The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash $96,928 Accounts Payable $205,898 Accounts Receivable 11,528 Wages Payable Notes Payable 1,138 Inventory 151,823 33,991 Prepaid Rent 6,392 Paid-In Capital 313,317 Equipment 348,579 Retained Earnings 60,906 Total Assets $615,250 Total Equities $615,250 The following summary transactions occurred during 2021: • borrowed $4,183 from the bank • purchased $268,201 of merchandise on account and $132,099 for cash • sold merchandise for $448,384 on account and $252,216 for cash; the merchandise cost $399,342 • paid $5,921 for land and equipment • received $8,583 in cash contributions from new owners Note: For the questions below, ignore adjusting entries on December 31, 2021. 5. What was the cash balance on December 31, 2021? OA: $73,440|OB: $106,488 Oc: $154,407 OD: $223,890| O E: $324,640 O F: $470,729| Submit Answer Tries 0/99 7. What was total owners' equity on December 31, 2021? O A: $386,717 B: $514,334| C: $684,064 O D: $909,805|O E: $1,210,041 F: $1,609,354 Submit Answer Tries 0/99

The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash $96,928 Accounts Payable $205,898 Accounts Receivable 11,528 Wages Payable Notes Payable 1,138 Inventory 151,823 33,991 Prepaid Rent 6,392 Paid-In Capital 313,317 Equipment 348,579 Retained Earnings 60,906 Total Assets $615,250 Total Equities $615,250 The following summary transactions occurred during 2021: • borrowed $4,183 from the bank • purchased $268,201 of merchandise on account and $132,099 for cash • sold merchandise for $448,384 on account and $252,216 for cash; the merchandise cost $399,342 • paid $5,921 for land and equipment • received $8,583 in cash contributions from new owners Note: For the questions below, ignore adjusting entries on December 31, 2021. 5. What was the cash balance on December 31, 2021? OA: $73,440|OB: $106,488 Oc: $154,407 OD: $223,890| O E: $324,640 O F: $470,729| Submit Answer Tries 0/99 7. What was total owners' equity on December 31, 2021? O A: $386,717 B: $514,334| C: $684,064 O D: $909,805|O E: $1,210,041 F: $1,609,354 Submit Answer Tries 0/99

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.2MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

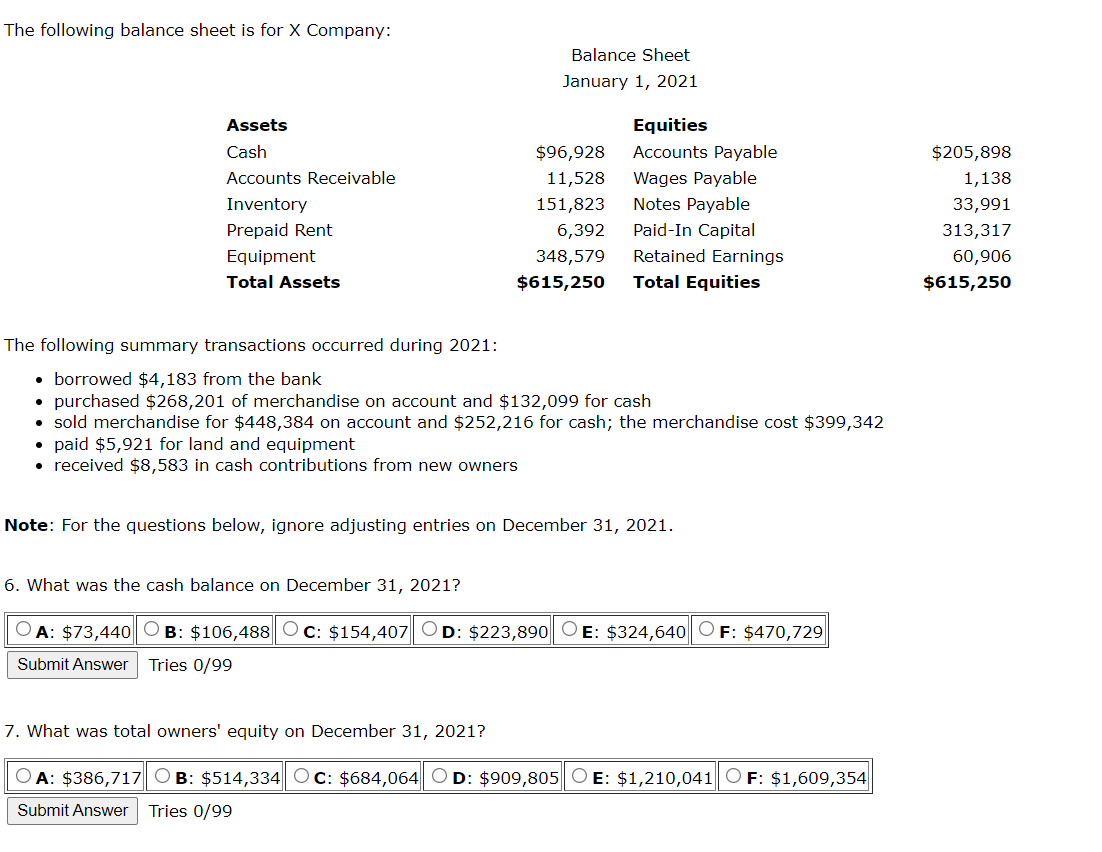

Transcribed Image Text:The following balance sheet is for X Company:

Balance Sheet

January 1, 2021

Assets

Equities

Cash

$96,928

Accounts Payable

$205,898

Accounts Receivable

11,528

Wages Payable

1,138

Inventory

151,823

Notes Payable

33,991

Prepaid Rent

6,392

Paid-In Capital

313,317

Retained Earnings

Total Equities

Equipment

348,579

60,906

Total Assets

$615,250

$615,250

The following summary transactions occurred during 2021:

• borrowed $4,183 from the bank

• purchased $268,201 of merchandise on account and $132,099 for cash

• sold merchandise for $448,384 on account and $252,216 for cash; the merchandise cost $399,342

• paid $5,921 for land and equipment

• received $8,583 in cash contributions from new owners

Note: For the questions below, ignore adjusting entries on December 31, 2021.

6. What was the cash balance on December 31, 2021?

O A: $73,440O B: $106,488 Oc: $154,407 OD: $223,890 OE: $324,640

F: $470,729

Submit Answer

Tries 0/99

7. What was total owners' equity on December 31, 2021?

O A: $386,717 O B: $514,334 Oc: $684,064 O D: $909,805| O E: $1,210,041|O F: $1,609,354

Submit Answer

Tries 0/99

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Questions 6 and 7 refer to the following information

The following balance sheet is for X Company:

Balance Sheet

January 1, 2021

Assets

Equities

Cash

$98,677

Accounts Payable

$227,659

Accounts Receivable

12,851

Wages Payable

1,230

Inventory

159,370

Notes Payable

30,751

Prepaid Rent

6,040

Paid-In Capital

263,939

Equipment

321,448

Retained Earnings

74,807

Total Assets

$598,386 Total Equities

$598,386

The following summary transactions occurred during 2021:

• paid $85,551 to suppliers for merchandise previously purchased on account

• paid $25,610 for advertising

• sold merchandise for $442,764 on account and $260,036 for cash; the merchandise cost $372,484

• agreed to a five-year rental lease for $10,000 and paid $2,000 in advance

• received $8,596 in cash contributions from new owners

Note: For the questions below, ignore adjusting entries on December 31, 2021.

6. What were total equities on December 31, 2021?

A: $440,868 OB: $515,816 OC: $603,504OD: $706,100

E: $826,137OF: $966,580

Submit Answer Tries 0/99

7. What were total liabilities on December 31, 2021?

A: $174,089 OB: $217,611 OC: $272,014

D: $340,018

E: $425,022|

F: $531,277

Submit Answer

Tries 0/99

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning