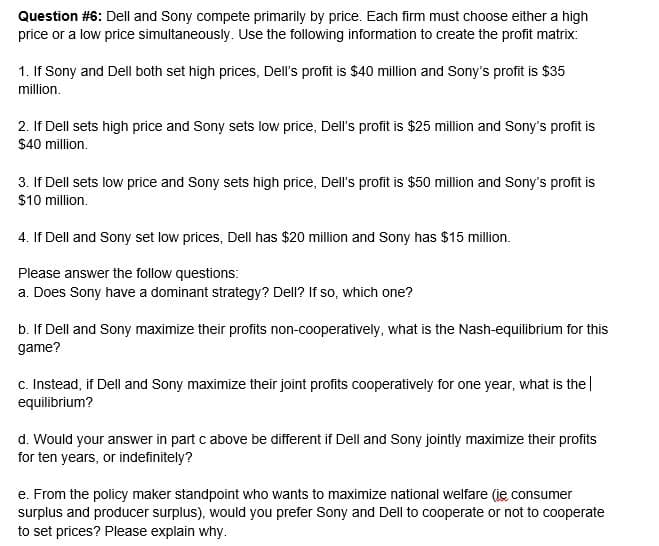

Question #6: Dell and Sony compete primarily by price. Each firm must choose either a high price or a low price simultaneously. Use the following information to create the profit matrix: 1. If Sony and Dell both set high prices, Dell's profit is $40 million and Sony's profit is $35 million. 2. If Dell sets high price and Sony sets low price, Dell's profit is $25 million and Sony's profit is $40 million.

Question #6: Dell and Sony compete primarily by price. Each firm must choose either a high price or a low price simultaneously. Use the following information to create the profit matrix: 1. If Sony and Dell both set high prices, Dell's profit is $40 million and Sony's profit is $35 million. 2. If Dell sets high price and Sony sets low price, Dell's profit is $25 million and Sony's profit is $40 million.

Chapter26: Monopolistic Competition And Oligopoly

Section: Chapter Questions

Problem 1E

Related questions

Question

i need part 4,A.B

Transcribed Image Text:Question #6: Dell and Sony compete primarily by price. Each firm must choose either a high

price or a low price simultaneously. Use the following information to create the profit matrix:

1. If Sony and Dell both set high prices, Dell's profit is $40 million and Sony's profit is $35

million.

2. If Dell sets high price and Sony sets low price, Dell's profit is $25 million and Sony's profit is

$40 million.

3. If Dell sets low price and Sony sets high price, Dell's profit is $50 million and Sony's profit is

$10 million.

4. If Dell and Sony set low prices, Dell has $20 million and Sony has $15 million.

Please answer the follow questions:

a. Does Sony have a dominant strategy? Dell? If so, which one?

b. If Dell and Sony maximize their profits non-cooperatively, what is the Nash-equilibrium for this

game?

c. Instead, if Dell and Sony maximize their joint profits cooperatively for one year, what is the|

equilibrium?

d. Would your answer in part c above be different if Dell and Sony jointly maximize their profits

for ten years, or indefinitely?

e. From the policy maker standpoint who wants to maximize national welfare (ie consumer

surplus and producer surplus), would you prefer Sony and Dell to cooperate or not to cooperate

to set prices? Please explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc