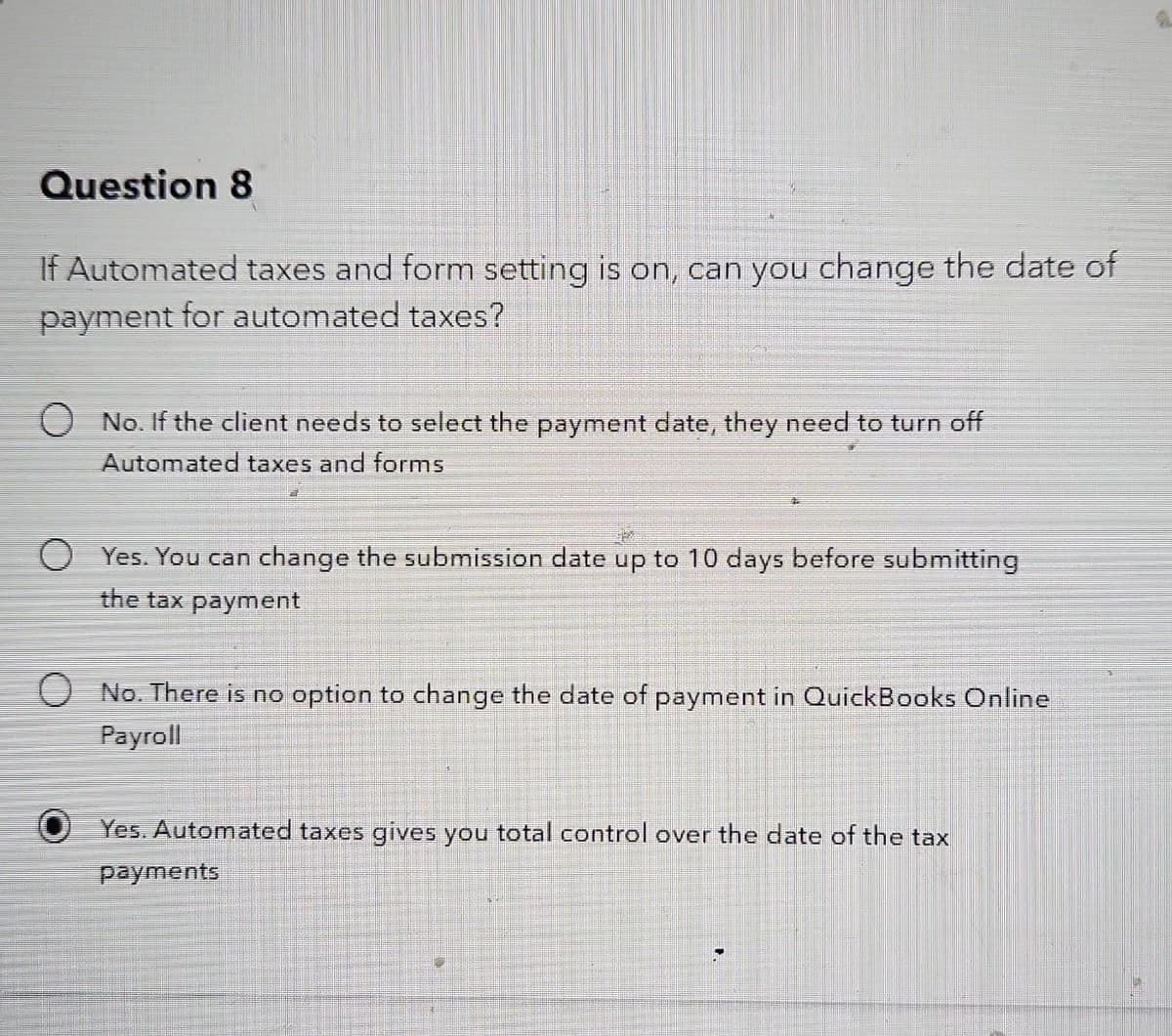

Question 8 If Automated taxes and form setting is on, can you change the date of payment for automated taxes? O No. If the client needs to select the payment date, they need to turn off Automated taxes and forms OYes. You can change the submission date up to 10 days before submitting the tax payment O No. There is no option to change the date of payment in QuickBooks Online Payroll Yes. Automated taxes gives you total control over the date of the tax payments

Question 8 If Automated taxes and form setting is on, can you change the date of payment for automated taxes? O No. If the client needs to select the payment date, they need to turn off Automated taxes and forms OYes. You can change the submission date up to 10 days before submitting the tax payment O No. There is no option to change the date of payment in QuickBooks Online Payroll Yes. Automated taxes gives you total control over the date of the tax payments

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 4RP

Related questions

Question

Transcribed Image Text:Question 8

If Automated taxes and form setting is on, can you change the date of

payment for automated taxes?

No. If the client needs to select the payment date, they need to turn off

Automated taxes and forms

Yes. You can change the submission date up to 10 days before submitting

the tax payment

No. There is no option to change the date of payment in QuickBooks Online

Payroll

Yes. Automated taxes gives you total control over the date of the tax

payments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning