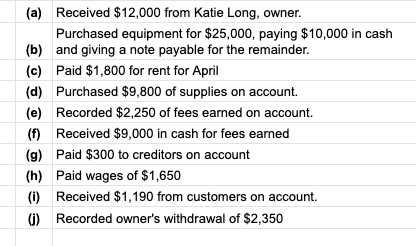

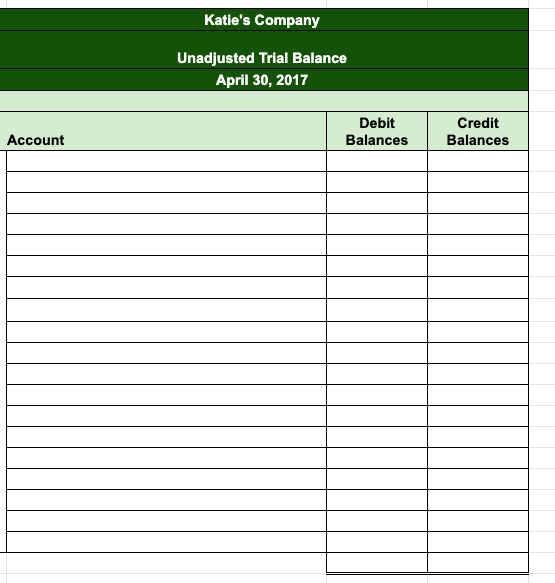

Received $12,000 from Katie Long, owner. (a) Purchased equipment for $25,000, paying $10,000 in cash (b) and giving a note payable for the remainder. (c) Paid $1,800 for rent for April (d) Purchased $9,800 of supplies on account. (e) Recorded $2,250 of fees earned on account. () Received $9,000 in cash for fees earned (g) Paid $300 to creditors on account (h) Paid wages of $1,650 () Received $1,190 from customers on account. ) Recorded owner's withdrawal of $2,350 Katie's Company Unadjusted Trial Balance April 30, 2017 Credit Debit Account Balances Balances

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: July 1-Owner invested $ 9,100 cash in the company. July 1 -Purchased used truck for $ 6,080, paying…

A: There is no adjustment detail related to depreciation given in question. Therefore question is…

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: transactions. Ali purchased land for Business for $35,000. Paid $20,000 cash. The balance will be…

A: Trial balance is prepared when debit balances are equal to credit balances and all balances so…

Q: Given below are the transactions related to Hameed Enterprises for the month of March 2021. Date…

A: Income statements and Balance sheets are prepared at the end of the period to analyze the income and…

Q: uly 1-Owner invested $ 9,100 cash in the company. July 1 -Purchased used truck for $ 6,080, paying $…

A:

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: The financial statements of the business include the income statement and balance sheet of the firm.

Q: Jan 2 Received $11,000 cash from Ruiz, and issued common stock to him. 2 Paid monthly office rent,…

A: Following are the requisite financial statement

Q: The following transactions, among others, occurred during August. Which transaction represented an…

A: A transaction is a formal agreement that is executed between two or more persons such as buyer and…

Q: On April 1, 2019, Maria Adams established Custom Realty. Maria completed the following transactions…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Q: The following entries are in the books of Moh Co. for the month of Jan,2021: 10th Jan Started up the…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Selected transactions for A. Aslam, a propertymanager, in her first month of business, are as…

A: Rules - 1- When asset increases, it is debited but when decreases, it is credited. 2- When…

Q: Mr. Arish opened Arish's Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Chart of Accounts On March 1, 2022, Mr. Martinez started his Photography business. The following are…

A: Journal entry is the primary step to record the transaction in the books of accounts. The journal…

Q: On July 1, 2021, Emilia Clarke opened a small paint shop called "Emilia Clarke Paint Shop." The…

A: The journal, ledger and trail balance are part of the accounting cycle. These are used to correctly…

Q: Emerita Modesto established a. Deposited P120,000 in a bank account in the name of the business.…

A: Accounting equation of the business says that total assets always must be equal to total liabilities…

Q: a. Received cash of $10,000 from owner and gave сapital. b. Earned video rental revenue on account,…

A: Accounting equation is referred to the first step of an accounting cycle. It represents that the…

Q: Mohammed started a delivery company in Muscat in June 2018 (Mohammed Delivery Service). During the…

A: The accounting equation states that assets equal to sum of liabilities and equity.

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: As posted multiple sub parts we are answering only one kindly repost the unanswered question as a…

Q: Mhay Faraan started a delivery service, Mhay Deliveries, on July 1, 2020. The following transactions…

A: The statement which is prepared to verify if the account balances results in equal debits and…

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2022. During July, the following…

A: Work Sheet

Q: Jared Hawk established an insurance agency on July 1 of the current year and completed the following…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Adjusting entries are those entries that are passed at the end of the period in order to accurately…

Q: Bought washing machines and dryers from Bataan Equipment Corp., P115,000. following transactions…

A: T accounts are the general ledger accounts that are prepared in the business for classification of…

Q: Using "I" accounts, shows the addition or subtraction by "position" for the following transactions:…

A: T-accounts are the accounts in which the journal entries are posted.

Q: Mr. Lopez opened a mini grocery store with business name Lopez Fiesta Mart. Operations began on…

A: JOURNAL ENTRY :— journal entry is the process of Recording financial transactions. A journal entry…

Q: The following transactions, among others, occurred during August. Which transaction represented an…

A: As per the accrual basis of accounting, the expenses are recorded in the month in which they occur.…

Q: Listed below are six transactions for TUV Company during its first month of operations: 1. Owner…

A: Accounting Equation of the business says that total assets in the business must be equal to total…

Q: Mr. Faroq opened a service station on May 1, a summary of May transactions is presented below.…

A: Accounting equation refers to relationship between the assets, liabilities and equity of a company…

Q: Daniels Company is owned and operated by Thomas Daniels. The following selected transactions were…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Q: Identify each of the following events as Accrual, Deferral or Neither. 1. Incurred operating…

A: Transactions are recorded based on accounting rules.

Q: Record the following selected transactions for April in a two-column journal, identifying each entry…

A: Journal entry means the entry in prime book with chronological order. Journal entry should have…

Q: and used it to open a new account in the náme of Montero Plumbing. April Acquired a service vehicle…

A: The journal entries are prepared to record day to day transactions of the business.

Q: ash and the balance on account July 3 -Purchased cleaning supplies for $ 680 on account. July 5…

A: Ledger refers to the record which is used to store bookkeeping the transactions for the income…

Q: Prepare journal entry Transactions: a) April 1- Mr. Song invested P100,000 cash and P 250,000 worth…

A: In accounting, each financial transaction enters the books of accounts through journal entry of the…

Q: On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following…

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are…

Q: During the year 2021, the following transaction took place: January 1 Elisha contributed additional…

A: Lets understand the basics. Journal entry is a recording of financial event and transaction in books…

Q: Record the following selected transactions for April in a two-column journal, identifying each entry…

A: Journal entries refer to the recording of transactions in an appropriate way. With the help of…

Q: March 2021 1 The owner, Gina, invested the following: filing cabinets and fixtures- 15,000; cash,…

A: The closing entries are the entries passed to close the temporary accounts to the income summary…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Journal entries are those where the transactions into the books of company and it is the very…

Q: Mhay Faraan started a delivery service, Mhay Deliveries, on July 1, 2020. The following transactions…

A: The journal entries are prepared to record daily transactions of the business.

Q: Invested in the business painting equipment valued at P12,300 and Winnie Villanueva is a painting…

A: The question is based on the concept of Business Accounting.

Q: 1. Write the following transactions using chart of accounts: Paid utilities expense of $400.…

A: Basic accounting equation means total of assets should be equal to total liabiltiies and equity.…

Q: On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions…

A: Requirement 1:Indicate the effect of the given transactions of Company HMR

Q: Transactions: a) April 1- Mr. Song invested P100,000 cash and P 250,000 worth of machine in his…

A: The journal entries keep the record of business and financial transactions on daily basis.

Q: March 2021 1 The owner, Gina, invested the following: filing cabinets and fixtures- 15,000; cash,…

A: In this question, we are required to prepare Trial Balance, Income Statement and Balance sheet of…

Q: Journalize entries for transactions Jan. 1 through 9. Refer to the Chart of Accounts for exact…

A: Note:- Since you have asked questions with multiple subparts, We will solve first three subparts for…

Q: Identify each of the following events as Accrual, Deferral or Neither. a. Incurred operating…

A: Deferred revenue is that the portion of a company's revenue that has not been earned, but cash has…

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700. g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250. i. Received and paid the bill for utilities, 280, Ck. No. 103. j. Received a bill for gas and oil for the truck, 130. k. Paid wages to the employees, 2,680, Ck. Nos. 104106. l. Sold services for cash for the remainder of the month, 3,500. m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700 (Service Income). g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250 (Service Income). i. Received and paid the bill for utilities, 280, Ck. No. 103 (Utilities Expense). j. Received a bill for gas and oil for the truck, 130 (Gas and Oil Expense). k. Paid wages to the employees, 2,680, Ck. Nos. 104106 (Wages Expense). l. Sold services for cash for the remainder of the month, 3,500 (Service Income). m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?

- In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015 (Rent Expense). c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 1,400, Ck. No. 2016. f. Sold services on account, 5,000 (Service Income). g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050 (Service Income). i. Received and paid the bill for utilities, 150, Ck. No. 2017 (Utilities Expense). j. Received a bill for gas and oil for the truck, 80 (Gas and Oil Expense). k. Paid wages to the employees, 1,400, Ck. Nos. 20182020 (Wages Expense). l. Sold services for cash for the remainder of the month, 4,200 (Service Income). m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.