Total Lawn Services earned $110,000 of service revenue during 2018, Of the $110,000 eamed, the business received $92,000 in cash. The remaining amount, $18,000, was still owed by customers as of December 31. In addition, Total Lawn Services incurred $68,000 of expenses during the year. As of December 31, $14,000 of the expenses still needed to be paid. In addition, Total Lawn Services prepaid $12,000 cash in December 2018 for expenses incurred during the next year. 1. Determine the amount of service revenue and expenses for 2018 using a cash basis accounting system. 2. Determine the amount of service revenue and expenses for 2018 using an accrual basis accounting system. 1. Determine the amount service revenue and expenses for 2018 using a cash basis accounting system. Cash basis Service revenue Expenses

Total Lawn Services earned $110,000 of service revenue during 2018, Of the $110,000 eamed, the business received $92,000 in cash. The remaining amount, $18,000, was still owed by customers as of December 31. In addition, Total Lawn Services incurred $68,000 of expenses during the year. As of December 31, $14,000 of the expenses still needed to be paid. In addition, Total Lawn Services prepaid $12,000 cash in December 2018 for expenses incurred during the next year. 1. Determine the amount of service revenue and expenses for 2018 using a cash basis accounting system. 2. Determine the amount of service revenue and expenses for 2018 using an accrual basis accounting system. 1. Determine the amount service revenue and expenses for 2018 using a cash basis accounting system. Cash basis Service revenue Expenses

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

100%

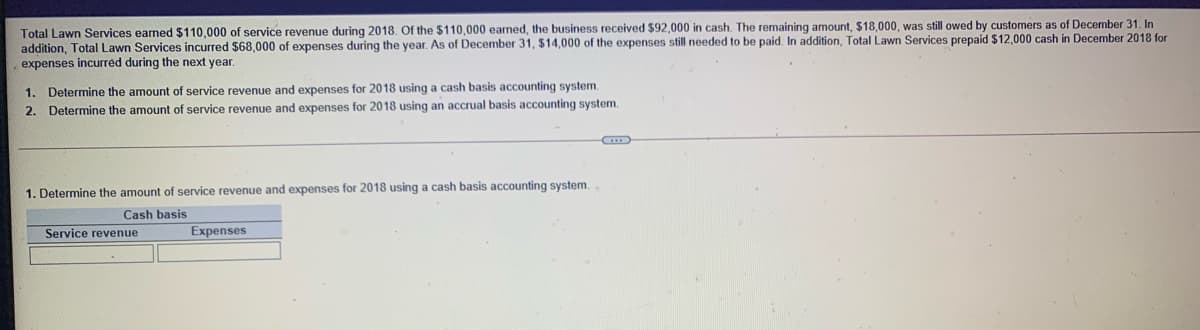

Transcribed Image Text:Total Lawn Services earned $110,000 of service revenue during 2018. Of the $110,000 eamed, the business received $92,000 in cash. The remaining amount, $18,000, was still owed by customers as of December 31. In

addition, Total Lawn Services incurred $68,000 of expenses during the year. As of December 31, $14,000 of the expenses still needed to be paid. In addition, Total Lawn Services prepaid $12,000 cash in December 2018 for

expenses incurred during the next year.

Determine the amount of service revenue and expenses for 2018 using a cash basis accounting system.

2. Determine the amount of service revenue and expenses for 2018 using an accrual basis accounting system.

1.

1. Determine the amount of service revenue and expenses for 2018 using a cash basis accounting system.

Cash basis

Service revenue

Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College