Question One : define inventory costing methods and compare between them in term of cost of goods sold, ending inventory and tax

Question One : define inventory costing methods and compare between them in term of cost of goods sold, ending inventory and tax

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 10P: LIFO and Inventory Pools On January 1, 2016, Grover Company changed its inventory cost flow method...

Related questions

Question

We need help for this

Transcribed Image Text:Teams .l

5:22 PM

© 44%

Refreshing document with downloaded fonts.

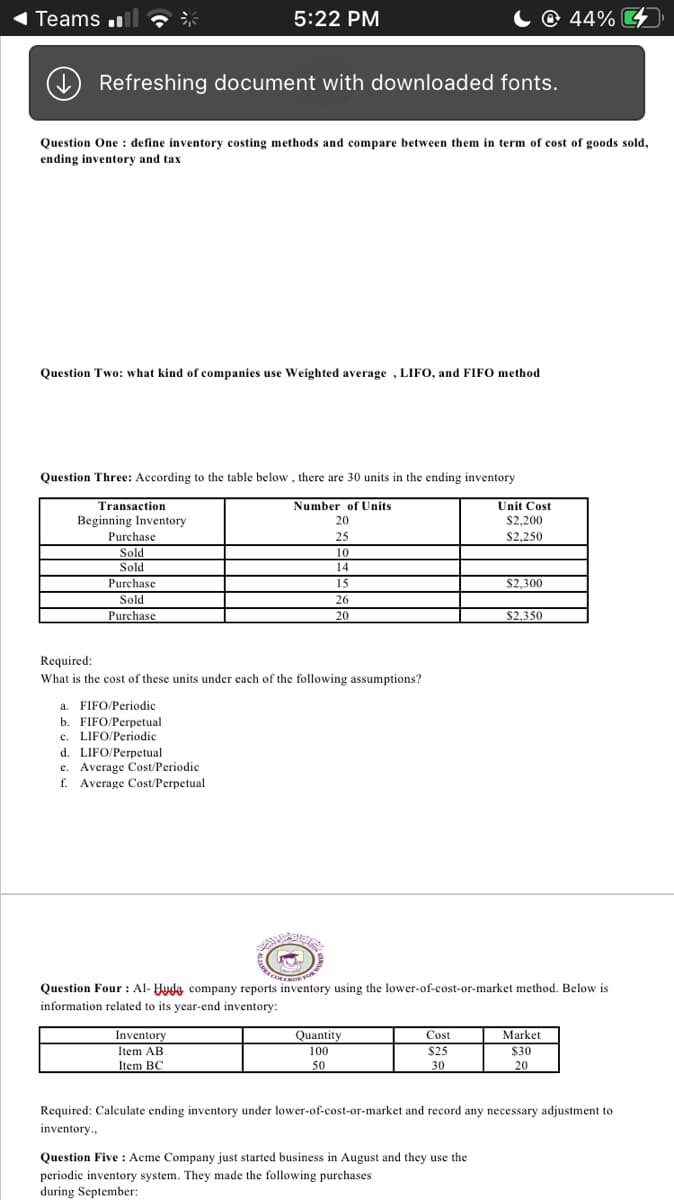

Question One : define inventory costing methods and compare between them in term of cost of goods sold,

ending inventory and tax

Question Two: what kind of companies use Weighted average , LIFO, and FIFO method

Question Three: According to the table below , there are 30 units in the ending inventory

Transaction

Beginning Inventory

Number of Units

Unit Cost

20

$2,200

Purchase

25

$2,250

Sold

Sold

Purchase

10

14

15

$2,300

Sold

26

Purchase

20

$2,350

Required:

What is the cost of these units under each of the following assumptions?

a. FIFO/Periodic

b. FIFO/Perpetual

c. LIFO/Periodic

d. LIFO/Perpetual

e. Average Cost/Periodic

f. Average Cost/Perpetual

Question Four : Al- Huda company reports inventory using the lower-of-cost-or-market method. Below is

information related to its year-end inventory:

Inventory

Item AB

Quantity

Cost

Market

100

$25

$30

Item BC

50

30

20

Required: Calculate ending inventory under lower-of-cost-or-market and record any necessary adjustment to

inventory.,

Question Five : Acme Company just started business in August and they use the

periodic inventory system. They made the following purchases

during September:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,