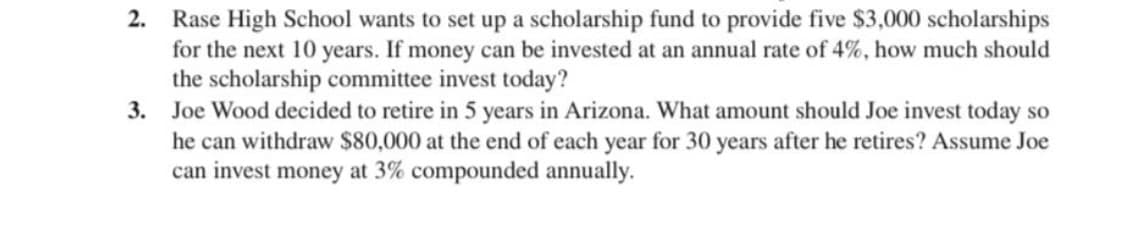

Rase High School wants to set up a scholarship fund to provide five $3,000 scholarships for the next 10 years. If money can be invested at an annual rate of 4%, how much should the scholarship committee invest today? Joe Wood decided to retire in 5 years in Arizona. What amount should Joe invest today so he can withdraw $80,000 at the end of each year for 30 years after he retires? Assume Joe can invest money at 3% compounded annually.

Rase High School wants to set up a scholarship fund to provide five $3,000 scholarships for the next 10 years. If money can be invested at an annual rate of 4%, how much should the scholarship committee invest today? Joe Wood decided to retire in 5 years in Arizona. What amount should Joe invest today so he can withdraw $80,000 at the end of each year for 30 years after he retires? Assume Joe can invest money at 3% compounded annually.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 22E

Related questions

Question

Use excel do it

Transcribed Image Text:Rase High School wants to set up a scholarship fund to provide five $3,000 scholarships

for the next 10 years. If money can be invested at an annual rate of 4%, how much should

the scholarship committee invest today?

Joe Wood decided to retire in 5 years in Arizona. What amount should Joe invest today so

he can withdraw $80,000 at the end of each year for 30 years after he retires? Assume Joe

can invest money at 3% compounded annually.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning