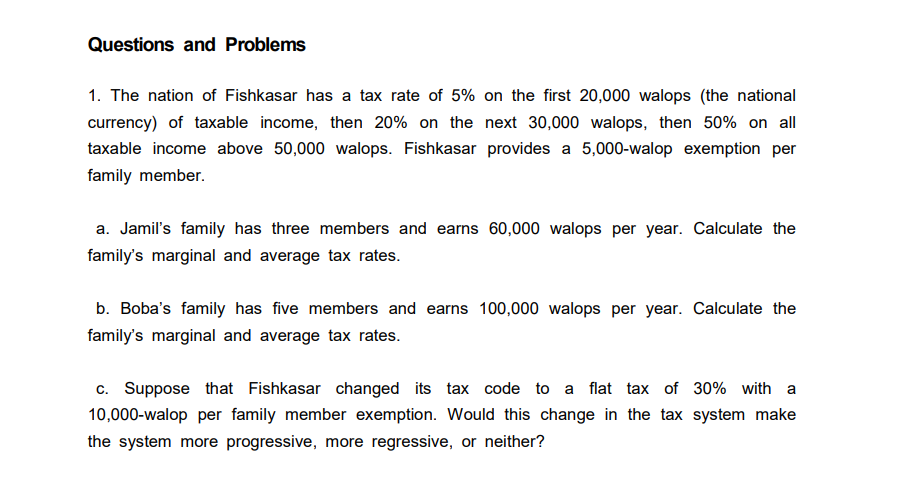

Questions and Problems 1. The nation of Fishkasar has a tax rate of 5% on the first 20,000 walops (the national currency) of taxable income, then 20% on the next 30,000 walops, then 50% on all taxable income above 50,000 walops. Fishkasar provides a 5,000-walop exemption per family member. a. Jamil's family has three members and earns 60,000 walops per year. Calculate the family's marginal and average tax rates. b. Boba's family has five members and earns 100,000 walops per year. Calculate the family's marginal and average tax rates. c. Suppose that Fishkasar changed its tax code to a flat tax of 30% with a 10,000-walop per family member exemption. Would this change in the tax system make the system more progressive, more regressive, or neither?

Questions and Problems 1. The nation of Fishkasar has a tax rate of 5% on the first 20,000 walops (the national currency) of taxable income, then 20% on the next 30,000 walops, then 50% on all taxable income above 50,000 walops. Fishkasar provides a 5,000-walop exemption per family member. a. Jamil's family has three members and earns 60,000 walops per year. Calculate the family's marginal and average tax rates. b. Boba's family has five members and earns 100,000 walops per year. Calculate the family's marginal and average tax rates. c. Suppose that Fishkasar changed its tax code to a flat tax of 30% with a 10,000-walop per family member exemption. Would this change in the tax system make the system more progressive, more regressive, or neither?

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

Transcribed Image Text:Questions and Problems

1. The nation of Fishkasar has a tax rate of 5% on the first 20,000 walops (the national

currency) of taxable income, then 20% on the next 30,000 walops, then 50% on all

taxable income above 50,000 walops. Fishkasar provides a 5,000-walop exemption per

family member.

a. Jamil's family has three members and earns 60,000 walops per year. Calculate the

family's marginal and average tax rates.

b. Boba's family has five members and earns 100,000 walops per year. Calculate the

family's marginal and average tax rates.

c. Suppose that Fishkasar changed its tax code to a flat tax of 30% with a

10,000-walop per family member exemption. Would this change in the tax system make

the system more progressive, more regressive, or neither?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning