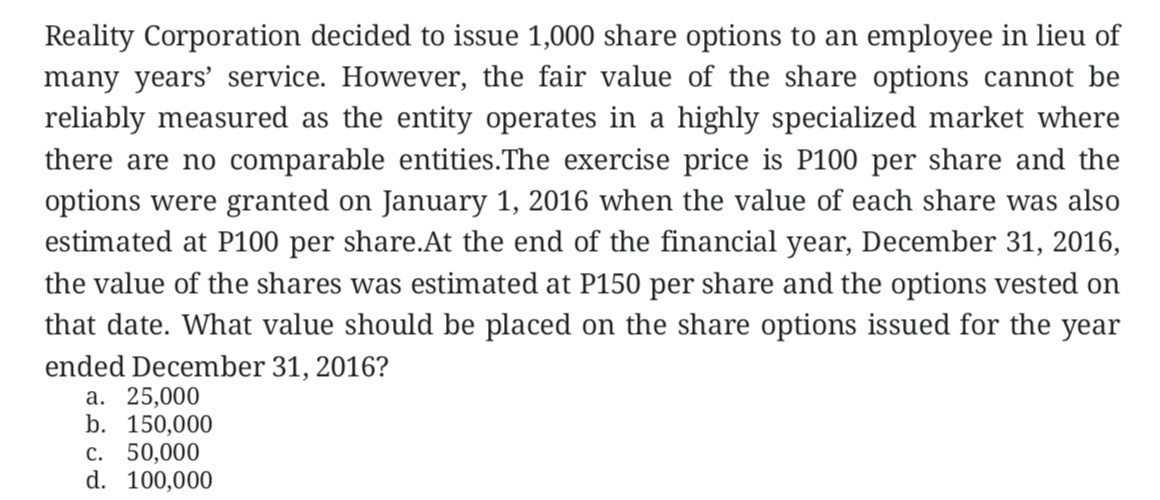

Reality Corporation decided to issue 1,000 share options to an employee in lieu of many years' service. However, the fair value of the share options cannot be reliably measured as the entity operates in a highly specialized market where there are no comparable entities.The exercise price is P100 per share and the options were granted on January 1, 2016 when the value of each share was also estimated at P100 per share.At the end of the financial year, December 31, 2016, the value of the shares was estimated at P150 per share and the options vested on that date. What value should be placed on the share options issued for the year ended December 31, 2016? a. 25,000 b. 150,000 C. 50,000 d. 100,000

Reality Corporation decided to issue 1,000 share options to an employee in lieu of many years' service. However, the fair value of the share options cannot be reliably measured as the entity operates in a highly specialized market where there are no comparable entities.The exercise price is P100 per share and the options were granted on January 1, 2016 when the value of each share was also estimated at P100 per share.At the end of the financial year, December 31, 2016, the value of the shares was estimated at P150 per share and the options vested on that date. What value should be placed on the share options issued for the year ended December 31, 2016? a. 25,000 b. 150,000 C. 50,000 d. 100,000

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 26CE

Related questions

Question

Transcribed Image Text:Reality Corporation decided to issue 1,000 share options to an employee in lieu of

many years' service. However, the fair value of the share options cannot be

reliably measured as the entity operates in a highly specialized market where

there are no comparable entities.The exercise price is P100 per share and the

options were granted on January 1, 2016 when the value of each share was also

estimated at P100 per share.At the end of the financial year, December 31, 2016,

the value of the shares was estimated at P150 per share and the options vested on

that date. What value should be placed on the share options issued for the year

ended December 31, 2016?

a. 25,000

b. 150,000

c. 50,000

d. 100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning