 2021 to shift the investment to Azerbaijan and to establish a new bottling factory and distribution channel. While the fixed expenses required for production, distribution and marketing as of 2021 are $ 3 million per year, 50 million liters of energy drink will be produced in the country at the end of each year. Variable costs arising from production and distribution will be 12 Cent per liter. According to the policy pursued, the expected minimum return rate of the company is accepted as 6%. The income from sales is expected to be 35 cents per liter. Bottling factories are expected to serve almost forever, so all unit costs and sales revenues are expected to remain constant forever. The company will be subject to a 30% tax tranche in accordance with the Azerbaijan tax law and capital investments will be eliminated with equal shares within 5 years. Do you think the company should make this investment? Why? ' Snoild to

Question 5: International energy drink giant Energica Turkey's regional sales manager Hakan Çokbilir investigate the plans for the Middle East and plans to launch in Azerbaijan in 2021. The market price of the Company's plant in Turkey is determined to be $ 5 million. It causes the company to need a capital of $ 20 million in 2021 to shift the investment to Azerbaijan and to establish a new bottling factory and distribution channel. While the fixed expenses required for production, distribution and marketing as of 2021 are $ 3 million per year, 50 million liters of energy drink will be produced in the country at the end of each year. Variable costs arising from production and distribution will be 12 Cent per liter. According to the policy pursued, the expected minimum return rate of the company is accepted as 6%. The income from sales is expected to be 35 cents per liter. Bottling factories are expected to serve almost forever, so all unit costs and sales revenues are expected to remain constant forever. The company will be subject to a 30% tax tranche in accordance with the Azerbaijan tax law and capital investments will be eliminated with equal shares within 5 years. Do you think the company should make this investment? Why? ' Snoild to

Chapter15: International Corporate Governance And Control

Section: Chapter Questions

Problem 7QA

Related questions

Question

Transcribed Image Text:Question 5: International energy drink giant Energica Turkey's regional sales manager

Hakan Çokbilir investigate the plans for the Middle East and plans to launch in

Azerbaijan in 2021. The market price of the Company's plant in Turkey is determined to

be $ 5 million. It causes the company to need a capital of $ 20 million in 2021 to shift the

investment to Azerbaijan and to establish a new bottling factory and distribution channel.

While the fixed expenses required for production, distribution and marketing as of 2021

are $ 3 million per year, 50 million liters of energy drink will be produced in the country

at the end of each year. Variable costs arising from production and distribution will be 12

Cent per liter. According to the policy pursued, the expected minimum return rate of the

company is accepted as 6%. The income from sales is expected to be 35 cents per liter.

Bottling factories are expected to serve almost forever, so all unit costs and sales

revenues are expected to remain constant forever. The company will be subject to a 30%

tax tranche in accordance with the Azerbaijan tax law and capital investments will be

eliminated with equal shares within 5 years. Do you think the company should make this

investment? Why? ' Snoild to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning