Questions 1. What is the Zapatoes Inc's capital structure? What is the effect of an additional debt? Additional equity? 2. Assess the profitability of Zapatoes Inc's. What is the effect of issuing debt to its profitability? Effect of equity? 3. What factors are considered in deciding whether to take long-term or short-term financing? 4. What financing should Anthony Cruz take?

Questions 1. What is the Zapatoes Inc's capital structure? What is the effect of an additional debt? Additional equity? 2. Assess the profitability of Zapatoes Inc's. What is the effect of issuing debt to its profitability? Effect of equity? 3. What factors are considered in deciding whether to take long-term or short-term financing? 4. What financing should Anthony Cruz take?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter17: Activity Resource Usage Model And Tactical Decision Making

Section: Chapter Questions

Problem 14E: Global Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell...

Related questions

Question

100%

Guide Questions

1. What is the Zapatoes Inc's capital structure? What is the effect of an additional debt? Additional equity?

2. Assess the profitability of Zapatoes Inc's. What is the effect of issuing debt to its profitability? Effect of equity?

3. What factors are considered in deciding whether to take long-term or short-term financing?

4. What financing should Anthony Cruz take?

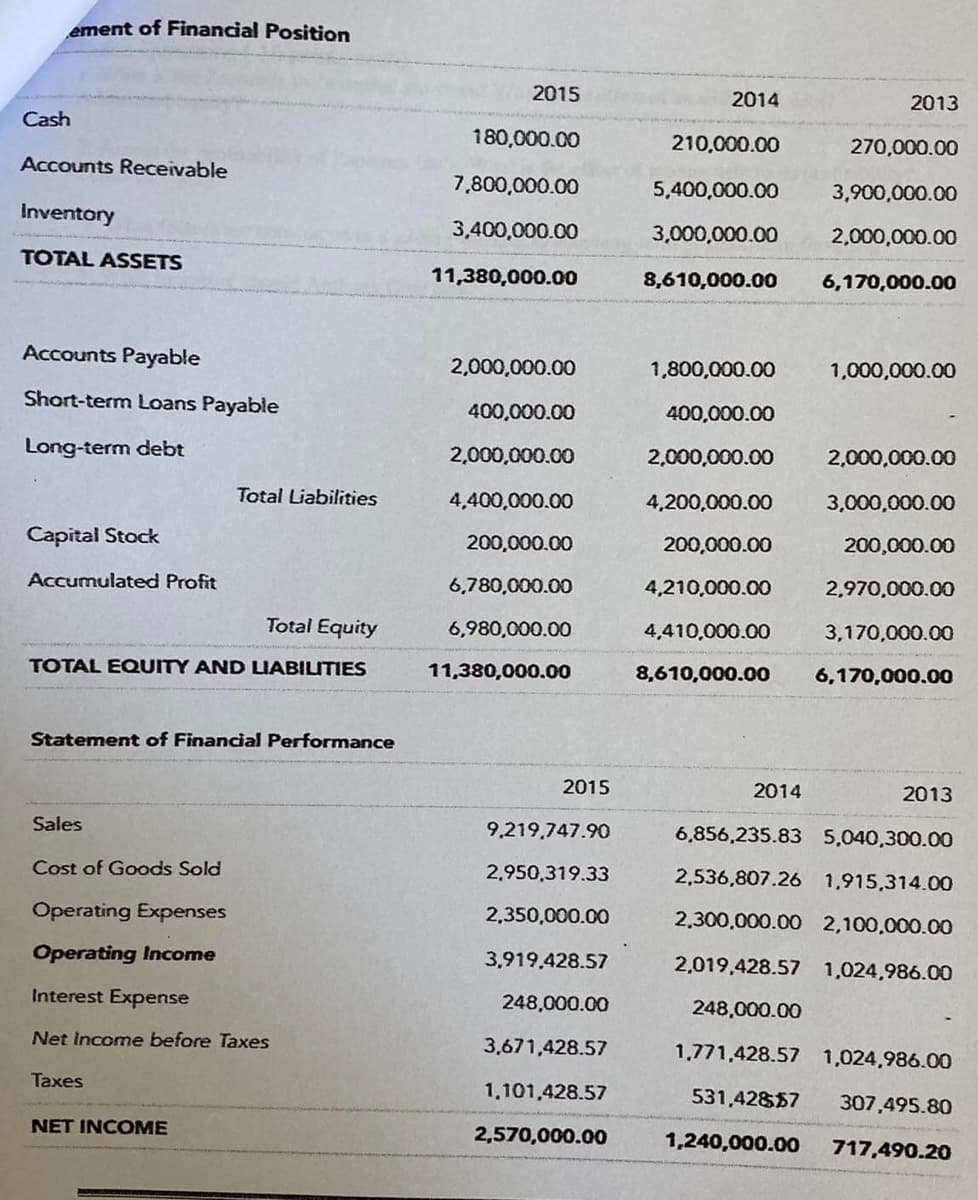

Transcribed Image Text:ement of Financial Position

2015

2014

2013

Cash

180,000.00

210,000.00

270,000.00

Accounts Receivable

7,800,000.00

5,400,000.00

3,900,000.00

Inventory

3,400,000.00

3,000,000.00

2,000,000.00

TOTAL ASSETS

11,380,000.00

8,610,000.00

6,170,000.00

Accounts Payable

2,000,000.00

1,800,000.00

1,000,000.00

Short-term Loans Payable

400,000.00

400,000.00

Long-term debt

2,000,000.00

2,000,000.00

2,000,000.00

Total Liabilities

4,400,000.00

4,200,000.00

3,000,000.00

Capital Stock

200,000.00

200,000.00

200,000.00

Accumulated Profit

6,780,000.00

4,210,000.00

2,970,000.00

Total Equity

6,980,000.00

4,410,000.00

3,170,000.00

TOTAL EQUITY AND LIABILITIES

11,380,000.00

8,610,000.00

6,170,000.00

Statement of Financial Performance

2015

2014

2013

Sales

9,219,747.90

6,856,235.83 5,040,300.00

Cost of Goods Sold

2,950,319.33

2,536,807.26 1,915,314.00

Operating Expenses

2,350,000.00

2,300.000.00 2,100,000.00

Operating Income

3,919.428.57

2,019,428.57 1,024,986.00

Interest Expense

248,000.00

248,000.00

Net Income before Taxes

3,671,428.57

1,771.428.57 1,024,986.00

Taxes

1,101.428.57

531,42857

307,495.80

NET INCOME

2,570,000.00

1,240,000.00

717,490.20

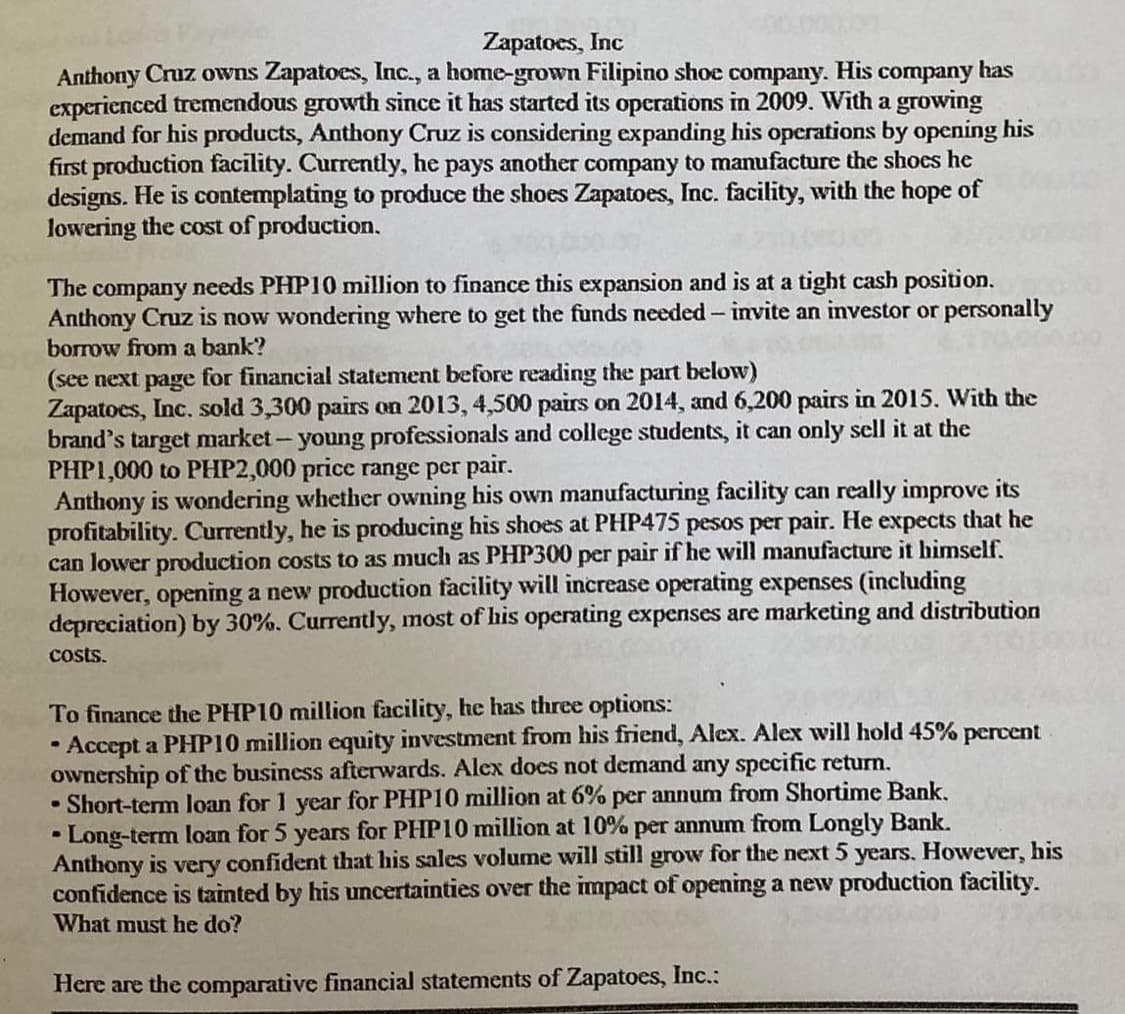

Transcribed Image Text:Zapatoes, Inc

Anthony Cruz owns Zapatoes, Inc., a home-grown Filipino shoe company. His company has

experienced tremendous growth since it has started its opcrations in 2009. With a growing

demand for his products, Anthony Cruz is considering expanding his operations by opening his

first production facility. Currently, he pays another company to manufacture the shoes he

designs. He is contemplating to produce the shoes Zapatoes, Inc. facility, with the hope of

lowering the cost of production.

The company needs PHPI0 million to finance this expansion and is at a tight cash position.

Anthony Cruz is now wondering where to get the funds needed- invite an investor or personally

borrow from a bank?

(see next page for financial statement before reading the

Zapatoes, Inc. sold 3,300 pairs on 2013, 4,500 pairs on 2014, and 6,200 pairs in 2015. With the

brand's target market- young professionals and college students, it can only sell it at the

PHP1,000 to PHP2,000 price range per pair.

Anthony is wondering whether owning his own manufacturing facility can really improve its

profitability. Currently, he is producing his shoes at PHP475 pesos per pair. He expects that he

can lower production costs to as much as PHP300 per pair if he will manufacture it himself.

However, opening a new production facility will increase operating expenses (including

depreciation) by 30%. Currently, most of his operating expenses are marketing and distribution

part below)

costs.

To finance the PHP10 million facility, he has three options:

Accept a PHP10 million equity investment from his friend, Alex. Alex will hold 45% percent

ownership of the business afterwards. Alex does not demand any specific return.

Short-term loan for 1 year for PHP10 million at 6% per annum from Shortime Bank.

• Long-term loan for 5 years for PHP10 million at 10% per annum from Longly Bank.

Anthony is very confident that his sales volume will still grow for the next 5 years. However, his

confidence is tainted by his uncertainties over the impact of opening a new production facility.

What must he do?

Here are the comparative financial statements of Zapatoes, Inc.:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub