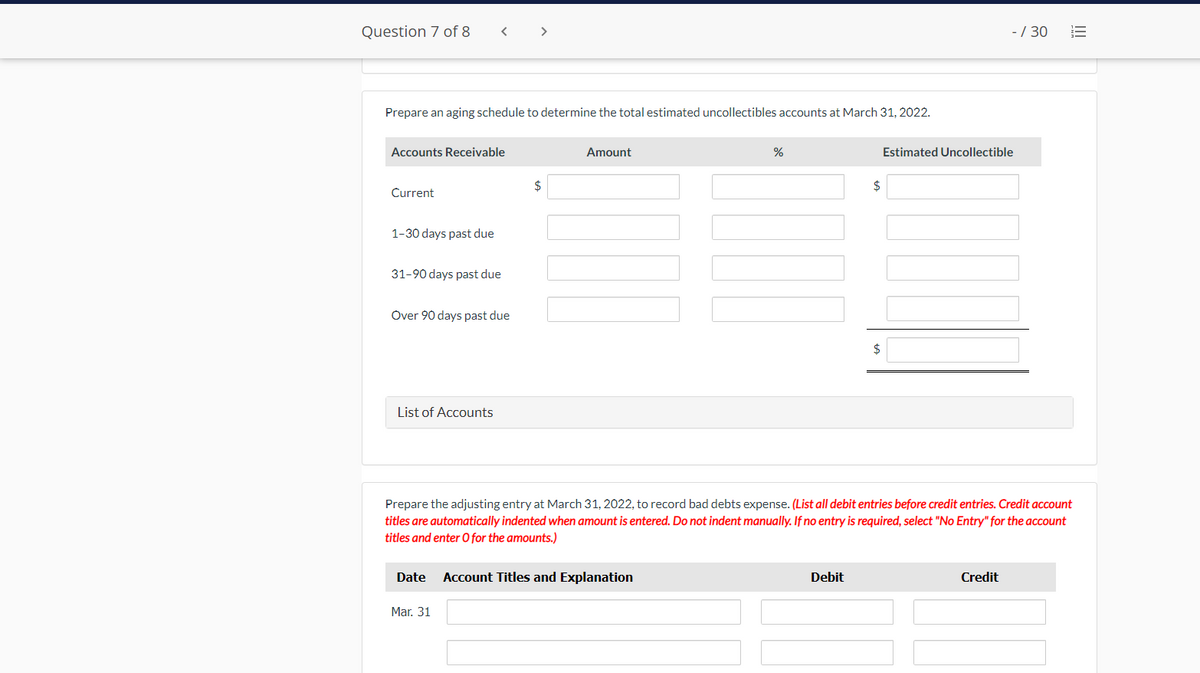

Question 7 of 8 -/ 30 E Prepare an aging schedule to determine the total estimated uncollectibles accounts at March 31, 2022. Accounts Receivable Amount Estimated Uncollectible Current 1-30 days past due 31-90 days past due Over 90 days past due List of Accounts Prepare the adjusting entry at March 31, 2022, to record bad debts expense. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 31 10

Question 7 of 8 -/ 30 E Prepare an aging schedule to determine the total estimated uncollectibles accounts at March 31, 2022. Accounts Receivable Amount Estimated Uncollectible Current 1-30 days past due 31-90 days past due Over 90 days past due List of Accounts Prepare the adjusting entry at March 31, 2022, to record bad debts expense. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 31 10

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

Transcribed Image Text:Question 7 of 8

-/ 30

Prepare an aging schedule to determine the total estimated uncollectibles accounts at March 31, 2022.

Accounts Receivable

Amount

%

Estimated Uncollectible

$

2$

Current

1-30 days past due

31-90 days past due

Over 90 days past due

$

List of Accounts

Prepare the adjusting entry at March 31, 2022, to record bad debts expense. (List all debit entries before credit entries. Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account

titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Mar. 31

I!

Transcribed Image Text:Question 7 of 8

>

-/ 30

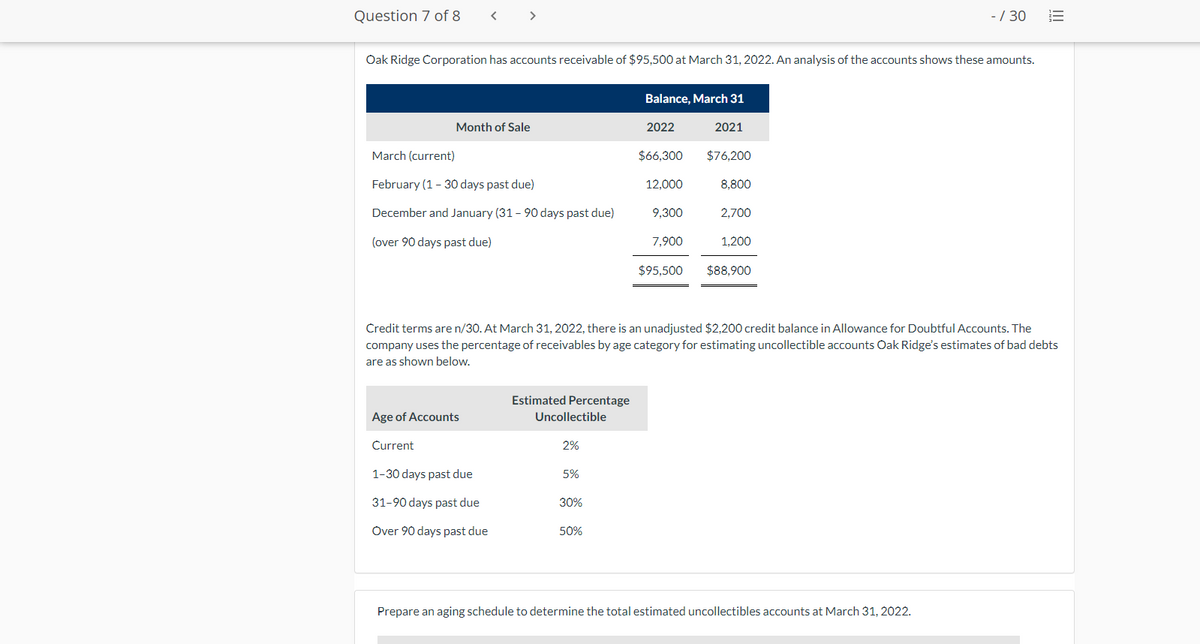

Oak Ridge Corporation has accounts receivable of $95,500 at March 31, 2022. An analysis of the accounts shows these amounts.

Balance, March 31

Month of Sale

2022

2021

March (current)

$66,300

$76,200

February (1 - 30 days past due)

12,000

8,800

December and January (31 - 90 days past due)

9,300

2,700

(over 90 days past due)

7,900

1,200

$95,500

$88,900

Credit terms are n/30. At March 31, 2022, there is an unadjusted $2,200 credit balance in Allowance for Doubtful Accounts. The

company uses the percentage of receivables by age category for estimating uncollectible accounts Oak Ridge's estimates of bad debts

are as shown below.

Estimated Percentage

Age of Accounts

Uncollectible

Current

2%

1-30 days past due

5%

31-90 days past due

30%

Over 90 days past due

50%

Prepare an aging schedule to determine the total estimated uncollectibles accounts at March 31, 2022.

III

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,