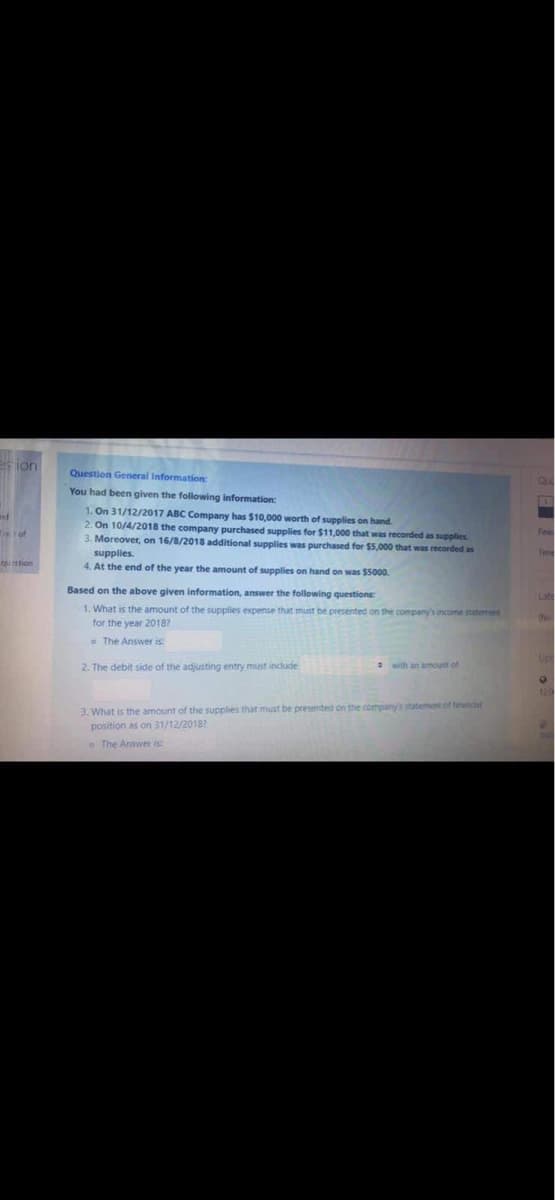

Question General Information You had been given the following information: 1. On 31/12/2017 ABC Company has $10,000 worth of supplies on hand 2. On 10/4/2018 the company purchased supplies for $11,000 that was recorded as supplies 3. Moreover, on 16/8/2018 additional supplies was purchased for $5,000 that was recorded as supplies. 4. At the end of the year the amount of supplies on hand on was $5000 Based on the above given information, answer the following questions 1. What is the amount of the supplies expense that must be presented on the company's income statemet for the year 20187 • The Answer is 2. The debit side of the adjusting entry must incude amount of 3. What is the amount of the supplies that must be presented on the company's statement of teandal position as on 31/12/2018 The Answer is

Question General Information You had been given the following information: 1. On 31/12/2017 ABC Company has $10,000 worth of supplies on hand 2. On 10/4/2018 the company purchased supplies for $11,000 that was recorded as supplies 3. Moreover, on 16/8/2018 additional supplies was purchased for $5,000 that was recorded as supplies. 4. At the end of the year the amount of supplies on hand on was $5000 Based on the above given information, answer the following questions 1. What is the amount of the supplies expense that must be presented on the company's income statemet for the year 20187 • The Answer is 2. The debit side of the adjusting entry must incude amount of 3. What is the amount of the supplies that must be presented on the company's statement of teandal position as on 31/12/2018 The Answer is

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.8E: Adjustment for supplies Answer each of the following independent questions concerning supplies and...

Related questions

Question

Transcribed Image Text:Es ion

Question General Information

You had been given the following information:

1. On 31/12/2017 ABC Company has $10,000 worth of supplies on hand.

2. On 10/4/2018 the company purchased supplies for $11,000 that was recorded as supplies.

3. Moreover, on 16/8/2018 additional supplies was purchased for $5,000 that was recorded as

of

supplies.

Time

4. At the end of the year the amount of supplies on hand on was $5000.

Based on the above given information, answer the following questions

Late

1. What is the amount of the supplies expense that must be presented on the company's income statement

No

for the year 20187

• The Answer is:

Up

2. The debit side of the adjusting entry must include

* with an amount of

120

3. What is the amount of the supplies that must be presented on the company's statement ot trancial

position as on 31/12/2018?

o The Answer is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning