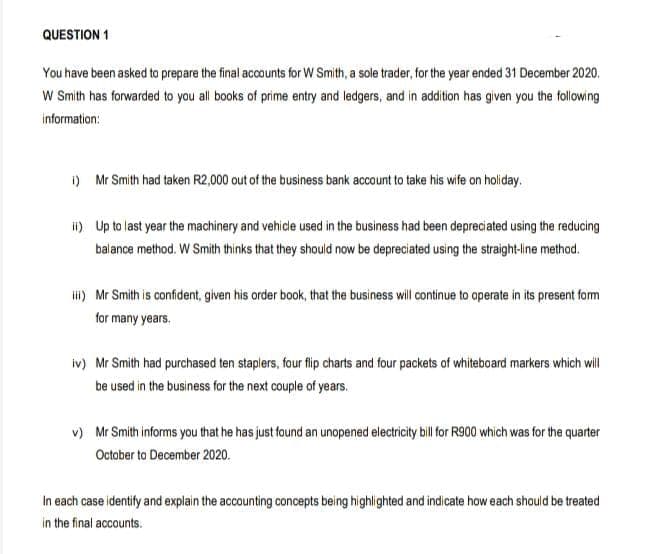

You have been asked to prepare the final accounts for W Smith, a sole trader, for the year ended 31 December 2020. W Smith has forwarded to you all books of prime entry and ledgers, and in addition has given you the following information: i) Mr Smith had taken R2,000 out of the business bank account to take his wife on holiday. i) Up to last year the machinery and vehide used in the business had been depreciated using the reducing balance method. W Smith thinks that they should now be depreciated using the straight-line method. li) Mr Smith is confident, given his order book, that the business will continue to operate in its present form for many years.

Q: You have been appointed the external auditor of BOA Ltd. On 25 August 2019, you were advised by…

A: Answer: Annual date of financials = 30 June 2019 Completion of audit work = 17 August 2019 Sign of…

Q: The following list of balances was extracted from the books of Kai Jordan at 31 December 2020, the…

A: Financial statements show the financial performance/position of the business entity. It is prepared…

Q: The following Trial Balance relates to the affairs of AUGUSTINE for the year ended 31st December…

A:

Q: On 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will…

A: A ledger is a log or list of accounts that keep track of account transfers.

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Journalize the given transaction: Date Accounts title and explanation Debit (OMR) Credit (OMR)…

Q: In the year, Jack owed RM2,000 and Rose owed RM5,000 to Wakanda Enterprise. At the end of the year,…

A: The business allows credit facility to the customers regarding sales. If the customers cannot repay…

Q: Crunch Craft, a catering company, provides catering services to its customers. Customers normally…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: The accounting equation is as follow:

Q: Assume you are the accounting manager for Logan’s Landscaping & Design. On December 1, 2013, Logan…

A: Under accrual concept, revenue should be recognized only when it is earned not only when cash is…

Q: Drex Montanez, a previously employed individual finally decided to put up his own business somewhat…

A: Journal entries shows the recording of the transaction during the year. Every transaction have dual…

Q: Blane commenced business on 1 January 20X6 and prepares her financial statements to 31 December…

A: Solution: Introduction: Allowance for Doubtful accounts is a contra asset, that it is related with…

Q: Jon Yanta, owner of Yanta’s Yard Care, is disappointed that his business incurred a net loss for…

A: Net Income:-It is income obtained by subtracting expenses from Revenue during the period. This…

Q: Assume you are the accounting manager for Logan’s Landscaping & Design. On December 1, 2013, Logan…

A: The correct answer for the above motioned question is given in the following steps

Q: accounting treatments

A: Contingent liabilities are liabilities that may arise in future period due to the outcome of an…

Q: The following list of balances was extracted from the books of Kai Jordan at 31 December 2020, the…

A: An income statement is a financial document that shows the details of all the income earned and…

Q: Andy Roddick is the new owner of Sunland Computer Services. At the end of August 2020, his first…

A: Adjusting journal entries are generally passed at the end of accounting period to record income or…

Q: You have been asked to prepare the final accounts for W Smith, a sole trader, for the year ended 31…

A: Hello! Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Andy Roddick is the new owner of Ace Computer Services. At the end of August 2020, his first month…

A: Introduction Adjusting Journal Entries are passed to manage any errors, omissions, adjustments etc.…

Q: Drex Montanez, a previously employed individual finally decided to put up his own business somewhat…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: F Polk, after being in Bakery business for some years without keeping proper records, now decides to…

A: Answer:-

Q: Nathan owns the Kavanan Bakeshop that has the following post-closing trial balance on December 31…

A: Revaluation refers to reassessing and remeasuring the value of the assets and liability based on the…

Q: On 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will…

A: Trial balance contains: Assets accounts Liabilities accounts Owner's equity account Revenue…

Q: You have been asked to prepare the final accounts for W Smith, a sole trader, for the year ended 31…

A: The financial accounting concept has its concentrates on the financial statements that are…

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Income Statement An income statement's purpose is to disclose the business transactions' as a result…

Q: You have been asked to prepare the final accounts for W Smith, a sole trader, for the year ended 31…

A: The financial accounting concept has its concentrates on the financial statements that are…

Q: At December 31, 2019, Jolie Inc. had a receivable of $500,000 from Relic Inc. on its statement of…

A: Since you have asked so many questions with same numerical name, We will be answering the first 3…

Q: Jean Smith, who retails wooden ornaments, has been so busy since she commenced business on 1 April…

A: Jean Smith Profit and Loss A/c for the Year ended 31-03-206…

Q: The following list of balances was extracted from the books of Kai Jordan at 31 December 2020, the…

A: Trial balance refers to the statement or workbook in which all the closing balances of ledgers are…

Q: wants “to get everything straightened out." Consequently, she has proposed the following accounting…

A: Accounting is a system that collects and processes which includes analyzing, measuring, and…

Q: Is this treatment appropriate?

A: Given information is: In February 2020, Ola Gott invested an additional $12000 in her business,…

Q: (a) Lara Croft has been hired as a new auditor for Jolie Inc. Ms. Croft has suggested the following…

A: a1 It is a change in accounting estimate as the uncollectible receivables are accounting estimates…

Q: You are the junior accountant at CBW Bank. You have been asked to assist with the 30 June 2022 tax…

A: Fringe benefit tax Fringe benefits are the additional benefits or we can say compensation given by…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Journal entry refers to the recording made by the business in the books of accounts, of all the…

Q: After having returned from his summer holidays on 1 September 2020, Mr. Willis, the owner of the…

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are…

Q: The Carrión-Carrión Law Firm offers legal services in the immigration area and operates under the…

A: There are two accounting methods cash basis and accrual basis.

Q: ra Croft has been hired as a new auditor for Jolie Inc. Ms. Croft has suggested the following…

A: Step 1 Accounting policy are the principles or rules which are considered by an entity while…

Q: On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date,…

A: Journal entries are the first recording of any transaction in the books of accounts on a…

Q: The Jamesway Corporation had the following situations on December 2021. Employee salaries for…

A: Interest expense must be recognized on December 31, 2021 = $60,000 x 8% x (4 months /12 months)…

Q: Mathys Inc. has recently hired a new independent auditor, Karen Ogleby, who says she wants “to get…

A: a. Classify the given following.

Q: On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date,…

A: The practice of recording commercial transactions for the first time in the books of accounts is…

Q: Puan Fatimah is the owner of Permai Trading in Gurun Kedah. The accounts are closed on 31 December…

A: For machinery: Since the machinery transferred and installed is general machinery, therefore the IA…

Q: Drex Montanez, a previously employed individual finally decided to put up his own business somewhat…

A: Trial Balance: It is a statement which shows the balances of all accounts at the end of the year.…

Q: The net income of Sogo & Sons, a department store, decreased sharply during 2019. Mohan Sogo,…

A: Net income is the amount earned. It is the part of revenues that are left after deducting all the…

Q: F Polk, after being in the Bakery business for some years without keeping proper records, now decide…

A:

Q: Prepare the journal entries necessary to record the transactions above using appropriate dates.…

A:

Q: Wishbone, Inc., is preparing its year-end balance sheet and needs to determine how much of its…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: Ms. Maryam opened training services company in January 2020. She plans to prepare the monthly…

A: Hey, since there are multiple questions posted, we will answer the first three questions. If you…

Q: Chris Nelson, the new assistant controller for Grand Company, is preparing for the firm’s year-end…

A: Financial Ratios: Financial ratios are the metrics used to evaluate the liquidity, capabilities,…

Step by step

Solved in 4 steps

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Taylor Company recently purchased a piece of equipment for $2,000 which will be paid within 30 days after delivery. At what point would the event be recorded in Taylors accounting system? When Taylor signs the agreement with the seller When Taylor receives an invoice (a bill) from the setter When Taylor receives the asset from the seller When Taylor pays $2.000 cash to the sellerHajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.

- Preparing financial statements. Hugo Garcia is preparing his balance sheet and income and expense statement for the year ending December 31, 2020. He is having difficulty classifying six items and sks for your help. Which, if any, of the following transactions are assets, liabilities, income, or expense items? a. Hugo rents a house for 1,350 a month. b. On June 21, 2020 Hugo bought diamond earrings for his wife and charged them using his Visa card. The earrings cost 900, but he hasnt yet received the bill. c. Hugo borrowed 3,500 from his parents last fall, but so far, he has made no payments to them. d. Hugo makes monthly payments of 225 on an installment loan; about half of it is interest, and the balance is repayment of principal. He has 20 payments left, totaling 4,500. e. Hugo paid 3,800 in taxes during the year and is due a tax refund of 650, which he hasnt yet received. f. Hugo invested 2,300 in a mutual fund. g. Hugos Aunt Lydia gave him a birthday gift of 300.Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.

- (Appendix 3.1) Cash-Basis Accounting Puntarelli Contracting keep its accounting records on a cash basis during the year. At year end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2018, Puntarelli reported the following balance sheet items. It is now the end of 2019. The companys checkbook shows a balance of 4,700, which includes cash receipts from customers of 51,300 and cash payments of 49,300. An examination of the cash payments shows that: (1) 30,600 was paid to suppliers, (2) 12,700 was paid for other operating costs (including 7,200 paid on January 1 for 2 years annual rent), and (3) 6,000 was withdrawn by T. Puntarelli. On December 51, 2019, (1) customers owed Puntarelli Contracting 55,900, (2) Puntarelli owed suppliers and employees 7,000 and 900, respectively, and (3) the ending inventory was 6,300. Puntarelli is depreciating the equipment using straight line depreciation over a 10-year life (no residual value). Required: 1. Using accrual based accounting, prepare a 2019 income statement (show supporting calculations). 2. Using accrual-based accounting, prepare a December 31, 2019, balance sheet (show supporting calculations).Comprehensive (Appendix 3.1) Dawson OConnor is the owner of Miller Island Sales, a distributor of fishing supplies. The following is the balance sheet of the company as of December 31, 2018: Dawson keeps very few records and has asked you to help him prepare the 2019 financial statements for Miller Island Sales. An analysis of the 2019 cash transactions recorded in the companys checkbook indicates deposits and checks as follows: Other information about the company is as follows: 1. Accounts receivable at December 31, 2019; 9,200. 2. Accounts payable at December 31: 3. Salaries payable at December 31, 2019, 1,800. 4. Equipment is depreciated by the straight-line method over a 10-year life. The equipment purchased in 2019 was acquired on July 1. All of the equipment will have zero salvage value at the end of its useful life. 5. Interest payable at December 31. 2019: 140. 6. The company uses a periodic inventory system Inventory at December 31, 2019: 17,400. Required: 1. Prepare a worksheet to summarize the transactions and adjustments of Miller Island Sales for 2019. (Hint: Include debit and credit columns for both transactions and adjustments.) 2. Prepare a 2019 income statement and a balance sheet as of December 31, 2019. (Contributed by Waller A. Parker)Journalize for Harper and Co. each of the following transactions or state no entry required and explain why. Be sure to follow proper journal writing rules. A. A corporation is started with an investment of $50,000 in exchange for stock. B. Equipment worth $4,800 is ordered. C. Office supplies worth $750 are purchased on account. D. A part-time worker is hired. The employee will work 15–20 hours per week starting next Monday at a rate of $18 per hour. E. The equipment is received along with the invoice. Payment is due in three equal monthly installments, with the first payment due in sixty days.